North Capital Builds Free Direct-to-Consumer Financial Planning PlatformNorth Capital Builds Free Direct-to-Consumer Financial Planning Platform

North Capital Inc. decided the financial planning tools available to investors weren't enough, so it built evisor and made it available for free.

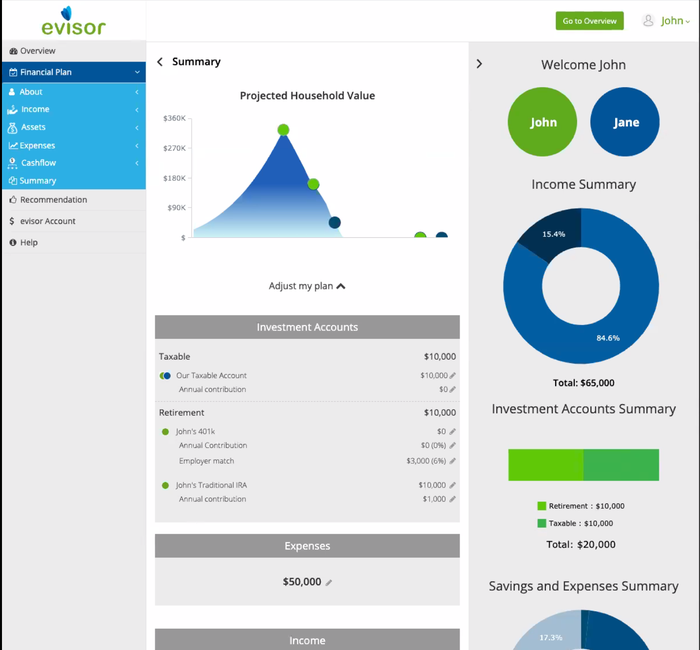

Just two years after automated investing platform Wealthfront introduced its algorithmic financial planning experience, Path, a team of advisors in Midvale, Utah, is introducing its own direct-to-consumer financial planning experience, called evisor. The platform, which provides no-frills financial planning designed for retirement, is available for free. It can also be used as a lead-generation tool for a fee-based investment management strategy built largely around Charles Schwab’s Intelligent Portfolios and even human advisor interaction, billed at $200 per hour.

While there are significant differences between the free financial planning offered by products like Wealthfront, or even the advisor-focused software like Envestnet | MoneyGuide, eMoney and RightCapital, evisor offers proof that advisors are beginning to see the value in digitizing their own strategies and financial planning models. It only took 18 months for CEO James Dowd and his team at North Capital Inc. to convert its own financial planning strategy, an Excel-based model called the “Lifetime Financial Analysis,” it into a web-based experience. While the plan currently provides simple financial planning built around the feasibility of retirement, the development team, led by Daren Dearden, expects to incorporate Monte Carlo bands and life changes, like switching from full-time employment to part-time, into the model by the end of the year.

The product will even offer a set of instructions based on rules and heuristics, said Dowd. Investors might receive recommendations to open a new account type or add funds to an emergency savings account.

The evisor platform also can route interested investors to an investment management solution that costs 25 basis points. It’s largely tied to the automated investing executed by Schwab’s Intelligent Portfolios, but also includes Dimensional Funds and certain socially responsible investing funds. It includes a proprietary system built around some of the “issues” the firm encountered with the outside automated investing tool, said Dowd, such as a lack of trading and rebalancing until certain asset thresholds are reached. The rebalancing that evisor executes takes place on a “regular schedule,” as well as when funds are added or withdrawn, he noted, and tax-loss harvesting is also included.

If investors want even more hand-holding, North Capital has nine advisors standing by to provide assistance at $200 per hour. Investors, however, are able to simply execute a financial plan for free and walk away, if they want. Moreover, while a white-labeled product is not available today, there are plans to release one for other advisor firms in the future.

North Capital has plans to add account aggregation to the tool through Morningstar’s ByAllAccounts, which the firm’s been using for six years, and Finicity.

The decision to build out a proprietary financial planning front end was born of necessity, said Dowd. “We looked at a lot of different tools,” he noted. “There are some tools that are OK and some tools that are terrible. We didn’t find any tools that we thought were great.”

Even products like Betterment for Advisors didn’t provide the thoroughness that clients needed, Dowd said. “We didn’t want to have to settle,” he added. “Direct-to-consumer tools are not that comprehensive. We felt that there was room in the market for a primarily planning-focused advisory solution.”