I am admittedly a little tired, but also energized and wanting more: We just concluded our second annual industry conference—Hightower's APEX—a collaborative forum for the disruptors of our industry, who never come up short on good ideas or strong opinions. Since the early days of building our firm, we have avoided being held to a single point of view, but instead exchange ideas and best practices on a regular basis. Not only do we value the creative open dialog, but it has become a necessity to compete in today’s complex financial market system.

The power of collective wisdom may easily outstrip a “professional house view,” considering that there was not a single financial services firm that, with conviction, rang the alarm bell before the market crash of the 2008 credit crisis. In fact, the Federal Reserve of New York even “came clean” in a 2011 blog entry, admitting “unusually large forecast errors” related to unemployment and real-GDP predictions for 2008/2009. Even better is an extensive list of research on why so many economists failed to predict the Global Financial Crisis, with explanations ranging from systemic failure of the financial profession to conspiracy theories.

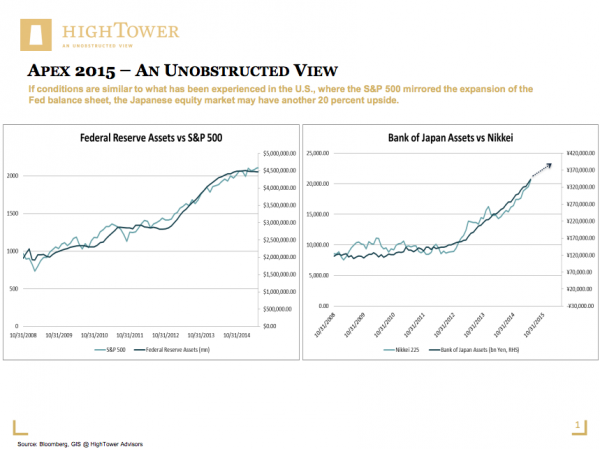

Summarizing our panelists’ perspectives, the financial future leading us into year-end appears rather uneventful (bias alert!). The domestic market should gain another 3 percent (average) from current levels, but with the potential of a sharp setback of up to 10 percent. Better equity “deals” can be found in regions where central banks continue to support the financial system, namely in Asia and Europe. If conditions are similar to what has been experienced in the U.S., where the S&P 500 mirrored the expansion of the Fed balance sheet, the Japanese equity market may have another 20 percent upside.

In contrast, investing abroad has become a challenge due to the strengthening of the domestic currency (USD), leading to losses from the perspective of U.S. asset allocators. The strong dollar trend, according to our panelists, has not fully played out, but could run into a shorter-term consolidation phase, especially vis-à-vis European currencies. The world will continue to be “on edge” over competitive aspects of currencies, and it is expected that the Chinese renminbi will materially improve as a recognized reserve currency; this aspect should also lead to a deeper, more liquid bond market in renminbi-denominated fixed income instruments.

The strong USD may also have “painted the Fed into a corner,” by softening the earnings potential of U.S. companies—consequently reducing domestic growth. Whereas our panelists see the federal funds rate rising to 50 bps by year end, the actual chance of this outcome may decline with domestic earnings being further impacted. On the other side of this argument is the concern over a sharp uptick in inflation, especially driven by recent wage growth. The significant adjustment of long-term European sovereign rates could have a spillover effect into U.S. rates, with 10-year Treasury yields moving closer to the 3-4 percent range.

The long-term picture conveyed by our panelists is even more interesting with the recency bias removed. Compared to other developed nations, the U.S. continues to be well-positioned and should be anchored as a global superpower for much longer than history would suggest. Advances in technology, a sustained boom from energy independence, and a related reindustrialization should favorably “underline” this position. At the same time, the emerging world continues to consolidate from years of speculative investment flows and is likely more vulnerable to abrupt changes in financial conditions.

When we eventually have the benefit of hindsight, it will turn out that some of our panelists’ forecasts were more correct than others—but we can be assured of one important aspect: HighTower’s approach to research is genuine, as we do not have to sell product, but rather provide advice to our clients. Our business was created with an objective to reduce or avoid many conflicts we may have faced earlier in our careers as financial advisors. True to our promise, we strive to continue delivering “an unobstructed view” to our clients.

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.