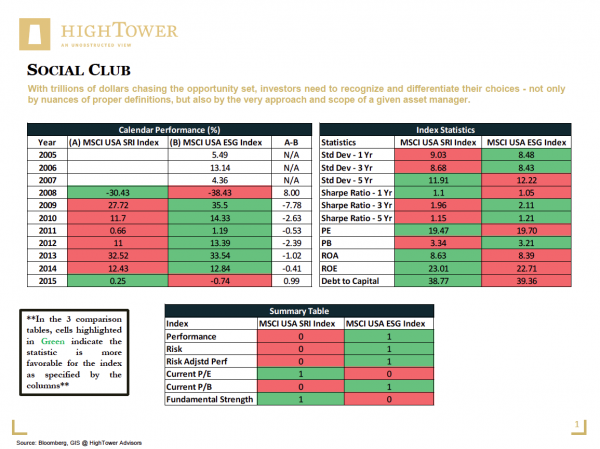

As always, everything depends on the point of view one chooses to take. What has been generally considered a "monetary virtue" is in need of a more refined understanding: social investing. With trillions of dollars chasing the opportunity set, investors need to recognize and differentiate their choices - not only by nuances of proper definitions, but also by the very approach and scope of a given asset manager. There are three main categories that broadly sum up the investment landscape in the social space: Socially Responsible Investing (SRI), Impact Investing (II), and Environmental, Social, and Governance Investing (ESG).

The first notable retail entry into social and ethical aspects of investing dates back to the 1920s, with the inception of the first mutual fund screening out what was originally the basis of perceived "unsocial" corporate money made via tobacco, alcohol, and gambling. Socially Responsible Investing (SRI) 1.0 consequently centered on "sin stocks"—not an entirely surprising label, as the original movement of avoiding "unsocial money" was mainly anchored in religious beliefs, even before collective investment vehicles became an option.

Market participants have moved beyond original sins, but deciphering "what is what" is far more complex to assess within today's offering. Whereas SRI can be considered a portfolio construction approach with the objective of screening out unsocial investment choices (often based on religious and ethical guidelines), impact investors will allocate money to companies with a mission typically dedicated to the improvement of living conditions and standards (e.g., "green" investing). ESG strategies take the investment objective even further, utilizing a factor-based approach in rating companies on their environmental/social engagement and corporate governance. ESG factors are designed to optimize investment performance by adding insight into the quality of a company's management and culture.

Being "socially responsible" may not only mean different things to different asset managers, but also varies amongst individuals pursuing investments in the space; it is a very personal aspiration. Inherent to this differentiation is commonly a generational gap in defining what is social or not, making choices even more difficult and highlighting a material opportunity when considering the trillions of assets to be transferred from baby boomers to their children in the coming years. In spite of the current "broad brush" set of standards, however, the general appeal to the good in us has fostered remarkable growth; the sustainable investment market grew from $13.3 trillion in 2012 to more than $21 trillion in 2014, and SRI assets now represent nearly 18 percent of the $36.8 trillion in total assets under management in the U.S.

The most sensible approach to investing appears to be based on a "screening-in" (rather than a "screening-out") process, typically embedded in asset management strategies following impact investing or ESG standards. Similar to my previous argument that companies with happier employees are better investments, the same is true for more "social" companies that support a higher standard of ethical values: as empirical evidence has shown, companies with higher scores on material sustainability concepts (ESG) tend to achieve better financial results. Similarly, since 1990, the social index (MSCI KLD 400) produced an average annual total return of 10.46 percent, compared with the S&P 500's 9.93 percent.

When following the money, we must stress the complexity and difficulty of applying the concept of social investing to real life circumstances. Whereas global warming is still widely debated as a potentially flawed concept, money managers and institutional investors have already decided differently and view climate change as the most significant environmental factor in terms of assets under management. On the other hand, England's Cambridge University, one of the world's oldest (and wealthiest!) educational institutions, has committed to adopt a new approach of investing at least half of its nearly $8 billion endowment according to updated ethical guidelines.

With all good intentions in mind, what we can learn is that all social investments are not created equal and that investors cannot be half social, but should be "all in." With so many different management approaches, the most sensible engagement with social investing is to first decide what aspects are most important on an individual basis, and then attempt to express this point of view via given options.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.

Click to Enlarge

Click to Enlarge