The art and science of investing is to combine quantitative facts with a qualitative assessment—often nothing else but a good portion of “gut.” This market environment is a tough one, and still seems largely influenced by what sort of “fix” central banks can offer. The violent correction of this past August has largely been forgotten, as investors have been “repaid” by an equally strong recovery; yet, under the surface, conditions remain challenged. Market internals are still not back to pre-summer levels, and the global economy is slowing, inclusive of economic output in the U.S. Further, equities in domestic markets—favorites for most asset allocators—are expensive. Sure, with interest rates at historic lows, the argument pro equities can always be “crafted,” but I do hope that some sort of “reverse logic” will apply should rates start to rise.

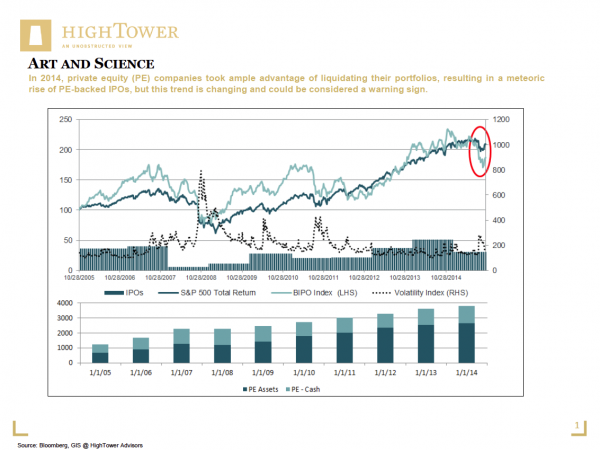

When in doubt, and traditional valuation models are not producing reliable results, advisors should look for other measures to guide their decision-making. As we discussed in Hangin’ with the Rich Kids, it is of benefit to identify how the “large pockets” of money, such as the ultra-high-net-worth and institutional clients, are investing (or divesting, for our purpose). An interesting perspective can also be gained by observing IPO activities, especially related to offerings where financial sponsors are looking to recapitalize their investments. In 2014, private equity (PE) companies took ample advantage of liquidating their portfolios, resulting in a meteoric rise of PE-backed IPOs, but this trend is changing and could be considered a warning sign.

Whereas the outlook for global IPO activity remains constructive overall, capital raised is down 13 percent year-over-year (H1 2014 vs. H1 2015), with notable declines experienced in European and U.S. markets. Critical observers will dismiss these developments, expecting pending blockbuster IPOs to reverse the current cautionary climate; this aspect, however, may be nothing else but the result of a self-fulfilling prophecy, given that PE assets and respective PE cash levels have nearly quadrupled over the past ten years (see chart) and almost doubled since the passing of the financial crisis in 2008/2009. In other words, by now, financial sponsors, especially those backed by capital raised through public funds, have seen their timelines “dwindle,” leaving no other choice but to seek recapitalization of their original investments.

Based on our research (see chart), other aspects are worth considering when trying to assess the overall health of current markets. Tracking post-IPO stock performance, the respective BIPO Index has historically reversed trend before major volatility impacted public markets—potentially purely coincidental, but current developments appear to be similar to the 2006/2007 declines, which were followed by only a short recovery into 2008. Should history “rhyme,” we could experience lower traditional markets 12-18 months out, or, at a minimum, a more significant uptrend in volatility. Lending further credibility to our research is the fact that the current average IPO deal size is the smallest on record since 2005; therefore, some parties may just have to “get things done” before an unproductive market environment threatens to delay IPO activities.

Today is not only the time to introduce a new concept to assess markets, but also to keep sending the message that risk is being “massaged” (please see our Life Of A Turkey blogpost), leaving investors too assured of the quality of the current equity uptrend. On the other hand, as traditional asset markets have not produced desired results for investors taking risk this year, it is certainly worth contemplating an increased allocation to illiquid investments. Even with caution that should be practiced given current market/economic trends, the average first-day gain of U.S. IPOs priced during Q3 of 2015 was 15 percent, and 93 percent of IPOs were priced within or above expectations.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.