Even if they can't “afford” a hedge fund, clients can choose among 83 long-short mutual funds and 129 bear -market mutual funds that Morningstar tracks. Many proved their value during the recent downturn, outperforming the S&P 500 by wide margins.

Besides producing solid returns, these “alternative” funds offer diversification and some advantages over hedge funds. For starters, mutual funds disclose all their holdings (albeit usually not on a real-time basis). In contrast, secretive hedge funds can invest in exotic (read: toxic) assets — and tell clients little about their strategies (see preceding article, on page 59). In addition, mutual fund shares can be redeemed every day. That makes them very (very!) different from hedge funds, which can prevent investors from obtaining their money for months or, in some cases, years.

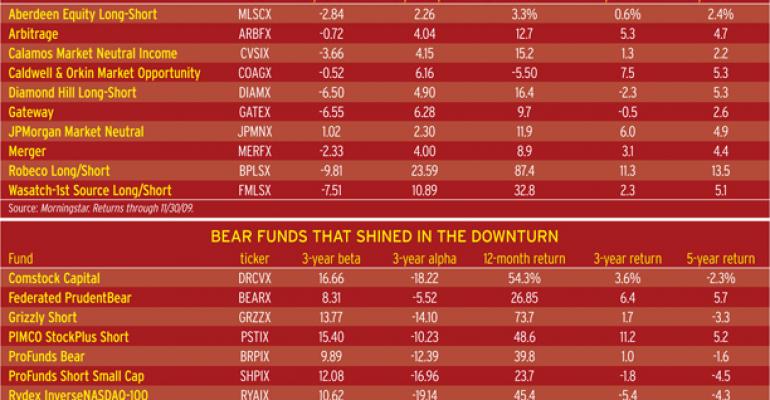

To find the best long-short choices, we screened for mutual funds that had avoided big losses in downturns and delivered decent results in up markets. The final selections all had healthy alphas and solid five-year returns. Among the top finishers were two merger arbitrage specialists, the Merger Fund and the Arbitrage Fund (see table below). By buying takeover targets and shorting the acquirers, the funds have stayed in the black during most years. Another notable choice was Robeco Long/Short, which scored huge gains last year by shorting rich industrial materials stocks and taking long positions in rebounding financials.

The only job of bear funds is to make money in downturns; they gush red ink in good times. So we simply looked for candidates that had “kicked it” during the downturn of 2008. A strong choice was Federated Prudent Bear. Besides selling stocks short, the fund holds precious metals stocks. Those boosted results when gold prices soared.