It was John Oliver who recently reminded us (different topic, yet relevant) that there is no use for “... people’s opinions on a fact.” With his simple truth in mind, let’s stay with facts, but those that were relevant in materially shaping the way our firm, HighTower, was built. The fact is that most professional money managers, as well as traditional Wall Street firms, did not have their facts right when there was a chance to identify the risks stemming from capital markets in 2007/2008, 2011, etc., and, quite frankly, many of them are still missing the mark. When reviewing a Google search on “the accuracy of Wall Street research,” the findings seem to be clear and rather sobering: it is a risk to build around one leading, and often binding, opinion.

The opposite has become the norm for us, as we have created a firm anchored in our collective wisdom. At HighTower (HT), we do not seek value on the basis of one single opinion, but instead have adopted a disciplined approach to exchanging best practices and ideas, and, more importantly, to constantly challenging each other in our views. Yes, admittedly, it is a luxury in today’s sales-driven financial industry – but a luxury we have adopted as the quintessential core of what we do, with our mission being to provide advice to our clients, rather than to sell products. In short, our business was created with an objective to reduce or avoid many conflicts of interest we may have faced earlier in our careers as financial advisors.

As we first introduced in our post, The Power of Crowds, we continue to build on the 1906 thesis of Sir Francis Galton (based on a competition to guess the weight of an ox) that a diverse group of independent individuals is likely to make certain types of decisions/predictions better than individuals alone, including subject-matter experts. On a regular basis, HT partners, analysts, corporate executives, and board members allocate (a sample) $100 over 13 asset classes to determine their preferred global multi-asset class allocation. All findings are aggregated and published monthly as an internal “WoX Index.” The input is not related to any specific client risk profile, but is simply a status quo assessment of current market conditions and preferences.

As this week our advisors gather for our semiannual “meeting of the minds” (aka the “Spring Forum”), it is time to take another look under the hood and provide an update on the success of our collective views:

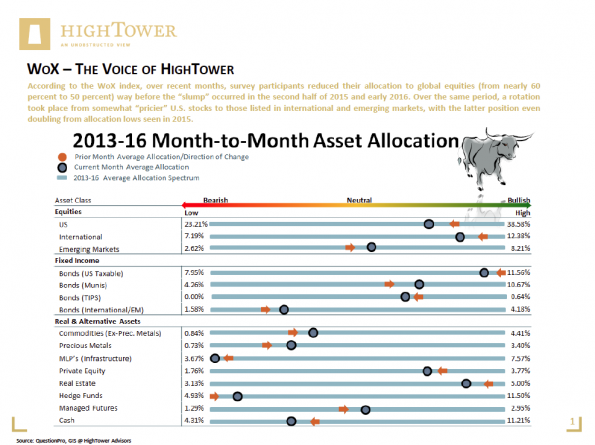

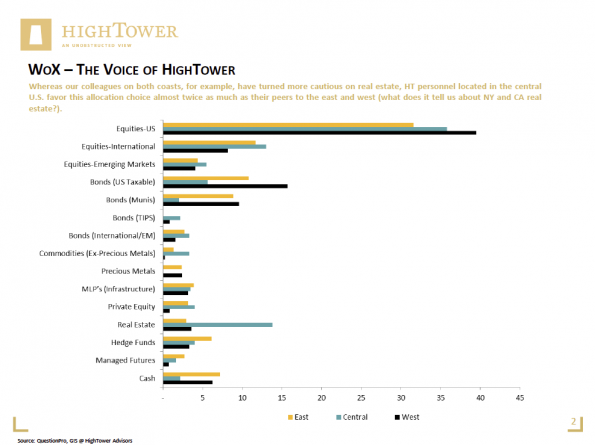

According to the WoX index, over recent months, survey participants reduced their allocation to global equities (from nearly 60 percent to 50 percent) way before the “slump” occurred in the second half of 2015 and early 2016. Over the same period, a rotation took place from somewhat “pricier” U.S. stocks to those listed in international and emerging markets, with the latter position even doubling from allocation lows seen in 2015. Overall, there still appears to be muted interest in hedge funds and select real assets, but respondents have voiced an increased desire for precious metals over the past months. Whereas our colleagues on both coasts, for example, have turned more cautious on real estate, HT personnel located in the central U.S. favor this allocation choice almost twice as much as their peers to the east and west (what does it tell us about NY and CA real estate?). Even with steep prices in most bond market segments, this particular allocation “bucket” has not been reduced significantly (at least in the U.S.), but recent additions are showing a trend towards the municipal market rather than corporate and treasury issuances.

True to the nature of HighTower, the WoX Index has become a source of allocation guidance to our advisors in their client-related work, but is not considered a binding or representative “house” opinion. In fact, WoX has enabled us to effectively increase our collaboration and underline the fact that we take the utmost pride in our differences of opinion. At the same time, we live up to the responsibility that arises with likely opposing views, staying engaged as a group, as well as a collective mind, to benefit our work and, ultimately, clients.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.