Oracle’s stock price fell nearly 10% on March 21 after the company’s earnings missed expectations for its third quarter. The company blamed the disappointing earnings on a lack of urgency from new members of its sales staff not finalizing deals in time. Many analysts, however, interpret it as a sign that Oracle is failing to adjust its business to the changes brought about by cloud computing.

I don’t share that pessimistic outlook nor do I rely on quarterly data to make investment decisions.

Quarterly earnings are often misleading. For one, quarterly earnings statements don’t include theFinancial Footnotes. Only in the footnotes can one find the full set of data required to assess the true profitability of a company. Quarterly data is not only incomplete, but it also not audited. Despite the obsession by the media and Wall Street with quarterly results, they represent a rather short period of time and, as stated above, may not accurately reflect the cash economics of the business. In short, do not throw the baby out with the bath water for one disappointing quarter.

The last time Oracle missed a quarterly number (December 2011), the stock dropped over 8%. The company’s explanation was the same as this time.

Guess what happened next? The stock rose 41% from its low point on December 23, 2011 to March 15 of this year as Oracle comfortably outperformed analyst’s projections after it closed those pending deals.

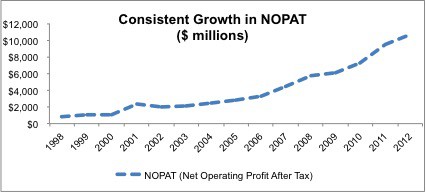

Consider that Oracle’s business has been remarkably strong and consistent in one of the most competitive sectors. Disruptive innovations have sent previous tech stalwarts into obsolescence without warning. Who would’ve imagined just a couple years ago that Dell (DELL), Palm or Blackberry’s (BBRY) businesses would shrink as they have. Oracle, on the other hand, shows no signs of slowing its consistent and impressive 20% compounded annual growth rate (CAGR) in NOPAT for nearly 15 years.

Figure 1: Oracle’s rising profitability: 20% CAGR in NOPAT

Why The Cloud Is Good For Oracle (and You)

In the short term, cloud computing poses challenges for Oracle. It has to reorient parts of its business around cloud-based solutions. Unburdened by legacy systems, upstarts, like Salesforce.com (CRM), have taken some market share from Oracle by building their businesses around the cloud. But, these companies are tiny compared to Oracle. The cloud is not the first disruptive innovation that Oracle has converted to its advantage.

Oracle has already made significant progress in its cloud computing business, which brought in $1 billion in revenue in 2012. When Oracle manages to optimize its cloud solutions and adjust its business to a subscription model rather than a licensing one, its scale and resources will give it a clear competitive advantage over these smaller cloud-centric firms.

Oracle is profitable and large enough to have margin for error when it comes to its dealing with disruptive technologies like the cloud. It can experiment while relying on its core enterprise software and server business to bring in the bacon. Even if it misses the mark, it has the time and resources to reload and try again. Lastly, Oracle can afford to wait and see what exactly the best approach to monetizing the cloud is without having to make risky investments. With nearly $30 billion In excess cash, Mr. Ellison’s deep pockets can buy him a strong competitive position in this emerging business at any time.

In the medium and long term, cloud computing has the potential to be as impactful on our daily lives as the national power grid by removing the bottleneck of proximity on usage. For more details, see The Cloud Is Good For Western Digital (WDC). I expect the cloud to increase the supply, demand and need for analysis of data. Hence, demand for all things related to data, especially data centers and databases, will rise as well.

Oracle is well positioned to translate that growth into profits unlike less profitable businesses. The company’s return on invested capital (ROIC) of 32% is in the top quintile of all the companies I cover. ItsROIC has not dipped below 20% since before 1998 when my model begins. Such consistent and high returns for nearly 15 years shows intelligent management, innovation and capital allocation. As long as Larry Ellison remains at the helm, I expect those trends to continue.

Now Is The Time To Buy

The recent 10% drop in Oracle’s share price makes it an especially attractive investment now. In fact, the stock has not been cheaper at anytime in the last 14 years.

At its current share price of ~$32.40, Oracle has a price to economic book value ratio of 0.9. This valuation implies that Oracle will experience a permanent 10% decline in NOPAT. Those expectations seem awfully low for a company that grew NOPAT by 20% compounded annually over the past 14 years with consistently top-quintile ROICs.

Figure 2: Stock Is The Cheapest Its Been in 14 Years

The chance to buy ORCL at such a cheap price is a great opportunity for investors.

Investors who want exposure to ORCL should buy the stock directly, as there are no ETFs or mutual funds that allocate more than 5% to ORCL and get an Attractive-or-better rating.

Sam McBride contributed to this report.

Disclosure: David Trainer owns ORCL. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.