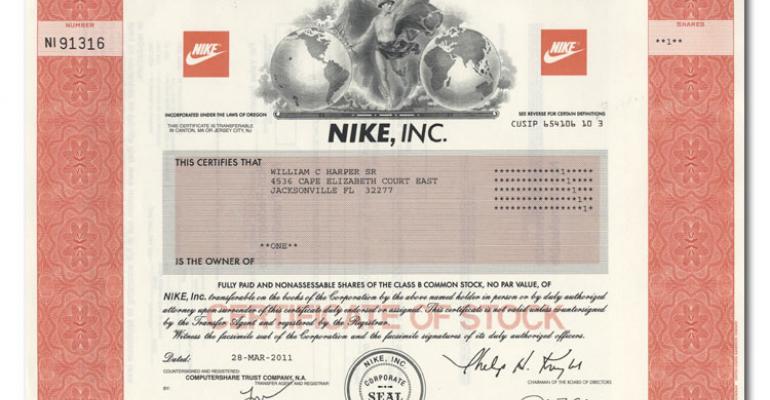

Used to be that giving kids savings bonds was a thing. Times, have of course, changed, and numerous websites let doting grandparents and other kindly souls gift stocks instead, writes Quentin Fottrell for MarketWatch. He talked with Josh Brown, CEO of Ritholtz Wealth Management, who recently joined the board of SparkGift, a company that lets you give stock as a gift to a friend or a child in just a few clicks. The website only allows gifts between $20 and $2,000, and automatically sends the recipient a stock certificate. “It’s a little bit like giving out pennies on Halloween versus lollipops,” Brown said, “but I think today’s younger generation is a lot more savvy about business, and studies show that they’re extremely interested in their career and growing wealth, even though they don’t have a lot of money to invest.” He suggests starting out with a basic index fund, or for older children, Netflix or Disney stock, and possible Nike or Under Armour for an athlete. "Choose one that reflects your and their values," Brown said. "Cigarette or beer companies would not be the most appropriate thing in the world."

Docupace Launches Alternative Investment Software

Docupace, the digital document management company, launched a new product for advisors to help them connect alternative investments to the clients that may need them. Called ePACS AI Solution, the platform identifies which clients in an advisor’s book of business are eligible for the alternative investments available on the broker/dealer’s platform, and ensures that investment recommendations are compliant. By using e-signature technology and digital processing, Docupace says ePACS makes investing in these strategies easier and faster. Docupace CEO and founder Michael Pinsker said it would set a new standard for alternative investments: “We have developed a solution that achieves rules-based compliance on a number of levels and eliminates many common points of processing failure,” Pinsker said in a statement.

Investors Want Human Advice, Not Robo

A new study from Financial Engines, a managed account platform for employer retirement plans, found that a majority of 401(k) investors not currently working with a financial advisor would like to do so in the future. The biggest barrier was affordability, but Financial Engines found that interest in working with a human advisor was stronger than using online advisory services. “While technology can broaden the access people have to investment advice, we’ve found that many people value the ability talk with a professional advisory, whether just to ask questions or to develop their retirement plan,” said Kelly O’Donnell, an executive vice president at Financial Engines, which recently launched new online tools for 401(k) plan participants to get in touch with an advisor.

National Estate Planning Awareness Week

Next week is National Estate Planning Awareness Week, which was adopted in 2008 to help the public understand what estate planning is and why it’s such a vital component of financial wellness. With so many on the verge of running out of money before they die, burdened with high student loans and other debt, and over half of American adults not having up-to-date financial plans, it seems many could use some education around the topic. The lack of financial awareness and financial literacy places crushing pressure on clients and advisors. The organizers of National Estate Planning Awareness week say the solution is education around personal financial management combined with motivation to take appropriate actions. More information about how to get involved can be found here.