This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

When a company has significant control in a subsidiary, the parent company’s equity stake in the subsidiary appears on the balance sheet, but the subsidiary’s financial statements are not consolidated into the parent company’s statements. If this subsidiary’s income is explicitly disclosed, we treated it as operating and add this income to the parent’s NOPAT and the subsidiary’s assets to the parent’s invested capital.

However, if this income is not explicitly disclosed on the income statement, we cannot determine the subsidiary’s impact on the parent company’s profits. In this case, we exclude the subsidiary’s income and assets from NOPAT and invested capital. We then treat the assets in the unconsolidated subsidiary like cash and add them to shareholder value as we do excess cash.

For example, CSX Corp. (CSX) had $511 million in unconsolidated subsidiary assets added to shareholder value in 2012. This adjustment was made due to its investments in “affiliates and other companies,” a line item on CSX’s balance sheet that is never broken out into its components. Because we cannot determine the income from these stakes in other companies, we add these assets to CSX’s shareholder value. This adjustment raised CSX’s economic book value from $11,250 to $11,761.

Without careful footnotes research, investors would never know that unconsolidated subsidiary assets increase the amount of future cash flow available to shareholders due to their bundling in other balance sheet line items.

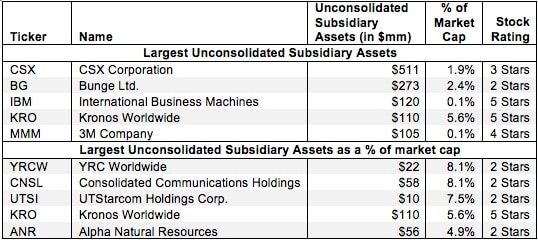

Figure 1 shows the five companies with the largest amount of unconsolidated subsidiary assets added to shareholder value in 2012 and the five companies with the largest amount of unconsolidated subsidiary assets as a percent of market cap.

Figure 1: Companies With the Largest Unconsolidated Subsidiary Assets Added To Shareholder Value

Sources: New Constructs, LLC and company filings. Excludes stocks with market caps under $100 million.

Sources: New Constructs, LLC and company filings. Excludes stocks with market caps under $100 million.

These are far from the only companies that are affected by unconsolidated subsidiary assets. In 2012 alone, we found 39 companies with unconsolidated subsidiary assets added to shareholder value, totaling almost $2 billion.

Since a company’s unconsolidated subsidiary assets increase the amount of cash available to be returned to shareholders, companies with significant unconsolidated subsidiary assets will have a meaningfully higher economic book value when this adjustment is applied. UTStarcom Holdings (UTSI) is a good example. UTSI had $10 million in unconsolidated subsidiary assets that we added to shareholder value in 2012. The addition of this amount to shareholder value raised UTSI’s economic book value from $55 million to $65 million, and its economic book value per share from $1.15/share to $1.36 a share.

Investors who ignore unconsolidated subsidiary assets are not getting a true picture of the cash available to be returned to shareholders. By adding unconsolidated subsidiary assets one can better understand the value of the stock to shareholders. Diligence pays.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.