Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Tangoe Inc (TNGO) is in the Danger Zone this week. TNGO operates in a very specialized sector of the software as a service (SaaS) field. It provides “communications lifecycle management”, or software that maximizes the efficiency and minimizes the costs of a company’s communications assets. The software as a service industry has been very popular with investors, and TNGO is no exception. Every analyst that covers the stock currently has a “buy” or “strong buy” rating on TNGO. Year to date the stock is up 112%.

TNGO checks all the marks of a Wall Street rollup scheme. Beating earnings estimates by a penny for share every quarter? Check. Constant acquisitions to keep the top line growing? Check. Shady management rewarding itself with massive stock options? Check.

Red Flags From Our Model

TNGO has successfully made their top and bottom-line results appear positive. The company grew total revenue by 53% in 2011 and 47% in 2012. Earnings per share increased by 150% last year and are expected to grow by a further 25% next year.

TNGO has managed this impressive growth by going on an acquisition spree. In 2011 and 2012, the company acquired four smaller competitors for a combined cost of $79 million, or 26 times its reported net income from last year. The company funded these acquisitions through its initial and secondary public offerings that allowed it to report positive cash flow for the past two years.

The reported growth from these acquisitions obscures the fact that the business is already in decline. The company’s after tax operating profit (NOPAT) declined by 14% as its margins shrunk from 5% to 3% in the last fiscal year. TNGO’s return on invested capital (ROIC) declined from 7% to 4% at the same time.

Beyond these profitability issues, the company has hidden liabilities that even further decrease the value of the stock. The company has $22 million of reported debt, but it also has a further $19 million in off-balance sheet debt. These liabilities wipe out the $42 million in cash that the company has left over from its public offerings.

The other hidden liability is outstanding employee stock options. TNGO had 6.9 million ESO’s outstanding at the end of 2012. At that time, they were worth only $40 million, but the massive growth in the stock price has brought the value of these liabilities up to over $100 million or over 10% of the stock’s market value.

Questionable Accounting Benefits Executives

Tangoe’s management manipulates the accounting metrics that help determine their compensation. The company’s cash flow measurement excludes capital expenditure, including money paid for acquisitions. Over the past two years, management has been able to exclude acquisitions and turn -$13 million and -$24 million of cash flows into +$9 million and +$15 million.

The other major metric that drives executive compensation, EBITDA, conveniently excludes stock-based compensation. Since stock based compensation makes up 77% of executive pay, the management of TNGO basically is allowed to exclude their own payment from expenses in order to award themselves even larger bonuses.

Don’t think that executive compensation is a minor issue for TNGO either. In 2012, TNGO executives earned $6.9 million. You might recognize that as being more than double the reported income from the entire company last year. When the CEO is making more money than the rest of the company combined, something has gone significantly wrong.

Unfortunately, TNGO’s executives have a history of this sort of behavior. The CEO and CFO’s last company, Information Management Associates, filed for Chapter 11 bankruptcy in 2000 after the SEC expressed concern over its accounting and NASDAQ halted the trading of its stock.

Insiders and Institutions Selling

Insiders and Wall St. have propped up this stock for a while, but it looks like they’re getting ready to pull the plug. Institutional investors have sold around 8 million shares, roughly 22% of all outstanding shares, in the last six months.

Insiders in the company have sold 1.4 million shares, about 20% of their holdings, in the last six months. Clearly, these investors are looking to reduce their exposure to this stock.

Competitive Disadvantage

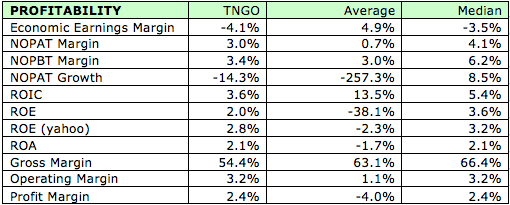

A closer look at TNGO’s operations and the state of its industry reveals why insiders are so ready to cash out on the stock. Quite simply, the company is falling behind in a competitive industry and it doesn’t have the resources to keep growing revenues and EPS through acquisitions. Figure 1 analyzes TNGO against several companies in its peer group along several different profitability metrics, including ROIC, gross margins, return on equity, and NOPAT margin. TNGO falls at or below the median on all 11 metrics.

Figure 1: Lagging Behind Peers

Another headwind for the company is the possibility of larger companies entering the field. For instance, IBM (IBM) recently acquired a direct competitor of TNGO’s and has begun actively competing in the field. Even worse, IBM accounted for over 10% of TNGO’s revenues as recently as 2010.

TNGO’s declining margins and slowing revenue growth projections support the thesis that its competitive position is eroding. The company’s options at this point are to accept lower profits or raise money through another round of debt or equity financing in order to fund new acquisitions. Neither option should be enticing for current shareholders.

Valuation

The end result of this run-up in the stock price is that TNGO is seriously overvalued. Its current valuation of ~$25/share implies that the company will grow NOPAT by 32% compounded annually for 15 years. The market appears to be extrapolating a couple years of acquisition-fueled growth out for the next decade and a half.

TNGO operates in a fragmented and competitive market place. Unless it somehow gains a dominant market share (which Figure 1 suggests is highly unlikely), I don’t see a way it can live up to those growth expectations. A complete implosion like the executive’s past company seems like a more likely scenario.

Avoid These Funds

Investors should avoid these ten mutual funds due to their 2+ percent allocation to TNGO and Dangerous-or-Worse ratings.

Sam McBride contributed to this article

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.