While retail investors are exiting equity mutual funds like no other, dividend-focused mutual funds are actually reaping the benefits of investors’ search for yield. According to Hong Kong-based CLSA, an independent research brokerage, dividend-focused mutual funds have seen net inflows of $12 billion over the last 13 months. And where better to look for higher dividends than the very companies providing those mutual funds?

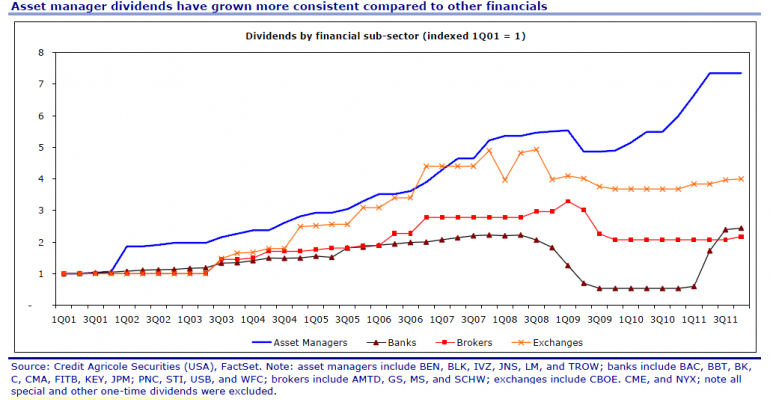

The CLSA report says asset manager dividends have held up better than any other financial companies, including banks, brokers and exchanges. This includes AllianceBernstein, Ameriprise, BlackRock, Franklin Resources, Invesco, Janus, Legg Mason and T. Rowe Price.

The 300-pound gorilla BlackRock is the most committed to paying out dividends, returning 40 to 50 percent of its earnings to shareholders, the report said.

- Over the last 10 years, asset managers have averaged core dividend increases of 14% per year, and since July 2007 their dividends have increased 11% (annl).

- Strong cash flows and significantly lower regulatory pressure compared to banks and brokers should help differentiate asset managers in coming years as well.

- Asset manager dividend yields are superior at 2.3% on average, above the KRE regional bank ETF (1.7%), BKX bank index (1.9%), XLF financial services index (1.6%), KIE insurance ETF (1.6%) and exchanges (2.0%).

Could be a huge conflict of interest if all these managers are holding a lot of equity in their own companies, but at least the numbers are there to back them up. And perhaps it’s one area of the equity market investors won’t be afraid to dip their toes in.