The Consumer Staples sector ranks first out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Attractive rating, which is based on aggregation of ratings of 9 ETFs and 9 mutual funds in the Consumer Staples sector as of July 8, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

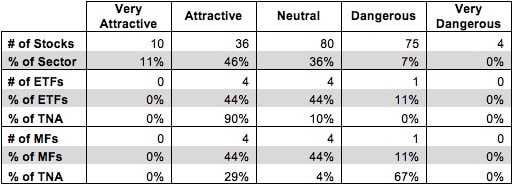

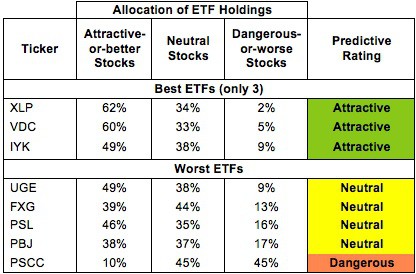

Figures 1 and 2 rank all 8 ETFs and all 8 mutual funds in the sector that meet our liquidity standards. Not all Consumer Staples sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 22 to 119), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Consumer Staples sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expensesof each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Consumer Staples sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Get my ratings on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

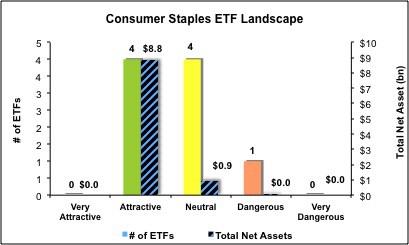

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Guggenheim S&P Equal Weight Consumer Staples ETF (RHS) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

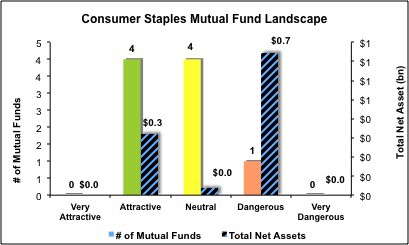

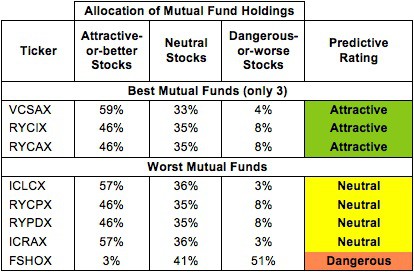

Figure 2: Mutual Funds with the Best & Worst Ratings

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ICON Consumer Staples Fund (ICLEX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Consumer Staples Select Sector SPDR (XLP) is my top-rated Consumer Staples ETF and Vanguard Consumer Staples Index Fund (VCSAX) is my top-rated Consumer Staples mutual fund. Both earn my Attractive rating.

PowerShares S&P Small Cap Consumer Staples Portfolio (PSCC) is my worst-rated Consumer Staples ETF and Fidelity Select Construction and Housing Portfolio (FSHOX) is my worst-rated Consumer Staples mutual fund. Both earn my Dangerous rating.

Figure 3 shows that 46 out of the 205 stocks (over 57% of the market value) in Consumer Staples ETFs and mutual funds get an Attractive-or-better rating. However, only 4 out of 9 Consumer Staples ETFs (90% of total net assets) and 4 out of 9 Consumer Staples mutual funds (less than 29% of total net assets) get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and consumers are putting their money into the best ETFs.

Figure 3: Consumer Staples Sector Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Low-Cost Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Consumer Staples ETFs and mutual funds, as less than half of all these funds get an Attractive or better rating. Only 4 ETFs and 4 Consumer Staples mutual funds in the Consumer Staples sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Altria Group (MO) is one of my favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Very Attractive rating. Since its separation from Phillip Morris International in 2007 and 2008 Altria has grown profits (NOPAT) every year, and maintains a return on invested capital (ROIC) of 18%, putting it in the top quintile of all companies I cover. The increased regulation of the smoking industry over the past 15 years seems to have had little effect on MO’s business. The company has been quick to adapt to recent trends in smokeless tobacco by acquiring wine and smokeless tobacco company UST in 2009. Altria has a price to economic book value ratio of 0.8, meaning that the market expects MO’s profits to permanently decline by 20%. Looking at MO’s sky-high margins and continually growing profits, as well as its recent acquisitions, this seems highly unlikely. MO is a leader in the tobacco and wine industry and it looks well positioned to stay at the top.

Lance Inc. (LNCE) is one of my least favorite stocks held by Consumer Staples ETFs and mutual funds and earns my Dangerous rating. LNCE has a return on invested capital (ROIC) of 5% while its weighed average cost of capital (WACC) is 7%. Moreover, it has earned negative economic earnings for 10 of the past 12 years. Despite rising net income, LNCE cannot seem to generate a return on the money provided by investors; rather, it is destroying value each year. Worst of all, LNCE has massive growth expectations embedded in its stock price. To justify its current valuation of ~$29.02/share, LNCE would need to growNOPAT by 17% compounded annually for 10 years. Such optimistic expectations seem to price out any upside for LNCE.

122 stocks of the 3000+ I cover are classified as Consumer Staples stocks, but due to style drift, Consumer Staples ETFs and mutual funds hold 205 stocks.

Figures 4 and 5 show the rating landscape of all Consumer Staples ETFs and mutual funds.

My Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with reports on all 9 ETFs and 9 mutual funds in the Consumer Staples sector.

André Rouillard and Sam McBride contributed to this report.

Disclosure: David Trainer, André Rouillard and Sam McBride receive no compensation to write about any specific stock, sector or theme.