“Winter Charts” is a series of current financial topics explained in dots, lines, and only a few words—just the right “mix” to concisely convey ideas for critical thinking about investing.

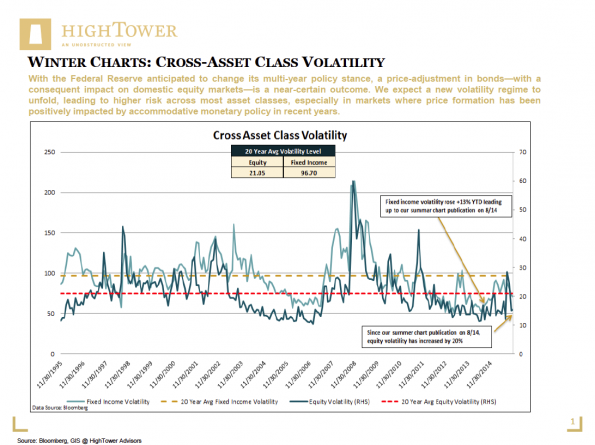

Suppressed volatility remains one of the most critical and least considered risks in today’s investment environment. As we correctly predicted in Summer Charts: Cross-Asset Class Volatility, risk in U.S. equities (as measured by volatility) has now increased by 20 percent since our August 2015 publishing date.

Investors need to consider the following aspects with respect to their asset allocation choices: 1) volatility patterns in U.S. equity and fixed income markets still remain more than 25 percent below their respective 20-year long-term averages; 2) fixed income volatility, in the past, has led equity volatility.

With the Federal Reserve anticipated to change its multi-year policy stance, a price-adjustment in bonds—with a consequent impact on domestic equity markets—is a near-certain outcome. We expect a new volatility regime to unfold, leading to higher risk across most asset classes, especially in markets where price formation has been positively impacted by accommodative monetary policy in recent years.

The right combination of global diversification, active stock selection (over passive “beta” investing), and thoughtful financial planning can provide a strong basis for every investment process.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.