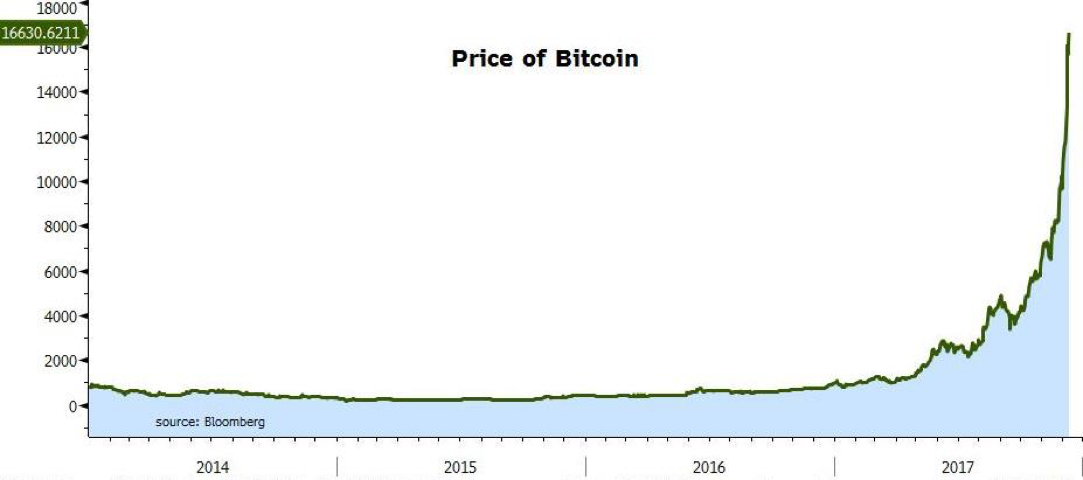

Bitcoin prices skyrocketed in the past 12 months, rising from about $750 to over $16,000. In the past month alone, prices have nearly doubled. The feverish price action and growing public interest suggest bitcoin is in a bubble, but we don’t track liquidity flows in the bitcoin market and don’t have a strong view on where bitcoin should be trading.

Recent performance helps explain some of bitcoin’s appeal. Big gains almost always attract speculative money. Also, the lead-up of bitcoin futures trading started on December 10, so some buying is likely in anticipation of greater institutional participation.

But we think two longer-term factors are driving interest in bitcoin:

- Bitcoin offers extremely high volatility, which is desirable to traders—including hedge funds—in a world of low volatility. Many traders don’t really care what they trade, they just need to trade something that moves so they can make money from the moves. Volatility is a hallmark of digital currencies, and bitcoin prices have dropped more than 80 percent multiple times.

- The bitcoin market is a real market that is not manipulated by central banks, unlike the stock market and the bond market.

We don’t think more people are trading bitcoin because they’re losing faith in traditional currencies. If they were, gold, silver, and perhaps even base metals and real estate prices, would be moving dramatically higher, and they are not.

David Santschi is the CEO of TrimTabs, an Informa Financial Intelligence company.