Stein Mart (SMRT) is in the Danger Zone this week and earns my Very Dangerous rating. Hidden items in its filings artificially boost earnings growth and mask significant liabilities. The lofty expectations in the current valuation of the stock look impossible to achieve, especially given the company’s weak competitive position.

The Weak Sister

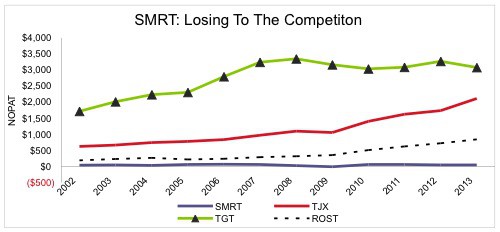

Stein Mart is one of the bottom dogs in a competitive industry. Its rivals T.J. Maxx (TJX), Ross Stores (ROST) and Target (TGT) have all displayed stronger growth and better management skill.

TJX and ROST have returns on invested capital (ROIC) of 19% and 20% respectively. TGT’s ROIC is 9% while SMRT comes in with a lowly 6% ROIC.

Figure 1 shows SMRT’s competition generating profits that dwarf Stein Mart’s performance. As an example, Ross Stores, one of SMRT’s closest competitors in terms of size, has grown NOPAT at 13% compounded annually since 1998 while SMRT has generated less than 1% compounded annual growth over the same period.

A struggling economy has been wind in the sails of SMRT’s competition, but, curiously, not for Stein Mart. The company’s declining ROIC of 6%, down from its high of 11% in 2006, demonstrates its inability to generate profit in the bargain-seeking consumer market.

I see this underperformance is a warning sign that SMRT management will not create value for investors.

Figure 1: Profit (NOPAT) Trends Show SMRT Losing Market Share

Misleading Income Hidden in the Footnotes

Last year, GAAP data overstated SMRT’s profit growth. SMRT’s 28% earnings per share growth may boost share prices and attract momentum investors, but diligence reveals that it after-tax cash flow (NOPAT) actually declined over this same period, and that SMRT’s economic earnings remained flat.

Specifically, our diligence in the footnotes reveals two unusual sources of income hidden in operating earnings that comprised 54% of SMRT’s GAAP net income in fiscal year 2013. First, $7.7 million (or 32%) of SMRT’s net income in 2013 was from actuarial gains on SMRT’s settlement of certain pension plan obligations. A further $5.3 million in income came from SMRT paying artificially low taxes due to unusual, non-taxable income. Without these non-recurring gains, SMRT’s earnings would have been $11.3 million instead of $24 million.

Our analysis of the footnotes enables us to garner a more accurate measure of SMRT’s core operating profits.

Beyond its profitability issues, SMRT’s balance sheet is also worse than GAAP data suggests. The company has no reported debt, but it has a total of $369 million in future operating lease obligations. Discounted to their present value, these off-balance sheet leases are equivalent to $292 million in debt.

Including these leases on the balance sheet gives a true representation of the capital invested in SMRT’s business and a more accurate measurement of its total ROIC. Without capitalizing these leases, SMRT’s return on invested capital would have been 13% instead of its actual 6%.

In early March of this year, Stein Mart failed to file its 2012 second and third quarter earnings results on time due to revisions in those reports, and soon afterward, NASDAQ announced that it would delist SMRT unless the company complied. Then, in early May, SMRT announced its continued listing on the NASDAQ in conjunction with better than expected earnings reports for the last fiscal year.

These announcements have caused the stock price to rise 86% since May. However, despite momentum investors jumping on the SMRT bandwagon at this first sign of good news, its inability to generate any operating profit growth over the past 15 years and its misleading earnings cause me to remain skeptical about its ability to do so in the future.

Footnotes diligence pays. Our analysis shows SMRT’s past reported earnings are inflated as result of accounting loopholes, and that its core business operations look worse than they appear at first glance.

Stock Valuation Seems Blind To True Profits

Despite Stein Mart’s stagnant last decade, the market is projecting growth that does not look likely to happen.

Right now, SMRT is trading at ~$15/share. It would need to increase NOPAT by 10% compounded annually for thirty-seven years to justify its current valuation. These expectations seem unrealistic for a firm that has failed to grow by more than 1% since 1998 and has lost significant market share to stronger competitors. The no-growth or economic book value of SMRT is about $3.50/share.

Perhaps too many investors have focused on reported accounting values and are willing to extend the illusory growth trends embedded in them. Those investors would likely change their minds if they did proper diligence.

André Rouillard and Sam McBride contributed to this article.

Disclosure: David Trainer, Sam McBride and André Rouillard receive no compensation to write about any specific stock, sector or theme.