1 8

1 8

ADVERTISEMENT

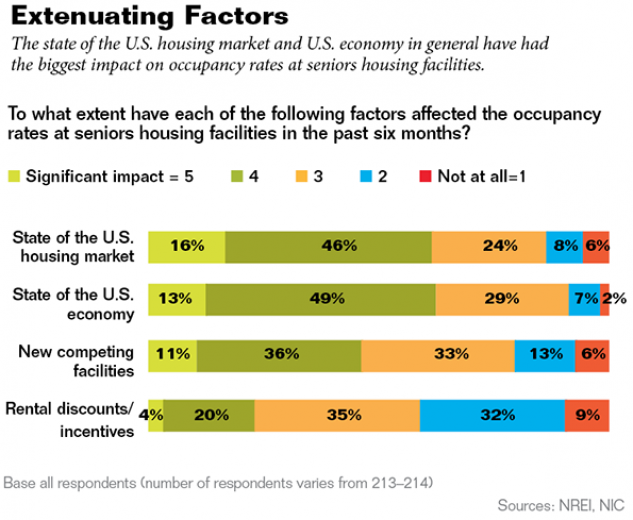

Extenuating Factors

According to survey respondents, the state of the U.S. housing market and U.S. economy in general have had the biggest impact on occupancy rates at seniors housing facilities over the past six months. Rental discounts/incentives have had the least impact.

Ample Funds

REITs, Fannie/Freddie and HUD are considered to be the most significant sources of debt capital for the seniors housing sector. Respondents are less likely to indicate significant funding from life insurance companies and pension funds.

Sober Expectations

While interest rates for seniors housing are expected to increase over the next 12 months, loan-to-value ratios, risk premiums and debt coverage ratios are expected to remain the same. Respondents are divided on their expectations for underwriting standards, as 27 percent expect looser standards while 24 percent expect tighter standards.

Looking Bright in the Sun Belt

Respondents were asked to rate each of four regions on the strength of market fundamentals for the Seniors Housing sector. Respondents who currently operate in each location are more likely to see the region as attractive, as 70% of those in the south/southeast/southwest see the region as attractive. The same is true for respondents in the Midwest/East North Central/West North Central (68 percent), West/Mountain/Pacific (67 percent) and East (63 percent).

Gauging the Development Pipeline

The majority of respondents expect to see an increase in seniors housing construction starts over the next 12 months. Of those respondents, more than one in three expects the new construction to result in overbuilding.

Transactional Velocity

While nearly half of respondents expect the volume of seniors housing property sales transactions to increase over the next 12 months, the majority expect the time to close to remain the same.

Availability of Capital

The majority of respondents expect to see an increase in the availability of both debt and equity capital over the next 12 months.

Attractiveness of Property Types

Among those in the industry, the seniors housing sector is considered the most attractive property type. Respondents also consider the Apartment sector to be attractive. Retail is considered the least attractive market sector. Overall, 85 percent of respondents plan to buy or hold seniors housing properties over the next 12 months.