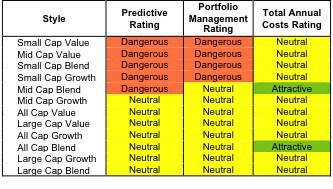

None of the fund styles earn a rating better than Neutral. The primary driver behind the Neutral-or-worse ratings is poor portfolio management. My style ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each style.

Investors looking for style funds that hold high quality stocks should focus on the All Cap and Large Cap styles. They are the only styles with any Attractive-or-better-rated funds. Figures 4 and 6 provide details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs. My fund rating methodology is detailed here.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by investment style. See my free ETF & mutual fund screener for rankings, ratings and free reports on 7000+ mutual funds and 400+ ETFs.

Reports on the best & worst ETFs and mutual funds in every sector and investment style are available on my blog and Trading Deck.

Figure 1: Ratings For All Investment Styles

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only 124 style ETFs and mutual funds meet these requirements, which is less than 2% of all style ETFs and mutual funds.

GMO Trust: GMO Quality Fund [s: GQETX] is one of my top large cap blend mutual funds. It is one of the four funds to earn my Very Attractive rating by allocating over 65% of its value to Attractive-or-better-rated stocks and only charging investors annual costs of 0.6% a year.

Microsoft Corporation [s: MSFT] receives my Very Attractive rating and is one of my favorite stocks held

GQETX. I’m bullish on Info Tech funds and MSFT is a prime example why. MSFT’s staggering return on invested capital (ROIC) of 72% places in the top 99th percentile of all Russell 3000 companies. In spite of MSFT”s strong history of profits, its valuation (~32.42) implies that profits will permanently decrease by 20%. These are surprising expectations considering MSFT has grown profits by an average of 21% annually over the past 10 years. MSFT’s high profitability and low valuation create an excellent risk/reward for investors.

Touchstone Funds Group Trust: Touchstone Small Cap Value [s: TVOAX] is my worst small cap value mutual fund. It gets my Very Dangerous rating by allocating over 77% of its value to Neutral-or-worse-rated stocks, and to make matters worse, charges investors total annual costs of 5.73%.

Intersil Corporation [s: ISIL] receives my Very Dangerous rating and is one of my least favorite stocks held by TVOAX. Although ISIL is an Info Tech stock, just like MSFT, its economics couldn’t be more different. ISIL has misleading earnings – its economic earnings are negative and declining while its reported accounting earnings are positive and increasing. ISIL’s valuation (~$10.80) implies that profits will increase by 9% compounded annually for 40 years. These are lofty expectations considering that the company’s profits have declined in four of the past six years. I can see no upside in a stock with such an expensive valuation and poor profitability.

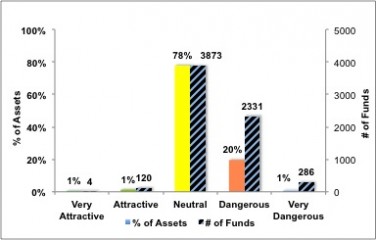

Figure 2 shows the distribution of our Predictive Ratings for all investment style ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Predictive Rating

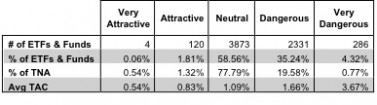

Figure 3 offers additional details on the quality of the investment style funds. Note that the average Total Annual Cost of Very Dangerous funds is almost 7 times that of Very Attractive funds.

Figure 3: Predictive Rating Distribution Stats

* Avg TAC = Weighted Average Total Annual Costs

Source: New Constructs, LLC and company filings

This table shows that only the best of the best funds get our Very Attractive Rating: they must hold good stocks AND have low costs. Investors desrve to have the best of both and we are here to give it to them.

Ratings by Investment Style

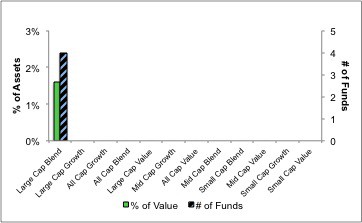

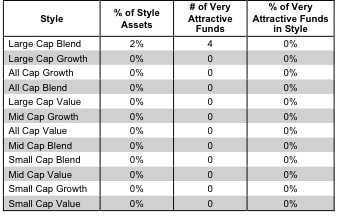

Figure 4 presents a mapping of Very Attractive funds by investment style. The chart shows the number of Very Attractive funds in each investment style and the percentage of assets allocated to Very Attractive-rated funds in each style.

Only 4 style funds earn our Very Attractive rating.

Figure 4: Very Attractive ETFs & Mutual Funds by Investment Style

Figure 5 presents the data charted in Figure 4

Figure 5: Very Attractive ETFs & Mutual Funds by Investment Style

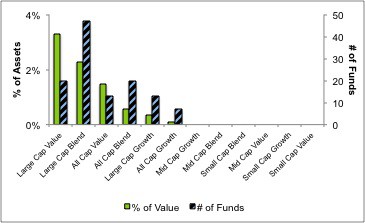

Figure 6 presents a mapping of Attractive funds by investment style. The chart shows the number of Attractive funds in each style and the percentage of assets allocated to Attractive-rated funds in each style.

Note that the mid cap and small cap styles do not house any Attractive-rated ETFs or mutual funds.

Figure 6: Attractive ETFs & Mutual Funds by Investment Style

Figure 7 presents the data charted in Figure 6.

Figure 7: Attractive ETFs & Mutual Funds by Investment Style

Source: New Constructs, LLC and company filings

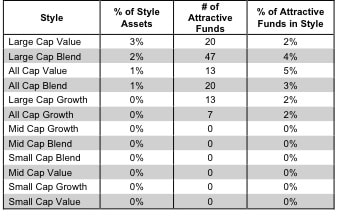

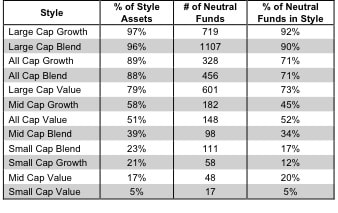

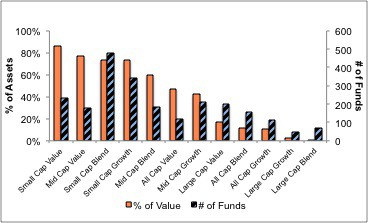

Figure 8 presents a mapping of Neutral funds by investment style. The chart shows the number of Neutral funds in each investment style and the percentage of assets allocated to Neutral-rated funds in each style.

Figure 8: Neutral ETFs & Mutual Funds by Investment Style

Source: New Constructs, LLC and company filings

Figure 9 presents the data charted in Figure 8.

Figure 9: Neutral ETFs & Mutual Funds by Investment Style

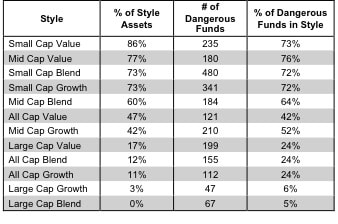

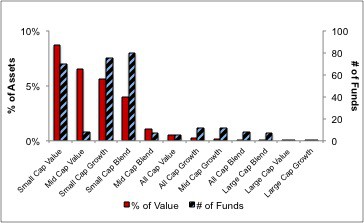

Figure 10 presents a mapping of Dangerous funds by fund style. The chart shows the number of Dangerous funds in each investment style and the percentage of assets allocated to Dangerous-rated funds in each style.

Over 70% of all small cap value, small cap blend, small cap growth, and mid cap value funds earn my Dangerours rating and should be avoided. The full list of funds that should be avoided is available at my free ETF and mutual fund screener.

Figure 10: Dangerous ETFs & Mutual Funds by Investment Style

Source: New Constructs, LLC and company filings

Figure 11 presents the data charted in Figure 10.

Figure 11: Dangerous ETFs & Mutual Funds by Investment Style

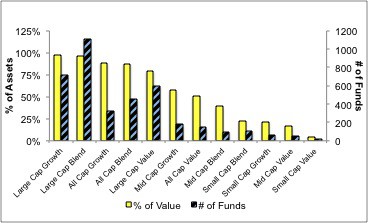

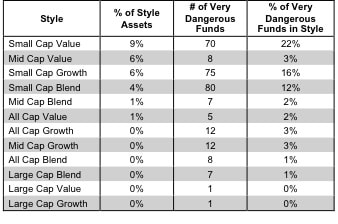

Figure 12 presents a mapping of Very Dangerous funds by fund style. The chart shows the number of Very Dangerous funds in each investment style and the percentage of assets allocated to Very Dangerous-rated funds in each style.

22% of the 322 small cap value funds earn my Very Dangerous rating by allocating too much value to Dangerous-or-worse rated stocks and charging investments high total annual costs.

Figure 12: Very Dangerous ETFs & Mutual Funds by Investment Style

Figure 13 presents the data charted in Figure 12.

Figure 13: Very Dangerous ETFs & Mutual Funds by Investment Style

Source: New Constructs, LLC and company filings