An “optimist” used to be defined as one who believes things will be good in the future. Now the term could be applied to anybody who thinks conditions won't get any worse. But whether you and your clients see sunny skies or dark clouds on the horizon, you should be calling them to discuss converting their IRAs to Roth IRAs, and the time to do that is right now. Here's why, and how.

The Benefits You Forgot, or Never Knew About

The primary advantage of converting an IRA to a Roth IRA, of course, is that the withdrawals from the latter are not subject to income taxes, as long the money has been in the Roth for at least five years, and the client has reached age 59 ½.

That bonus is even better than it sounds, for several reasons. First, Roth IRA distributions are one of the only sources of income that aren't figured into the formula that determines whether your clients' Social Security payments are taxable. Second, a hefty Roth IRA balance will give your client more flexibility in choosing sources of income in retirement, which could mean lower income taxes each year, and therefore more income for as long they live. Finally, as there is no mandatory distribution age for Roth IRAs, your clients will take out money from the accounts when it works best for them, rather than when the IRS life expectancy table tells them to.

The only age-based withdrawal requirement for Roth IRAs is that inherited balances must be taken out according to the beneficiary's life expectancy. But even then, there will be no tax liability on the withdrawn amounts — which could be extended over several decades.

Oh, and one more benefit to converting: subject to certain conditions, the amount converted may be withdrawn with no taxes or penalties, regardless of the owner's age, as long as at least five years have elapsed since the conversion (see IRS Publication 590 for more details).

Why Now?

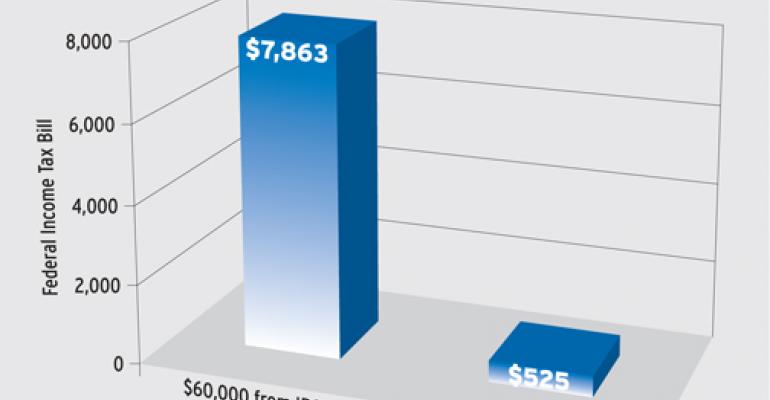

Both optimistic and pessimistic clients should be receptive to the idea of moving some or all of their IRAs to Roth IRAs. The doom-and-gloomers may foresee Uncle Sam taking a bigger chunk of personal income through higher tax rates in the coming years, making them eager to “buy” freedom from future taxes on withdrawals from retirement accounts.

More hopeful clients may believe that even if tax rates remain the same, higher tax rates are still on their personal horizons — due to an increase in individual earned income. Or, they could be among the few remaining souls who believe that equity prices will actually rise at some point in the decades to come, and would prefer to pay taxes on today's diminished values, instead of what will hopefully be much more money down the road.

A Money-Saving Mulligan

But say their confidence in rapidly-rising account values is premature, and the clients' investments continue to tumble after the conversion to Roth IRAs. The clients can call for a “do-over” of the conversion, “recharacterizing” the IRA-to-Roth IRA transfer at the new, lower amount, and paying a new, lower tax bill in the process.

Technically, the deadline for a recharacterization is April 15 of the year after your clients perform the first conversion. So if the clients were to convert an IRA to a Roth IRA right now, they would have about a year for a re-do. But if the clients choose to apply for a six-month extension to their income tax filing deadline, they could have up to October 15th of the year after the conversion is made for the recharacterization.

A caveat, though: if clients already have a Roth IRA in place and are interested in converting an IRA to the Roth as well, they should establish a new Roth IRA to receive the converted amount. Otherwise, trying to recharacterize the conversion can get sticky, from both a tax and paperwork perspective.

Who Can and Can't Convert

Sadly, for the time being, clients may be precluded from converting IRAs to Roth IRAs if they make too much dough. For 2009, taxpayers must have modified adjusted gross income of less than $100,000 — whether they file married or single. The good news is that the converted amount doesn't count towards the $100,000 ceiling. The better news is that there are several ways to get MAGI below the limit — the easiest of which is to increase pre-tax contributions to an at-work retirement plan.

The best news is that in 2010, the income limit is scheduled to go away. That means you have several months to start planning and scheming so that your higher-income clients are positioned to convert after the end of this year. There is the small matter of where to get the money for the taxes due. Ideally, the clients will have non-qualified accounts containing more than enough money to cover the ensuing bill from the IRS.

If the only way they can cover the taxes on the conversion is to take additional withdrawals from the IRA, they should probably refrain from making the move. Pulling more money out of the IRA to pay the IRS could mean an upward spiral of withdrawals that could tap the entire account.

More help

As you can imagine, converting an IRA to a Roth IRA is not a transaction that should be entered into carelessly. Interested clients should bring their CPA into the discussion as soon as possible.

But you can increase the depth and breadth of your expertise on the subject by consulting the exhaustive 2009 edition of Go Roth! by Kaye A. Thomas, available at amazon.com, or via Thomas's helpful website (www.fairmark.com).

Writer's BIO:

Kevin McKinley

CFP© is Principal/Owner of McKinley Money LLC, an independent registered investment advisor. He is also the author of the book Make Your Kid a Millionaire (Simon & Schuster), and provides speaking and consulting services on family financial planning topics. Find out more at www.advisortipsheet.com.