1 7

1 7

Think of Stake as a place for you to let your clients engage with their activist investor side. More than that, you, as an advisor can also purchase a profile page to hang your own shingle. This can be a good spot to show you are an advisor with an impact investing bent and share the story behind that (take the page of Brent Kessel, founder of $2 billion AUM fee-only Abacus Wealth Partners, for example). You also get a big blue button referring prospects to “Speak” with you. Clicking on that a potential client goes to another page and gets the choice of clicking a few boxes as to what they are looking for among a list of your services (college savings, estate, financial planning, investment management, retirement, taxes are all on Brent’s page), sees a drop-down menu where the can select how much he or she would “like to invest” (half a dozen choices from “less than $100k” to “more than one million” and “I’d rather not say”), and see a final dropdown to select what state he or she is from.

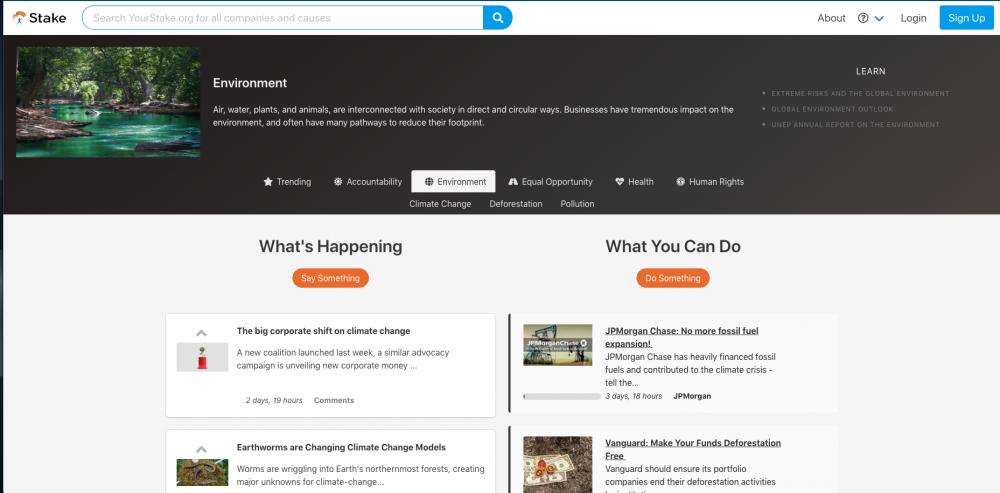

Headquartered in New York, the startup was founded in May 2018 and it categorizes itself as both a direct-to-consumer and B2B offering. The way it markets to consumer investors is as a place to organize shareowners around petitions. Registered users can upload and synch their investment accounts (which, of course provides a lot of good account aggregation data). Once Stake knows the investors holdings the site then connects the user with relevant news about the companies in those holdings. It also tells you about active petitions related to the companies you hold that you, as an investor, can sign. Users can also start their own petitions.

You are probably already getting the gist of what potential the Stake offering holds for advisors but here’s how the firm describes it: Stake offers financial advisors a way to connect with clients (existing and prospective) at a deeper values level.

Firms partnering with Stake that advisors may be familiar with include Orion Advisor Services, First Affirmative Financial Network, and CircleBlack.

Los Angeles-based Our Libra describes itself as a data driven automated financial advisor and consumer lender focused on helping middle-class Americans manage their savings, investments and debt. While on the surface, it might sound like another Wealthfront, Betterment, Acorns or Stash Invest, Our Libra is taking a fundamentally different tack.

Its first product offering is a 9.9% interest rate loan (Libra Loan) to help those with high-interest-rate credit cards pay down their debt more quickly. Why might that be interesting to financial advisors?

As CEO and founder George Mathew explained it, not everyone with this type of debt is from the mass market. Those that apply for an Our Libra loan have to share at least one checking account, which is connected via the account aggregation provider Plaid. Once a user is on board, they are encouraged, though not required, to aggregate more of their accounts.

“Before I started this I assumed there would be a high correlation between how much people earn and how much they save,” Mathew said. “That is not the case, the more they earn the more they spend—we see people wth $200,000 in after tax income and they have none left over—it’s crazy.”

The idea is that as people like this are won over with products such as the loan and other features, Our Libra will earn their trust and eventually keep the company as their financial advising partner. Mathew hinted that a tentatively named feature called “Future View” will help, if not outright tell, users how to prioritize their spending, saving and investing.

Mathew, whose background is in investment banking, mostly in M&A between banks and other institutions, taught himself to code and has largely written the application’s algorithms to date. He said the company already has 15,000 users and has low, very low, customer acquisition costs (in the very low double-digits per customer, he said). His partner, an LA-based marketing expert with his own firm, has run the various online advertising campaigns to date.

Next best action is not a new concept in the advisor vernacular as various CRM vendors have been telling advisors how good their NBA feature is for years and various massive CRM vendors (one in particular) have been promising to reinvent predictive next best action actions for a couple of years now with its homegrown AI named for a famous mathematician and physicist.

Similar ideas are held by Responsive AI, though this Vancouver-based company that started in 2015 has an application that it says will combine personal aggregation and correlate it with CRM systems.

“We help wealth advisors make better, faster decisions,” the presenter said of Responsive AI’s Symbiosis Next Best Action product. “Our technology makes an event human-readable and helps and advisor determine whether that event is an opportunity or risk.”

Individeo by BlueRush was a Best of Show winner at the conference. The name is an abbreviated version of “individual video,” which, according to BlueRush, will be the next generation of customer service. In a nutshell this application from Toronto-based BlueRush, which was founded in 2004, will combine an investor’s data with personalized moving graphics, animation and video and audio to provide multi-faceted materials.

“That pdf from 1993 is not engaging and doesn’t help your investor take action,” according to the presenter. The firm also claimed a 250% lift when it came to eliciting user response.

With key partnerships that include Broadridge and Microsoft this might amount to more than marketing hype. And the seven-minute BlueRush demo video is now available to view.

Noted author Tim Urban gave an entertaining and information-packed review and overview of both the history and milestones of computer intelligence and helped the audience see where things are headed with his keynote address: The Rise of the Machines—The Artificial Intelligence Revolution And the Road to Super Intelligence.

There are 400 possible configurations of a chessboard after the first 2 moves Urban explained as the keynote got underway. And we quickly moved through milestones, including the battle between IBM’s Deep Blue versus Garry Kasparov in 1996. Twenty years later, noted Urban, the exponentially more complex game of Go had been tackled and won by a machine in a 2016 bout with the human champion of the game Lee Sedol.

He made fascinating segues beyond the milestone to point out like how there have already been over 1 billion miles driven by Teslas, meaning the Tesla platform (remember, the electric car is also a highly digital one). And as but one such interesting anecdotal example, “One deer for one car = one deer for all cars” meaning that the experiences of one Tesla car interacting with a deer will then be uploaded to all the others upon the car’s systems synching.

So where does all this take us ultimately? Well, he covered various developments in key industry sectors, for instance how when it comes to medicine, mammograms are already much better at finding breast cancer. “In five years, it will be considered medical malpractice for scans to be reviewed only by humans,” Urban said.

He covered similar changes when it came to the practice of law and how in financial services things like loan assessment and risk management are increasingly the domain of software. He noted how JPMorgan Chase had let 200 people go that were responsible for contract review.

All this culminated in his analysis of other experts' predictions of when machine intelligence will equal our own: 2025. And then the stage beyond that whereby we humans are left behind, referred to generally as “artificial super intelligence,” or ASI, the “median expert prediction for ASI is 2040.”

Two of the six companies that gave seven-minute demonstrations during the final session, called the Accelerators’ Showcase, had potential to be disruptive in the advice space. These early stage startups were introduced by their respective accelerator or venture capital backer.

The first one of interest was an insuretech offering called Waffle, and its logo is, you guessed it, a waffle. Its CEO, Quentin Coolen, talked about how insurance companies today provide “leaky coverage.” In other words the incumbents offer you specific point solutions like life insurance, auto insurance and home owner insurance but not comprehensive coverage of everything you care about in one fell swoop.

Enter Waffle, whose underlying algorithms are “based on MIT Tech,” according to Coolen and the site’s webpage.

“We will be able to offer you much broader coverage for a similar price,” Coolen said. The key difference empowering Waffle would be altering two fundamental principles of insurance, the most important being applying a comprehensive risk model.

The second firm at the Accelerators’ Showcase of interest was LionX, presented by co-founder Aimeelene Gaspar (pictured). Many advisors have benefited from use of account aggregation to grow their books of business by getting a broad look at a client’s held away assets and in some cases bringing those assets under their discretion. While the technology underlying account aggregation continues to improve, there are increasing concerns over data privacy and data ownership.

This has led some banks and institutions, including one of the major four custodians to either step in and stop account aggregation or form partnerships with aggregators and other institutions. In the case of custodian Fidelity, it created an offering whereby its investing customers can control what other institutions have access to their personal data.

LionX is a direct-to-consumer offering that does the same thing. A user would set up an account with an email, phone and password. That user would then take a photo of their government ID and send it to LionX for verification purposes and then once provided an account the user builds out their profile.

“Your financial information and your identity belong to you. Take control over who has access to what information and for how long,” reads the site’s main page. On the product roadmap is a “customer-first marketplace” where consumers can apply anonymously for financial products across multiple institutions and businesses with one request. Only after selecting the best offer would the consumer’s personal information be shared with the provider. Prospective users can sign up for early access by providing an email address at the LionX website.