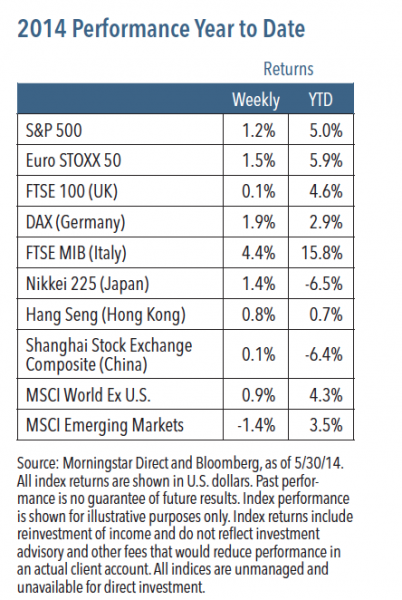

Another week brought another record close for equities. The S&P 500 Index increased 1.2% for the week (1), notching a new high, but investor attention appeared to be focused elsewhere. Low levels of market volatility, a pickup in M&A activity, a difficult revenue environment for banks and improving housing data all gathered headlines, yet the bond market garnered the most focus.

“We think we’re more likely to see rising bond yields than falling equity prices.”

Why Are Yields So Low? And What Does It Mean?

Since declining bond yields are often associated with weak economic growth and falling equity prices, many are wondering why yields are low and falling. There’s a long list of reasons, but we want to highlight five: First, investors are still engaged in a flight to quality in light of the geopolitical crisis in Ukraine. Second, weak European growth appears to be prompting the European Central Bank to consider aggressively easing monetary policy. Third, the shrinking U.S. budget deficit brings with it less supply of Treasuries. Fourth, real economic growth and inflation have remained low. (2) And fifth, it looks to us like many investors are abandoning short positions in Treasuries.

Other fixed income signals, in contrast, are suggesting increased risk appetite and stronger growth. Corporate credit spreads are narrowing (meaning investors are still investing in higher-yielding bonds, which is usually a signal of more risk appetite). Also, the yield curve is steepening (typically a signal for stronger economic growth). (3)

Weekly Top Themes

1. Real GDP contracted at a 1.0% annualized rate in the first quarter. (4) The details in the report, however, actually appear favorable for second quarter growth. Almost all of the downward revision was due to a decline in inventory accumulation, which should translate into a more rapid pace of production in the second quarter since businesses are now operating with less inventory overhang.

2. We expect second quarter GDP growth of 4% or higher, and also forecast growth of more than 3% for the second half of the year.

3. With increasing consumer confidence (5) and declining unemployment claims, (6) we think the data will show that consumer spending accelerated in May.

4. Initial unemployment claims dropped to 300,000 last week. (6) The four-week average for claims is at its lowest level since the expansion began, (7) indicating improvement in the U.S. job market.

5. A close look at the stock market suggests this is still a stock-pickers environment. Although the S&P 500 is at an all-time high, some data does cause us to pause. There have been limited new daily highs, and equally-weighted and small cap averages have not made new highs. Clearly, the rising tide is not lifting all boats, which to us means that a selective approach remains critical.

The Big Picture: Tug of War Between Equities and Bonds

Based on recent performance, stocks are suggesting that better economic times are ahead, while the bond market is telling a bleaker story. It seems either bond yields will need to rise or stock prices will need to fall. So which is it? We expect economic growth to accelerate and thus believe that bonds yields are more likely to rise than stock prices are to fall in the coming months.

But would rising rates derail the bull market? Not necessarily. If yields were to rise quickly and dramatically, that could unnerve investors and cause a downturn in equity prices. But we believe equity markets will be able to remain resilient if and when yields start to move higher, and we would only become concerned after yields have moved quite a bit higher than where they are today.

1 Source: Morningstar Direct, as of 5/30/14. 2 Source: Bureau of Labor Statistics. http://www.bls.gov/news.release/cpi.nr0.htm. 3 Source: Bondsonline.com http://www.bondsonline.com/Todays_ Market/Corporate_Bond_Spreads.php. 4 Source: U.S. Department of Commerce: Bureau of Economic Analysis http://www.bea.gov/newsreleases/national/gdp/2014/gdp1q14_2nd.htm. 5 Source: The Conference Board http://www.conference-board.org/data/consumerconfidence.cfm. 6 Source: U.S. Department of Labor http://www.dol.gov/ui/data.pdf. 7 Source: U.S. Department of Labor Historical Data http://www.oui.doleta.gov/unemploy/claims.asp.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy. Euro STOXX 50 Index is Europe’s leading Blue-chip index for the Eurozone and covers 50 stocks from 12 Eurozone countries. FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. Deutsche Borse AG German Stock Index (DAX Index) is a total return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange. FTSE MIB Index is an index of the 40 most liquid and capitalized stocks listed on the Borsa Italiana. Nikkei 225 Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. Hong Kong Hang Seng Index is a free-float capitalization-weighted index of selection of companies from the Stock Exchange of Hong Kong. Shanghai Stock Exchange Composite is a capitalization-weighted index that tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The MSCI World Index ex-U.S. is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets minus the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

RISKS AND OTHER IMPORTANT CONSIDERATIONS

The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. Equity investments are subject to market risk or the risk that stocks will decline in response to such factors as adverse company news or industry developments or a general economic decline. Debt or fixed income securities are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Non-investment-grade bonds involve heightened credit risk, liquidity risk, and potential for default. Foreign investing involves additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. Past performance is no guarantee of future results.

Nuveen Asset Management, LLC is a registered investment adviser and an affiliate of Nuveen Investments, Inc.

Robert C. Doll, CFA is Chief Equity Strategist and Senior Portfolio Manager for Nuveen Asset Management. Follow @BobDollNuveen on Twitter.