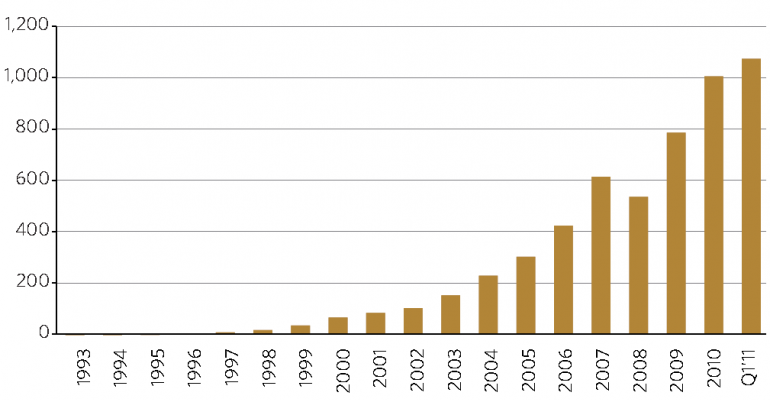

Our long-time mutual fund correspondent Stan Luxenberg writes: "Criticism of ETFs is growing almost as fast as are the vehicles' assets. Don Phillips of Morningstar and others say that as

ETFs have proliferated, they have become more expensive and hazardous for individuals to use.

Our long-time mutual fund correspondent Stan Luxenberg writes: "Criticism of ETFs is growing almost as fast as are the vehicles' assets. Don Phillips of Morningstar and others say that as

ETFs have proliferated, they have become more expensive and hazardous for individuals to use.

"The original ETFs were designed to provide low-cost exposure to broad market segments. But now many ETFs use leverage or aim at narrow niches. These specialized ETFs are volatile and have higher expense ratios. Some analysts argue that ETFs are a chief cause of the increasing volatility of markets. The SEC is currently investigating the role of ETFs in making markets more volatile. ETFs are popular vehicles of high frequency traders. In the past, a rapid trader may have bought and sold a few stocks. Now with ETFs, the trader can buy hundreds of stocks with the click of one key." See also Stan's article comparing ETFs to closed-end funds ("ETF Clones at a Discount"), because in some cases closed-end funds might be a good choice for clients.