Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Consumer Discretionary mutual fund managers and ETF providers are in the Danger Zone this week. They do the worst job of picking stocks out of all the sectors. The quality of the funds and ETFs in the Consumer Discretionary sector is the worst of all sectors compared to the quality of the stocks available to them.

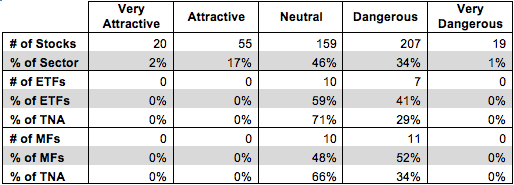

As Figure 1 shows, there are numerous Attractive rated stocks in the Consumer Discretionary sector from which fund managers and ETF providers can choose. 75 out of the 460 stocks (16%) held by Consumer Discretionary funds earn an Attractive-or-better rating. However, no ETFs or mutual funds in the sector allocate enough value to these Attractive-or-better stocks to earn an Attractive rating.

Click here for our report on the Best & Worst ETFs and Mutual Funds in the Consumer Discretionary Sector.

Figure 1: Consumer Discretionary ETF and Mutual Fund Landscape

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Here are my top three reasons for poor stock selection by managers in this sector:

1. Focus on short-term performance

2. Relying too much on technical or momentum analysis

3. Lack of diligence on earnings quality and valuation

One stock in particular stands out to me as indicative of all these issues: Amazon (AMZN). 12 out of the 38 ETFs and mutual funds in the Consumer Discretionary sector allocate over 4% of their assets to AMZN. AMZN has delivered strong short-term performance to investors (like its 9% jump on Friday) and its charts look good.

As for the earnings and valuation diligence, it’s no secret that AMZN holders don’t care about the lack of profits or extremely high valuation. Still, investors might be surprised to find out that AMZN’s current valuation of ~$363/share implies that the company will grow after tax profit (NOPAT) by 25% compounded annually for 19 years (more details in my article here). They also might not realize that AMZN’s earnings for the third quarter of this year were boosted by $12 million in income tax benefits and $9 million of foreign currency gains. Without these unusual gains, AMZN doesn’t meet its earnings expectation for 3Q13 and the stock probably doesn’t shoot up the way it does.

The narrative behind AMZN has kept the stock surging upward, and all the fund managers keep buying it so they don’t miss out on those short-term gains. This behavior creates a self-fulfilling prophecy that often leads to some rather dramatic corrections in the stock.

Rydex Series Funds: Retailing Fund (RYRTX) is one of my least favorite Consumer Discretionary funds and allocates 4.3% of its assets to AMZN. Overall, RYRTX allocates over 64% of its assets to Neutral-or-worse rated stocks. RYRTX also charges high total annual costs of 4.6%. A significant part of these costs comes from transaction costs, as RYRTX has a 472% portfolio turnover rate due to its performance chasing strategy.

While funds like RYRTX chase after high-flying stocks like AMZN, fundamentally sound but unspectacular stocks in the Consumer Discretionary sector get looked over. For instance, Autozone (AZO) earns my Very Attractive rating, but only two out of the 38 ETFs and mutual funds in the sector allocate even 2% to the stock.

AZO has not wowed like some other stocks so far this year. The stock is up 21% year to date, and auto parts are not as sexy as online retail. Still, a close look at AZO’s financials shows that it is much safer than AMZN. AZO has increased NOPAT every single year since 1998 with a compounded annual growth rate of 11% over that timeframe. AZO’s return on invested capital (ROIC) is 24%, more than double the industry average of 9%.

Despite its solid track record of growth and profitability, AZO remains significantly undervalued by the market. At its current valuation of ~$429/share, AZO has a price to economic book value ratio of 1, which means the market does not expect any future growth in AZO’s NOPAT. AZO is only fairly valued if you never think its going to earn more profit than it did in 2012. Given its history of growth, that outcome seems highly unlikely. AZO’s combination of strong fundamentals and a low valuation make it a low risk/high reward prospect for long-term investors.

The only two funds to allocate more than 2% to AZO are Fidelity Select Portfolios: Retailing Portfolio (FSRPX) and Market Vectors Retail ETF (RTH). Both earn my Neutral rating. Unfortunately, both FSRPX and RTH allocate more to AMZN than they do to AZO. They’ve managed to identify strong stocks, but they still follow the herd and over-allocate capital to a Dangerous stock like AMZN.

Investors deserve better than what they’re getting from Consumer Discretionary ETFs and mutual funds. Fund managers and providers need to do more diligence and less performance chasing to deserve their fees.

The one positive to take away from Figure 1 is that investors are putting the majority of their assets in the better ETFS and mutual funds. Nearly 70% of all assets in the sector are in Neutral ETFs and mutual funds even though roughly half of the funds in the sector are rated Dangerous. Investors do a good job of allocating their money to the better run ETFs and mutual funds. The problem is that there are no good options to choose from.

Sam McBride contributed to this article

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.