A clear target market is essential to a successful financial advisory practice. It's one of those mantras that's on every coach's lips. And yet, most RIA firms bring these target markets into fuzzy focus, at best.

The narrower and clearer your client niche is, the more efficient you can be about creating and offering services that will appeal to the group, says Dan Inveen, one of the founders of consulting firm FA Insight, which recently published benchmarking research on marketing and operations for RIA firms.

Employees of firms that specialize in a particular line of business, like, say telephone line repair, may have certain pension issues, similar retirement programs, similar incomes, similar stock options that you need to know about, he says.

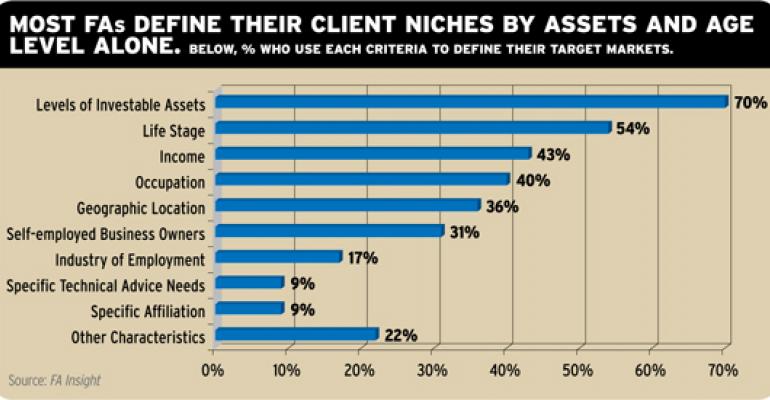

“Most firms are just focusing on the obvious — how much the client has in terms of assets, and how old she is basically,” says Inveen. In fact, about 70 percent of the firms surveyed that did have a target market used assets to define that target market, and 54 percent of firms used client life stage. “And if you have defined a target client, many firms are still serving clients that are outside that target mix, or failing to build operational infrastructure around serving that target client.”

Professionals with a really defined target market spent 59 percent of their time getting revenue in the door; those without spent only 50 percent. Before you narrow your target market, try segmenting your current clients to find out what you've got in the mix.