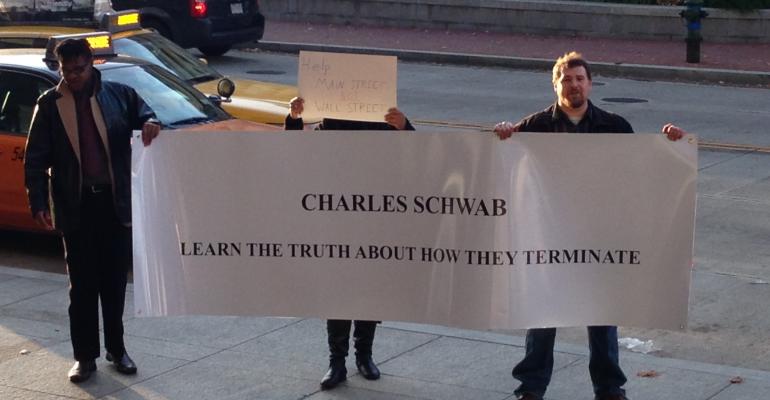

A group of about five former Schwab independent advisors protested outside of Schwab’s annual IMPACT conference in Washington, D.C. The protest was organized by Michael Kelly, a Thousand Oaks, Calif.-based registered investment advisor, who was terminated by Schwab in January 2012.

The group was trying to call attention to what they said was Schwab's unfair practices of terminating agrreements with their independent advisors. Schwab’s Investment Manager Service Agreement includes a clause stating that the firm can terminate an independent advisor. But Kelly takes issue with how the firm went about his dismissal, claiming that Schwab did not provide a sound reason for severing their relationship. Kelly got a call on Oct. 20, 2011, telling him he was terminated.

“It was so unexpected by me—it was on a recorded line—that I thought I was being pranked,” Kelly said.

That day, the firm also sent a letter to all of his clients, informing them of the termination as of Jan. 3, 2012, and telling them that if they didn’t transfer their account, Schwab would continue to provide them with brokerage services. Their account would also be subject to the Charles Schwab Pricing Guide for Individual Investors, the letter said.

“This protocol was designed to create what Schwab refers to as ‘stranded accounts,’” Kelly said.

Schwab spokeswoman Susan B. Forman said the firm disagrees with Kelly’s characterization of his termination, and that he was informed well in advance of the January 2012 termination. The firm said he was terminated for impersonating a client. Kelly denies he impersonated a client on a phone call to verify a signature on a document.

“We do not take advisor terminations lightly,” Forman said in an email. “When we make a decision to terminate an advisor it is always for a cause, and it is always investigated thoroughly by both the business and our legal and compliance teams before we take any action.

“We take our role as custodian very seriously, as you would expect. It is our duty to protect investors and the assets custodied with us. Our regulators expect this of us.”

Kelly took his compliant to a FINRA arbitration panel, which dismissed the case without a ruling.

Kelly said he has assembled a group of about 25 former Schwab advisors who are trying to organize more formally around the termination issue.

The termination had a negative impact on his firm, Airgead Clann, including the loss of his largest client, Kelly said.