Advisors and millionaires are often on different pages a good deal of the time, judging from research by Fidelity Investments.

In two separate surveys—one of more than 1,000 millionaire households, the other of more than 1,000 financial professionals at RIAs, independent broker/dealers, insurance companies, regional b/ds, and other firms—there was sometimes wide disagreement between both sides on such matters as market confidence, where to put money in portfolios, and use of communication technologies like LinkedIn.

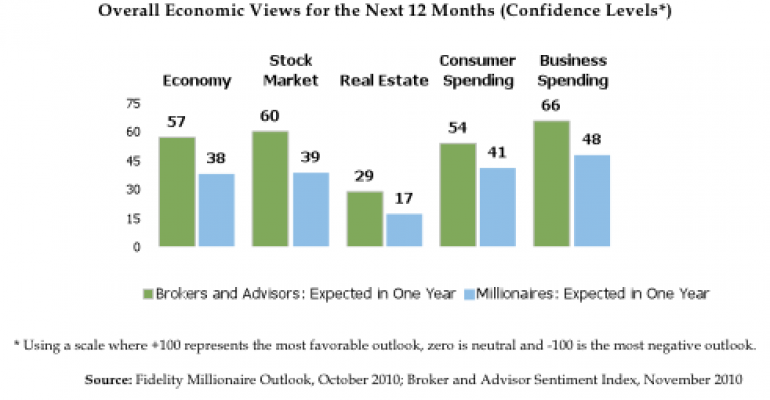

On their overall economic views for the next 12 months, wealthy investors and advisors differed widely. Advisors consistently were more optimistic than the millionaires, sometimes by large margins; on the prospects for the stock market, for example, advisors showed 50 percent more confidence than the investors.

On their overall economic views for the next 12 months, wealthy investors and advisors differed widely. Advisors consistently were more optimistic than the millionaires, sometimes by large margins; on the prospects for the stock market, for example, advisors showed 50 percent more confidence than the investors.

Both groups expect to increase portfolio investments in the coming year, Fidelity says. But brokers and advisors have a far stronger taste for such investments as annuities and international/emerging markets assets than millionaires do.

Both groups expect to increase portfolio investments in the coming year, Fidelity says. But brokers and advisors have a far stronger taste for such investments as annuities and international/emerging markets assets than millionaires do.

And, perhaps as a consequence of the heavy regulation in the financial industry, advisors and brokers appear to be adopting communications technologies at a far smaller rate than wealthy investors. Twice as many millionaires use or want to use media such as texting, smartphone applications and social media (85 percent) as do brokers and advisors (43 percent), Fidelity said. Advisors may need to step up to the plate at some point: Fidelity says two-thirds of millionaires indicated they want to use technology-enabled media with their advisors.

“With the average age of advisors increasing, the younger generation of brokers and advisors have an opportunity to differentiate themselves through their communications approach and attract new clients—specifically, clients under 50 who are most actively using technology,” says Sanjiv Mirchandani, president of Fidelity’s National Financial clearing provider.