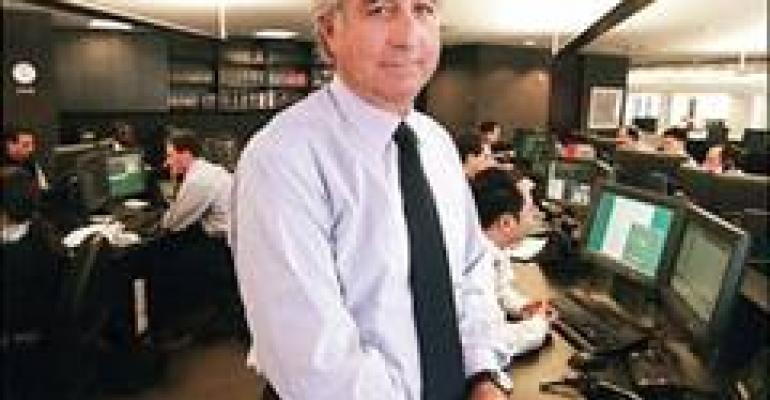

During an average year, approximately $29.2 billion is lost to fraud in the United States, according to a Federal Trade Comission report conducted in 2007. Bernie Madoff's epic scam alone resulted in losses to investors of over $50 billion. And new Ponzi schemes seem to surface every week.

During an average year, approximately $29.2 billion is lost to fraud in the United States, according to a Federal Trade Comission report conducted in 2007. Bernie Madoff's epic scam alone resulted in losses to investors of over $50 billion. And new Ponzi schemes seem to surface every week.

Some regulators warn that new social media and other technologies may make it even easier for financial criminals to find easy targets. Meanwhile, previous efforts to educate the public, and even to provide them with tools and scripts to avoid fraud, haven’t been effective, regulators admit.

With all of this in mind, Stanford University and the FINRA Foundation together this week launched a new fraud prevention research center. The center will have an inaugural conference in early November in Washington, D.C.

The idea is for the group to consolidate current research on the subject and connect that research with practical prevention and detection efforts. According to backgrounder’s on the new group’s website, surveys conducted in different countries around the globe suggest that at minimum, anywhere from 6.5 percent to 16 percent of individual countries’ populations are each year. The actual rates are probably higher, it says, as individuals tend to under-report their experience as victims—only 20 percent to 50 percent of victims report.

Investment fraud victims tend to be between 55 and 62 years old, male, married, wealthier and more financially literate than the general population, as well as more open to sales pitches used by con men, more likely to have invested in high-risk investment and not likely to have checked the background of a broker before investing, according to research cited on the group’s website.

Investment con-men tend to try a bunch of techniques at once—on average, they use 13 different tactics in combination to persuade a single victim to hand over his money, according to research conducted by Wise for FINRA in 2006.