The behavior of global financial markets this week could be characterized as “oil, roil, and turmoil.” The bottom line is that the price of oil—currently around $60 per barrel—is in a free fall. Technically speaking, oil prices have taken out one price level support after another and are now in an accelerated downtrend. The measured move, or the minimum downside potential price according to the rules used by market technicians, is now approximately $50 per barrel.

The free fall in oil has equities under pressure and bonds rallying. Based on our analysis, we recently set a target near-term yield for benchmark 10-year U.S. Treasury bonds of 1.9 percent, approximately 30 basis points below current levels. For those who have been following my commentaries and Guggenheim’s research on interest rates, such a move lower would be a continuation of the theme we have been preaching for some time.

What’s to be made of the oil roil? Well, the obvious first order effect is gasoline prices will head even lower, which is a healthy sign for holiday retail sales and the U.S. economy in general. This is the bright side of lower energy prices, but there is a dark side as well. The decline in oil prices reflects not just oversupply, but shrinking global demand due to economic malaise in Europe and Asia. The grim situation in Europe means we are likely to continue to see downward pressure on energy prices and commodity prices, including copper and other industrial metals.

The situation in Europe is where we get to the turmoil portion of the current macro outlook. The economic situation across the euro zone is not improving and policymakers are spinning their wheels. The most recent reading of industrial production in Germany disappointed and events in Greece have fueled further chaotic speculation about economic stability and the future of the monetary union.

Months ago, I expressed concern that the European Central Bank was falling behind the curve. After the ECB’s recent inaction following their December meeting, however, I had to change my tune. The ECB is no longer falling behind the curve—it is now completely behind the curve. Time is not on the side of the bold, let alone the impotent.

In the next few months, things will likely go from bad to worse. The ECB’s long-term refinancing operations—LTRO1 and LTRO2, which were the process by which the ECB provided financing to euro zone banks—are beginning to expire. This will result in approximately 256 billion euros of assets rolling off the ECB’s balance sheet at a time when it is endeavoring to expand it.

Why is this significant? For those who are not a monetary-policy geek like me, as the size of a central bank’s balance sheet contracts, the amount of money in the economy declines. As the amount of money in the economy declines, stimulus is removed by hampering the ability to lend and transact, let alone to support higher asset prices. Today, the ECB’s balance sheet is approximately 2.2 trillion euros. To lose over 250 billion euros, or about 12 percent of its assets, in the next few months is significant. To put this into perspective, this would be the equivalent of the Federal Reserve taking more than $500 billion off its balance sheet in the next 90 days. Can you imagine how disruptive that would be to U.S. financial markets? The fact that the ECB may be shrinking its balance sheet at such a pace, and at such a time, will be highly disruptive. This is why I say the outlook for Europe is grim and policymakers are markedly behind the curve.

What does this mean for investors? Well, the recent price action in the market is telling us something important. It is betraying that we potentially have something darker and more sinister on our hands than we may have thought just a few weeks ago. If things play out as I suspect, interest rates and oil prices will head meaningfully lower in the near term.

In the long run, I always remind people there has never been a recession in the United States that was not preceded by a prolonged period of interest rate increases by the Federal Reserve. The ominous signs we are witnessing are likely to push back rate increases further into 2015 than most currently anticipate, and perhaps even into 2016 or beyond. While the Fed is clearly not actively tightening, the wildcard is whether or not the end of QE is tantamount to a form of monetary tightening that we have never seen before. The Fed would likely say it is not, but the jury is still out. Certainly, the shrinking of the ECB balance sheet constitutes tightening for Europe.

Without a recession in the United States, the bull market in equities that began in March 2009 will likely remain intact. I believe we are heading toward a meaningful correction in equity prices sometime soon, likely in the first half of 2015, but I do not anticipate a bear market. If we fail to see a rally in the stock market this month—typically referred to as the Santa Claus rally—then I will get really worried, as historically that has been a precursor to a bear market. But, in the spirit of spreading holiday cheer, I believe seasonal strength will carry U.S. equity prices through the current oil, roil, and turmoil and ultimately to new highs. What happens thereafter is a conversation for another time.

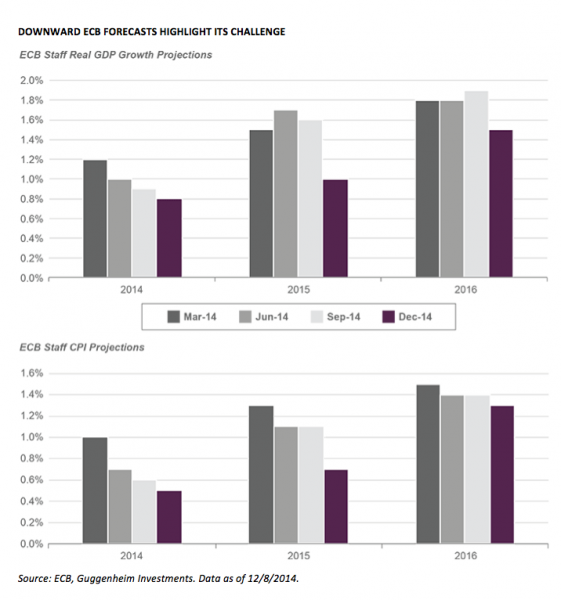

The ECB Forecasts for Growth and Inflation Are Still Too High

Over the past year, the ECB has repeatedly cut its forecasts for both growth and inflation for 2014 and the following years. The latest changes to the projections were particularly large, painting a much more challenging picture for the year ahead. These forecasts demonstrate that the ECB may be coming around to fully realizing the problem on its hands, but now bold action is needed to address it.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2014, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Scott Minerd is Chairman of Investments and Global Chief Investment Officer at Guggenheim Partners