The tendency for advisors from independent firms to be less likely to recommend variable annuities is particularly noteworthy given that independent advisors tend to have a slightly higher percentage of client assets invested in this product than do advisors from large firms (22% vs 17%, respectively). Perhaps not surprisingly, advisors from “other firms” have the highest average (24%) of the three channels.

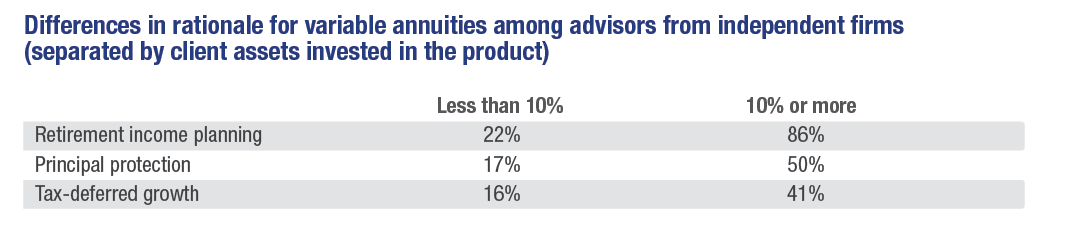

However, the average figures mask a distinct difference in outlook among advisors from independent firms. Those who have 10% or more of their clients’ assets invested in variable annuities see strong value in recommending the product for retirement income planning and principal protection, while those with less than 10% invested find those objectives much less compelling.

Next Part 3 of 4: Preferences carry over to other investment types

Click to Enlarge

Click to Enlarge