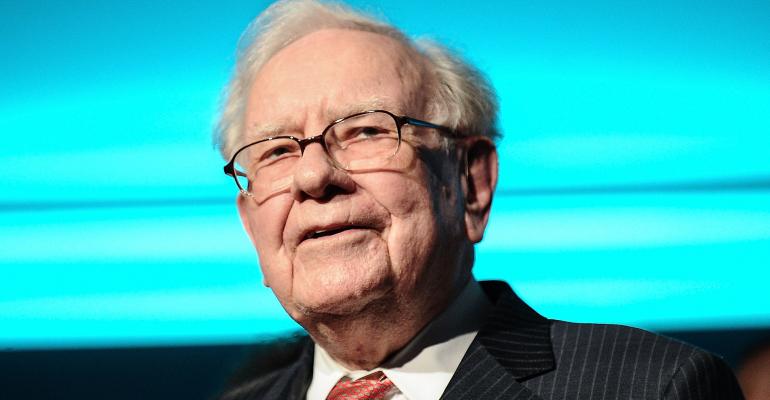

(Bloomberg) -- Warren Buffett’s Berkshire Hathaway Inc. has amassed $158 billion of domestic infrastructure assets, a feat the billionaire investor said underscored the conglomerate’s stature as an industrial powerhouse which he only expects to grow.

The vast collection of assets is the biggest by any U.S. company, Buffett said in his annual letter released on Saturday. The pool highlights the shifts that Berkshire has taken from a company rooted in insurance, retail and stock picks to an operation with a mammoth-sized railroad and sprawling energy empire.

“Many people perceive Berkshire as a large and somewhat strange collection of financial assets,” Buffett said. “In truth, Berkshire owns and operates more U.S.-based infrastructure assets -- classified on our balance sheet as property, plant and equipment -- than are owned and operated by any other American corporation.”

The $700 billion conglomerate has seen expansion in its railroad, BNSF, and energy operations gather momentum in recent years. Buffett called BNSF the “number one artery of American commerce” and praised the energy operations for the record $4 billion of earnings last year. After growth in its domestic infrastructure assets in 2021, Buffett expects the figure will continue to rise, with Berkshire always building, he said.

“We think about Berkshire as kind of a tollbooth on the American economy,” Jim Shanahan, an analyst at Edward Jones, said in a phone interview. “There’s broad exposure here across the U.S. economy.”

In recent years, Berkshire has been struggling with a high-class problem of too much cash without enough attractive opportunities to spend it on, leaving the firm with nearly $147 billion on hand at the end of the year. The hoard is just shy of the record set three months earlier.

Berkshire’s shift to more stable, industrial behemoths makes sense given how much money the company can put to use and still remain, by Buffett’s own words, “financially impregnable.” The businesses are considered among Berkshire’s “Big Four” alongside the insurance operations and its stake in Apple Inc. They’re a good fit for Berkshire at this stage, according to shareholder James Armstrong.

“If you are in a position where your company, Berkshire Hathaway, is gushing cash, an electric power business is a good fit because you then can deploy your cash into a business that is enormous,” said Armstrong, whose Henry H. Armstrong Associates oversees around $1 billion including investments in Berkshire shares. “It’s a regulated business, so you’re never going to make super high returns, but you are pretty likely to make very good returns because the regulators want the electric power grid to be well maintained.”

Here’s other key takeaways from Berkshire’s letter:

Todd and Ted

Buffett’s two investing deputies, Todd Combs and Ted Weschler, often remain behind-the-scenes, helping to orchestrate the deployment of Berkshire’s billions into different stock picks. Buffett revealed in the letter that the pair now oversees a total $34 billion of investments, some of which rank among Berkshire’s top 15 largest stock bets.

The duo’s influence can be seen in some of Berkshire’s recent bets, including the purchase of Activision Blizzard Inc. stock before Microsoft Corp. agreed to buy the game maker. Still, the $34 billion that the pair manages would account for just under 10% of the company’s total $350 billion stock portfolio. Both managers should be given more capital, according to Edward Jones’s Shanahan.

“There’s evidence of their influence more broadly in the portfolio, but there’s been a nice change here in the composition of the portfolio,” Shanahan said. “Especially given that the operating companies are more old economy, they’ve brought more of a new economy angle to the portfolio, which I think creates a more balanced franchise.”

Record Buybacks

Buffett conceded there was “little that excites” the investor and his longtime business partner Charlie Munger on the stock-buying front these days. That’s led Buffett to lean even more into stock repurchases as a key way to deploy capital. Berkshire spent $27.1 billion on buybacks last year, the most ever, and continued to snap up $1.2 billion of its shares from year-end to Feb. 23.

“They’re still at what we think to be such a comfortable discount in valuation from intrinsic value per share that we still believe every penny spent is accretive to the remaining shareholders,” Tom Russo, who oversees $9 billion including investments in Berkshire shares at Gardner Russo & Quinn LLC, said in a phone interview.

But Russo acknowledged that Berkshire can’t take that pledge to the extreme “because if you depleted yourself of all resources and a big elephant comes tip-toeing by, you won’t be able to take advantage of the thing you really want to do which is generate more earnings streams.”

Buffett mentioned his favorite ways to deploy capital -- buying companies outright, investing in publicly traded stocks, and even repurchasing Berkshire’s own shares. But his omission of another option -- dividends -- and Berkshire’s history of not issuing one, reinforces to shareholders that he’s still against the idea of Berkshire declaring one, according to Edward Jones’s Shanahan.

“For anyone thinking he might change his mind about a dividend, there was no fourth choice,” Shanahan said. “That actually, by omission, was a fairly strong statement.”

What Bloomberg Intelligence says:

“Warren Buffett’s annual letter included a more cautious tone on share repurchase and while buybacks should continue, the pace may slow. Cash stands at $147 billion but Berkshire is likely to stay away from large investments. Berkshire’s diverse earnings streams could combat supply chain issues as 4Q operating earnings rose 45% to $7.3 billion.”

-- Matthew Palazola, Kylie Towbin, BI analysts

Succession

Buffett granted a portion of Berkshire’s report to his likely successor, Greg Abel, in a rare move. Abel detailed how Berkshire is approaching environmental issues such as greenhouse gas emissions in some of its biggest businesses, including the railroad and energy operations.

Berkshire has been pressured in recent years to address environmental issues given the scale of those businesses, and the topic has become increasingly important for investors, according to CFRA Research’s Cathy Seifert.

“Berkshire is a laggard here and I think this is a much-needed catchup,” said Seifert. “I’m glad to see that it’s Greg and that it’s somebody who is going to be stepping into a role where this is going to be required. It’s no longer sort of a nice-to-have.”

Little to Buy

Berkshire came up short last year with no big deals to supercharge its growth. Buffett was blunt in saying that “there was little action” in 2021 at Berkshire that would’ve been considered new or interesting. The firm was even a net seller of common stocks in the fourth quarter, the fifth quarter in a row that the company has sold more stocks than it has bought.

Still, Berkshire’s operating businesses kept chugging along, with operating profit in the fourth quarter climbing to its second-highest level in data going back to 2010. And Buffett has lots of funds to work with if a deal comes his way.

“What a cash machine Berkshire has become,” Armstrong said.

© 2022 Bloomberg L.P.