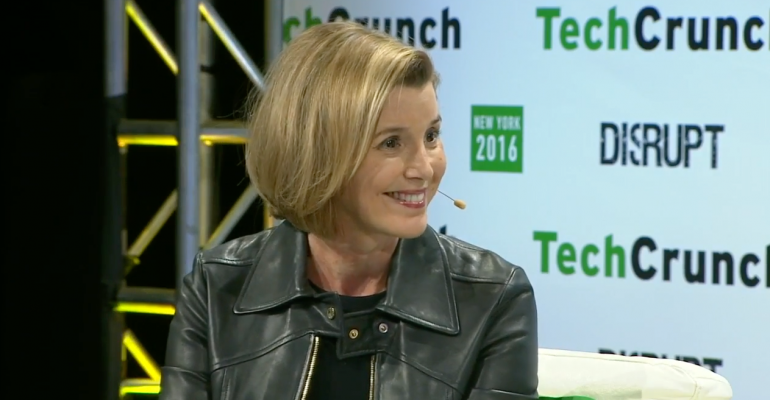

Sallie Krawcheck, the president of the Ellevate network of professional women, kicked off the third day of TechCrunch Disrupt New York on Wednesday with the public launch of Ellevest, an automated investment platform designed for women.

In an interview with TechCrunch’s Connie Loizos, Krawcheck said Ellevate would build a comprehensive, goals-based financial plan that, unlike other automated advice services, takes into account a woman’s unique financial needs.

“This isn’t ‘for women,’ ‘pink it and shrink it,’ ‘make it smaller,’” Krawcheck said. “We’re going to forecast out your life so that you can achieve your goals. And then we’ll put a bespoke investment portfolio against each goal to help her achieve them.”

For example, Ellevest will account for a woman’s salary arc, which is often quite different from a man’s. During retirement planning, the algorithm also considers the fact that women tend to live longer than men and is built to consider career decisions men don’t face, such as taking a career break to raise children.

Though Krawcheck said she doesn’t like the term “robo advisor,” saying it was a term invented by the industry to dismiss digital investment platforms, Ellevest acts like other automated investment services by sticking to portfolios of managed ETFs. With 21 available asset classes, Ellevest does feature more options than other robos already on the market.

Ellevest is also approaching risk tolerance and asset allocation differently. Instead of using a risk questionnaire to determine an investment model, Ellevest’s portfolios will put investors into portfolios that will reach their goals or better in 70 percent of market scenarios. Krawcheck added that Ellevest portfolios won’t be “set it and forget it,” but instead actively monitored and adjusted over time.

To accomplish this, Krawcheck said Ellevest will focus on client engagement and actively reaching out if an investor isn’t on track to reach her goal.

Ellevest will charge users 50 basis points, which is more expensive than other automated services already on the market.

“We talked to women, and they said, ‘I don’t want the cheapest, what I want is the one that’s the best for me and that is tailored to me.’ And alone amongst anyone else we’re going to give them this full personalized financial plan, this highly customized investment portfolio and ongoing risk management,” Krawcheck said.

Women have an estimated $5 trillion of investable assets, but some wonder if it’s advisable to intentionally exclude half of the population from a product.

Krawcheck responded that because the majority of financial services professionals are male, the industry is intrinsically biased towards serving men and leaving the unique needs of women by the wayside.

“To have us talking to the market of women, I don’t feel like we’re leaving the guys out. I feel like we’re beginning to include the women. This doesn’t hurt anybody,” Krawcheck said. “If you’re talking to everybody, you’re talking to nobody.”

To this end, Krawcheck wanted to build a product from the ground up without ties to the traditional financial services industry (besides Krawcheck’s own deep experience, of course). Sylvia Kwan, a newcomer with degrees from Stanford and Brown, will serve as chief investment officer and Charlie Kroll, the founder and CEO of tech start-up Andera, will serve as COO. A Vogue.com veteran is heading up Ellevest’s design, the CTO is coming from digital media company Thrillist, and a former Weight Watchers person is heading up product management.

When Krawcheck announced Ellevest and a $10 million round of funding led by Morningstar in September, she said it would be “unlike anything else out there,” but there have since been other automated investment services launched to specifically serve women, such as WorthFM. Now Krawcheck says the market is big enough for a variety of players.

Bill Winterberg, an advisor technology consultant and blogger, said he doubts there is room for more players in the automated advice market, but said he wouldn’t underestimate the ability of Krawcheck’s personal brand, reputation and resume to attract users.

Looking closer at the start-up’s methodology, Winterberg said Ellevest eschews products like emerging market government bonds that are prominent in holdings at established robos.

Oh, @Ellevest says holding $VWOB “can pose a risk to our clients.” (notably in @Betterment accounts) It's on! pic.twitter.com/GTmmq7kJme

— Bill Winterberg CFP® (@BillWinterberg) May 11, 2016

“I’m definitely interested in the whole discussion of looking at expense ratios but also bid-ask spread,” Winterberg said, adding that that illuminates the true cost of robo advice to consumers.

He added that though Ellevest is built using technology from FOLIOfn, Ellevest does take a different approach to risk that he called a “refreshing strategy.”

“[Ellevest is] trying to focus on risk capacity and not risk tolerance,” Winterberg said. “Not all households need to take the maximum amount of risk they can tolerate. They can accomplish goals without having to go really high up the risk scale.”