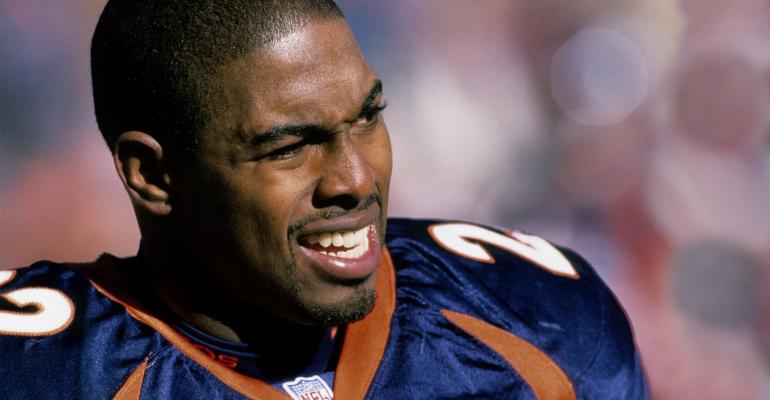

Like any other kid, the moment I picked up a football, it was an instant love affair. After playing throughout high school and college, it was a dream come true when, in 1993, I signed as a free agent with the Philadelphia Eagles. Three years later, I joined the Denver Broncos, and I went on to two Super Bowls.

While I was playing football, what I was making seemed like big money to me, but it was nothing compared to some of the other guys. My mindset was, I wasn’t a big spender and I figured I was just going to save. A family friend wanted to help out, but I thought I didn’t need anybody to give me advice. I didn’t grow up around investing, and if you don’t grow up in a world where your parents invest, you don’t understand what the stock market is. You think that’s for someone else.

I retired in ’99 and then started working at a gym as a trainer. A few years later, I started my own fitness center. While I was working at the gym, a financial advisor started training with me. I found out what he did, and I told him my story. I didn’t know anything about investments, so I thought, let me see what that’s about. We formed a friendship.

Probably a year later, I decided to become his client. All these memories came back, and I realized how I could have used this knowledge when I played football. At the time, I’d thought that, with the comparatively measly amount I was making, I didn’t need help. But that was B.S. In fact, I really needed it. I could have doubled or tripled my money. But you don’t know what you don’t know.

In the beginning, like any good advisor, he had to get to know me better. But he had a pretty good idea right away what I needed. Being a football player for so long, my life was always run by itineraries. I’m used to a schedule. And that’s how we set up my accounts. He created a machine for me. We talk about my goals for the year, form a plan and then when my check is deposited, a certain amount goes to this account, another part goes to that account and there’s no chance to make bad decisions. Little tricks like that have been invaluable to me.

He knows that you’ve got to understand your client and what works best for them. Some people want to be involved in every part of it, with a million questions. That’s not me. I feel that’s the reason for the meeting at the beginning of the year. After that, I sit back, and you do your thing.

The biggest benefit for me was the education I got. I can’t express enough how important that was. A lot of people just don’t believe investing is for them. But once you start doing something, you think, “This is not that bad.” And once you start understanding it, you wonder, “Why didn’t I do this sooner?”

When we first met, although my advisor was very successful, he was also trying to go after professional athletes. My advice for him was, he needed to start young, while they were in college or younger. They might not be ready to listen right away. And they might not be making money yet. But the earlier you start talking to these kids, the sooner you can start helping them make better decisions. Now I work with him, meeting with prospective clients to talk about my own experiences and how this type of advice would have helped me.