The Small Cap Growth style ranks tenth out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 11 ETFs and 441 mutual funds in the Small Cap Growth style as of July 17, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

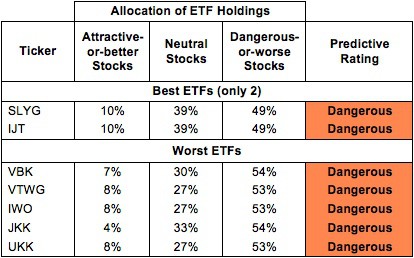

Figure 1 ranks from best to worst the seven Small Cap Growth ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated Small Cap Growth mutual funds. Not all Small Cap Growth style ETFs and mutual funds are created equal. The number of holdings varies widely (from 27 to 1344), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Small Cap Growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expensesof each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any Small Cap Growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Two Best and Five Worst

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Guggenheim S&P Small Cap 600 Pure Growth (RZG) and Vanguard S&P Small Cap 600 Growth ETF (VIOG) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

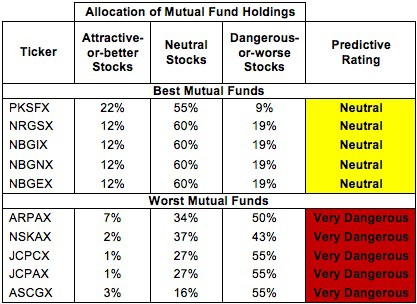

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Virtus Small Cap Sustainable Growth Fund (PXSGX), Oak Associates River Oak Discovery Fund (RIVSX) and Virtus Small Cap Sustainable Growth Fund (PSGCX) are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

SPDR S&P 600 Small Cap Growth ETF (SLYG) is my top-rated Small Cap Growth ETF and Virtus Small Cap Core Fund (PKSFX) is my top-rated Small Cap Growth mutual fund. SLYG gets my Dangerous rating, while PKSFX gets my Neutral rating.

ProShares Ultra Russell 2000 Growth Fund (UKK) is my worst-rated Small Cap Growth ETF and Forum Funds Adams Harkness Small Cap Growth Fund (ASCGX) is my worst-rated Small Cap Growth mutual fund. UKK is rated Dangerous, while ASCGX earns my Very Dangerous rating.

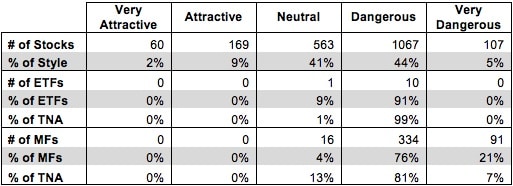

Figure 3 shows that 229 out of the 1966 stocks (over 11% of the market value) in Small Cap Growth ETFs and mutual funds get an Attractive-or-better rating. However, zero out of 11 Small Cap Growth ETFs and zero out of 441 Small Cap Growth mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Small Cap Growth ETFs hold poor quality stocks.

Figure 3: Small Cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Low-Cost Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Small Cap Growth ETFs and mutual funds, as almost all of them receive a Dangerous or worse rating. No ETFs and no mutual funds in the Small Cap Growth style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Investors would be better off focusing on individual stocks instead.

Assurant Inc. (AIZ) is one of my favorite stocks held by Small Cap Growth ETFs and mutual funds and earns my Very Attractive rating. AIZ has grown profits (NOPAT) by 8% compounded annually since 2008 and has a return on invested capital (ROIC) of 11%. Most encouraging though is the fact that AIZ has earned positive economic earnings every year since it went public in 2004. Its economic earnings have been growing at an impressive 25% compounded annually over the same period. While AIZ reached a new 52-week high earlier this week, its current price of ~$53/share means that there is still plenty of value to be had in this growing company. This stock price gives AIZ a price to economic book value ratio of 0.6, which means that the market expects AIZ’s profits to decline by 40% and never recover. This kind of decline seems unlikely judging by AIZ’s past decade of profit growth. AIZ is trading at a steep discount and presents a serious opportunity for investors in the small cap market.

Radian Group (RDN) is one of my least favorite stocks held by Small Cap Growth ETFs and mutual funds and earns my Dangerous rating. There is no shortage of things to dislike about Radian, starting with the fact that it has earned negative profits (NOPAT) for 5 of the past 6 years. Most alarming is RDN’s return on invested capital (ROIC) in 2012, which was -41%. This means that RDN destroyed the equivalent of 41 cents of every dollar invested into its business that year. If this is not enough to scare off investors, it should be noted that RDN is also expensive at its current price of ~$13/share. To justify this stock price, RDN would need to raise its ROIC from -41% to 3% and grow revenues by 48% compounded annually for 7 years. This is an unlikely scenario for any company, and seems even more unlikely for RDN with its negative ROIC. Investors would do well to avoid RDN.

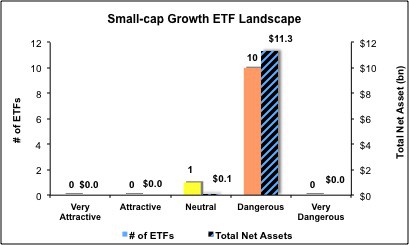

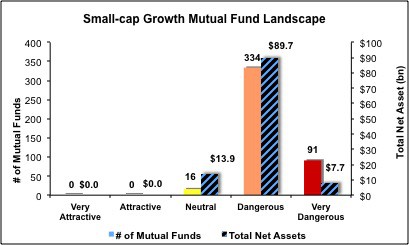

Figures 4 and 5 show the rating landscape of all Small Cap Growth ETFs and mutual funds.

My Style Rankings for ETFs and Mutual Funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with reports on all 11 ETFs and 441 mutual funds in the Small Cap Growth style.

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, style or theme.