Redtail Adds Integration, eMoney Rebrands Marketing Tool, Holistiplan Introduces Tax LetterRedtail Adds Integration, eMoney Rebrands Marketing Tool, Holistiplan Introduces Tax Letter

Advisor tools and features addressing tax planning, marketing and cash products all had recent announcements.

There were a number of recent notable tech announcements that merit a mention and context. Here are the latest:

A New Take on Tax Planning

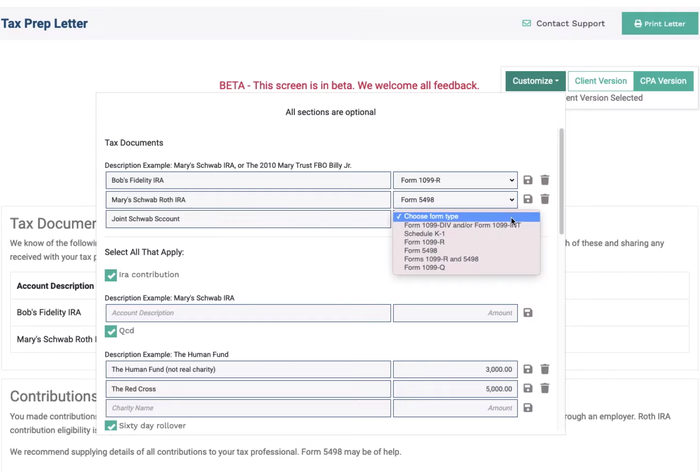

Fintech firm Holistiplan, which aims to turn client tax documents into a tax planning opportunity, is launching a feature to make it easier for advisors to summarize their tax planning strategies for clients and third-parties, like CPAs. It's called the "Tax Prep Letter," and software developer Holistiplan said the personalized letter, available as a premium feature, is a way for advisors to demonstrate to clients their value as financial planners from a tax perspective.

The new feature works by allowing advisors to add pre-formatted tax actions to an overall letter. Actions like Roth conversions, 529 and HSA contributions and other consequentional tax actions can be selected from a pre-populated list. The selections flow into a document, with the advisor's logo and name at the top, and with details on the tax-sensitive actions undertaken with the guidance of the advisor in the previous year. The advisor can also alert clients to which documents to be on the lookout for, in order to pass along those documents to the client's accountant.

“While Holistiplan started primarily as a tax return review automation tool, this is another step in our commitment to being a year-round tax planning software solution,” co-founder Kevin Lozer said in a statement. The letter helps clients see the value being provided by advisors in a well-organized manner. The firm won a fintech competition sponsored by XY Planning Network in 2019.

“Creating a custom document for every client is an enormous undertaking.,” he added. “Tax Prep Letter reduces that process to just a few clicks.”

One-Click Cash Management

Speaking of minimizing clicks, advisors using Redtail Technology’s CRM and MaxMyInterest will now benefit from an integration of the two services. The one-click onboarding helps clients earn “up to 0.75% APY on same-day liquid, FDIC-insured deposits,” according to a spokesperson.

The integration works by allowing advisors to open a MaxMyInterest account for a client through the Redtail platform. Some client information is automatically pulled from the CRM system. Clients are then sent an email to complete the sign-up.

“Max provides advisors with a quantifiable value add by providing the ability to offer a high-yield solution for a typically overlooked and under-earning asset class,” said Michael Halloran, head of partnerships and business development for MaxMyInterest, in a statement. “By integrating with Redtail, we are excited to help even more advisors grow their AUM, while their clients earn the highest yields in the market.”

All cash in MaxMyInterest is held directly by the client, according to the announcement.

Marketing Growth Needs A Rebrand

The financial planning software developer eMoney rebranded its Advisor Branded Marketing as Bamboo, according to the firm. As ABM evolved from its launch in 2012, with extensive automation, eMoney executives deemed the moment ripe for a new identity for the software.

“This rebranding is the next step in eMoney’s journey toward providing a comprehensive marketing solution that uses financial planning data to deliver personalized marketing content and insights to efficiently engage and grow an advisor’s book of business,” said Valerie Rivera, eMoney’s senior product marketing manager, in a statement. “The name ABM no longer fit our vision. We wanted something fresh to signify growth.”