Independence and a desire for self-sufficiency drove pioneers westward in the 1800s. Those same qualities often drive entrepreneurs to build successful companies.

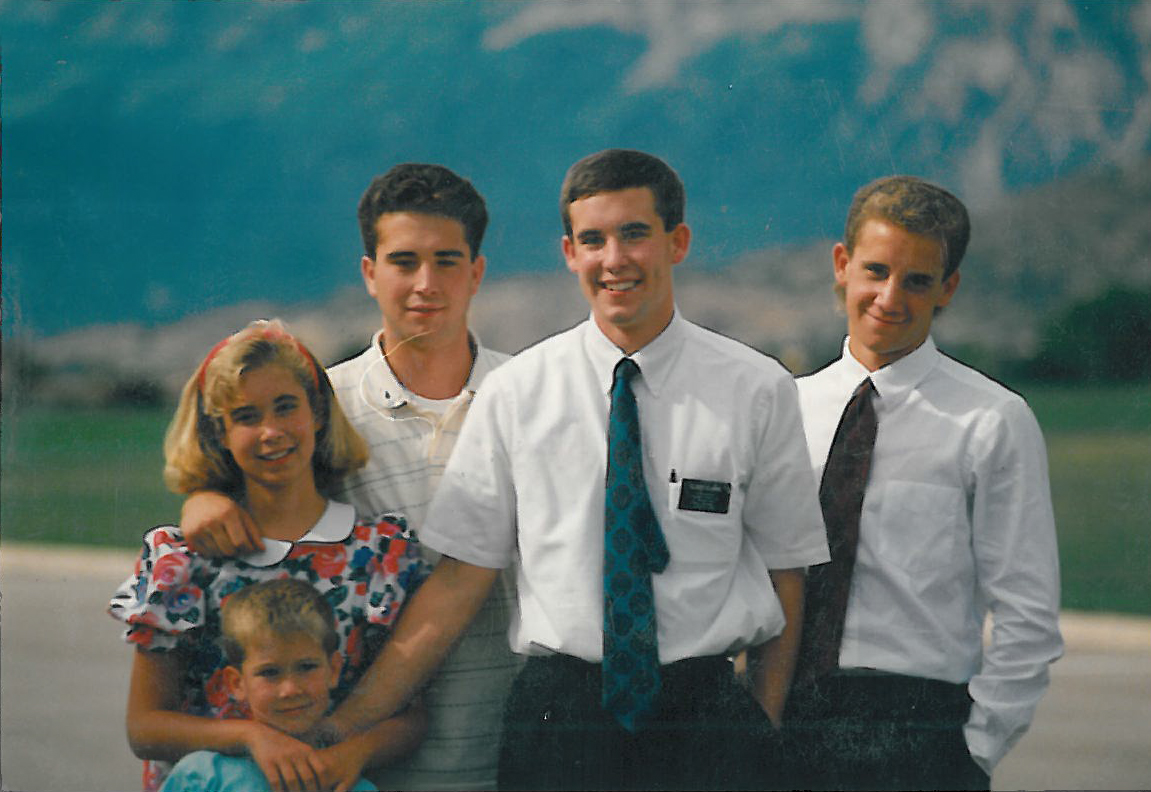

Few feel this more than the Clarke brothers of Omaha. Descendants of Mormon pioneers, brothers Todd and Eric today lead NorthStar Financial Services, a firm co-founded by their father W. Patrick Clarke and grown over the years into a major player in the independent advisory space.

Consider the breadth of NorthStar: It’s a constellation of companies, many originally built to meet a need either of their own or for their clients, and then spun out into self-contained businesses on their own.

Todd runs CLS Investments, an ETF strategist that manages $6.5 billion for over 2,000 advisors. Eric runs Orion Advisor Services, a homegrown portfolio accounting and performance platform now used by over 600 firms and overseeing $209 billion in assets under administration.

Included in NorthStar are The Gemini Companies, which help investment managers and hedge funds launch retail funds. There’s Northern Lights Distribution and Northern Lights Compliance Services; there’s a web and video production company; and there’s even a company that prints prospectuses and shareholder reports.

All in all, some 700 employees at NorthStar oversee nearly $300 billion in assets, either under management or administration.

“If you look at the pioneers that crossed the plains, they did it themselves,” says Todd Clarke, Patrick’s eldest son and the CEO of CLS Investments. “They weren’t looking for government handouts. They weren’t looking to be subsidized. They truly built it and did it themselves.”

What’s propelled the success is that the Clarke family, sons of an early RIA adopter, grew up along with the industry of fee-based, independent advisors; they see no reason to doubt the trend will continue.

“The fiduciary model is something that continues to win market share,” says Todd. “We play right into that because the firms that we service are fiduciaries for their clients.”

Given that streak of independence and self-sufficiency, it was notable that in May, three years after the family patriarch was killed in an airplane accident along with another Clarke brother, Scott, the family completed a deal to sell the firm to TA Associates, a Boston-based private equity shop specializing in the technology, financial services, business services, healthcare and consumer industries.

The Clarke brothers are quick to point out they will continue to run the shop; the capital from their new owners will allow them to make more investments in growing the business, possibly buying another investment management firm or making an international push.

Regardless of what happens, the firm will likely always embrace the spirit of its pioneering founder.

Goodbye, Dean Witter

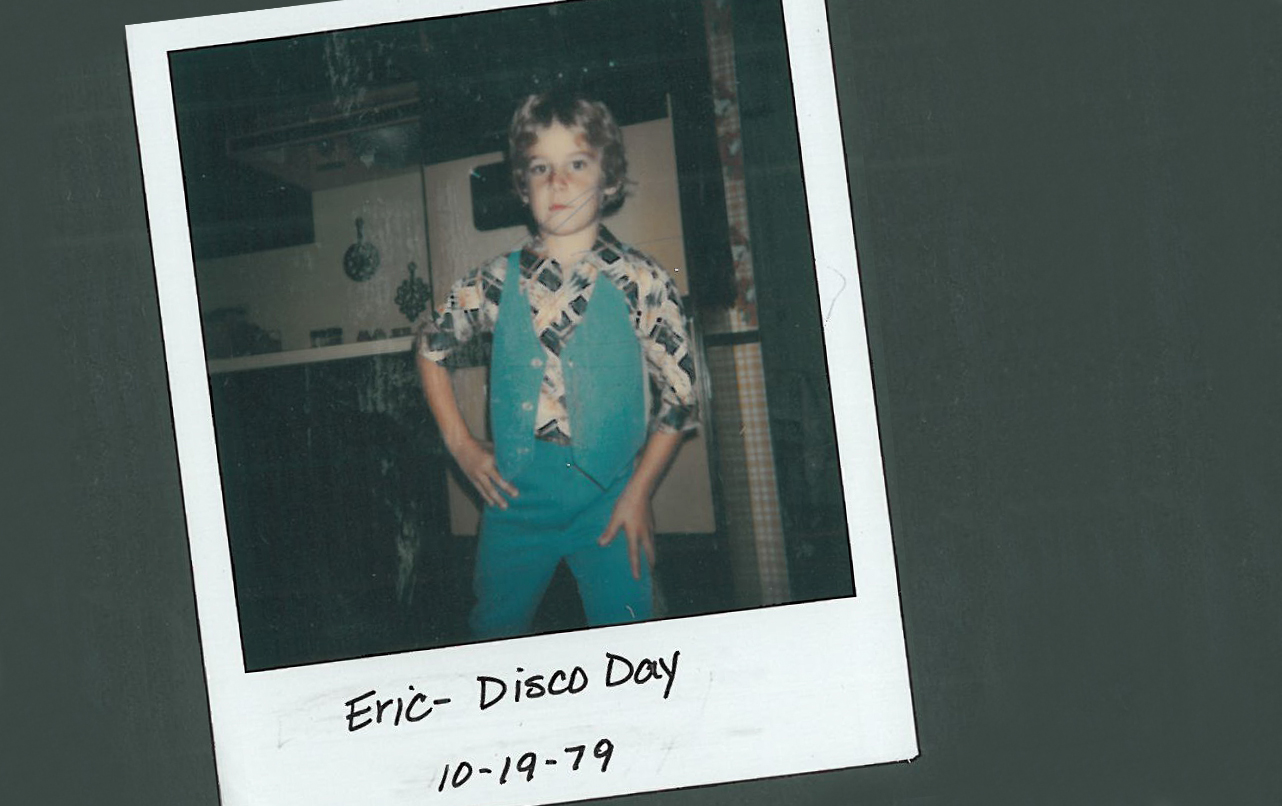

W. Patrick Clarke graduated with a marketing degree from Brigham Young University in 1970. His first job was with International Harvester, where he sold the tractors to the dealerships that would then turn around and sell them to the farmers. He enjoyed the work, but with a growing family he was looking for something that paid better.

When he was 27, he got a job in Omaha as a stockbroker for regional brokerage firm H.O. Peet. Clarke was an unusual broker in that he built a business model by putting his clients into mutual funds, which were still relatively odd securities but it seemed to Clarke to be a better way to give his clients cheap access to a diversified portfolio without having to sell them baskets of individual stocks one by one.

It worked, for a time. But when Dean Witter bought H.O. Peet in 1975, the new owners failed to recognize the wisdom in Clarke’s approach; they did recognize they weren’t making as much money off of selling mutual funds as they were selling individual stocks. If Clarke wasn’t going to play along, his bosses at Dean Witter told him, he could leave. So he left.

That made Clarke, in 1975, an early incarnation of the “breakaway broker,” though the term had yet to be uttered. After he left, he didn’t look for another brokerage firm, but instead started his own company, CLS Investments. It was one of the first RIA firms putting clients into mutual funds, using investment strategies that Clarke conceived; he would charge them a fee based on the assets they had invested with him.

Over time, the client base grew beyond those first clients in Omaha outward to Iowa and Kansas. Perhaps without even knowing exactly how it would turn out, CLS Investments was laying the groundwork to both help and benefit from the trend towards independent, fee-based advisory services.

The Evolution of CLS

In the meantime, Clarke was raising a family. First there was son Todd, born in 1969. Then, in order, Scott, Eric, Jennie and Brett.

All of them, to one degree or another, inherited something of their father’s zeal for self-sufficiency and entrepreneurship. Todd grew a lawn-mowing business to 50 residential and commercial customers. Eric and his brother Scott started giving swimming lessons in their backyard pool, eventually hiring instructors and bringing some 500 kids through their classes. “We had people working for us, and it was efficient and it was way less work,” says Brett, now 30, who also helped run the swimming school and now runs NorthStar’s marketing, branding and video business Blu Giant.

Todd was the first to join his father’s business, but it wasn’t his original intention. He studied business at Brigham Young University before going to Japan on his Mormon Church mission, where he evangelized for the cause and taught English. He came back to the U.S. with the intention of becoming a teacher before realizing how little the work paid.

His father explained that working at CLS, in fact, involved teaching people about financial planning. That struck a chord with Todd, and in 1992 he joined the firm.

His timing was good. Within weeks of his joining, they got a call from Integrated Resources, the independent b/d they were using at the time (now known as Royal Alliance), asking if Patrick would teach the other reps how to transition their business to a fee-based model. And to sweeten the deal, if those brokers chose to put some of their new fee-based assets into Clarke’s investment strategies, so much the better.

“That really opened up the door for us to begin to transition from a retail financial planning practice more to an asset management business in the ‘90s,” says Todd. By 1994, the Clarkes had shed most of their individual clients in favor of managing assets for other advisors.

Early on, the Clarkes’ asset management business focused on a proprietary “risk budgeting” method for allocating client portfolios; the aim is to keep the amount of risk in the portfolio consistent with the client’s tolerance, but rather than strategically rebalancing, they take a more “active approach” and look at the changing levels of risk in each asset class, depending on market conditions.

Orion Is Born

In the meantime, Todd’s brother Eric worked for the family firm in the billing department whilehe was studying accounting at Brigham Young. He’d eventually go on to get his master’s in business from the University of Utah.

“When I was a kid, the mutual fund wholesalers would come into town to meet with my dad, and we’d go play golf together and go do those types of things,” he recalls. “I always enjoyed spending time with them. So when I was in college, I wanted to try to do something where I could work with advisors, similar to what those mutual fund wholesalers were doing when they would call my dad and his partners.”

After graduation in the late 1990s, he started out as a wholesaler in CLS’s asset management division, trying to convince advisors to invest with the firm.

He was also known to complain to his father and brother about how the firm handled some of its portfolio accounting; they didn’t have the capacity to manage the volume of data they were handling, totaling over 10,000 accounts.

After hearing the complaints, Patrick suggested Eric fix the issue himself. Eric was now in charge of CLS’ back-office functions.

“My dad was always able to give us our own area of responsibility, which we could nurture and grow and develop,” Todd says. “That’s been good because often in family businesses, you have sibling rivalry. You can even have father-son fights. Not that we didn’t have those or don’t have those, but it was always nice because we trusted each other to oversee our different areas of responsibility.”

Eric looked at a number of options for portfolio accounting, including existing firms that would fly into Omaha from the more “sophisticated” centers of finance and technology on either coast. At least one provider, Advent, demanded the Clarkes commit $100,000 in exchange for getting a proposal.

None fit what CLS needed, so Eric decided to build it. In Clarke fashion, they figured they could also sell the system to other firms. Thus, Orion Advisor Services was born.

Orbitex

By 2000, Orbitex—at the time, a mutual fund company that was in the process of acquiring a number of TAMPs—started looking at CLS. A year before, Orbitex bought American Data Services, a mutual fund administration company that helped investment strategists launch new funds, led by Michael Miola.

Miola, a Bronx-bred New Yorker, had joined the board of Orbitex and went to Omaha to evaluate the Clarke business. “It was not warm at first,” he recalled. “Here were these people from New York coming out to Omaha. (Patrick) was skeptical, and he asked me a lot of questions about how the acquisition went.”

CLS decided to sell. But soon a biotech fund that Orbitex controlled faltered, and Orbitex ran out of money.

So the elder Clarke and Miola came together and took back the businesses in lieu of the money they were owed. At this point, both saw the synergies they could exploit, and they merged the firms. Patrick was at one time a Boy Scout, and Miola a Star Trek fan. Naturally, they settled on the name NorthStar for the combined company.

“We wanted to build a company where we have a service for every registered investment advisor, independent rep, broker/dealer—anybody that’s in the investment business. We will have a product for them.”

Each of the divisions of NorthStar was named after celestial objects: Orion Advisor Services; Northern Lights Distributors, which distributes funds; Northern Lights Compliance for compliance services; and Constellation Trust Company for custody. GemCom is the printing services division.

American Data Services was renamed The Gemini Companies, and is, in a way, the heart of NorthStar. Based in Hauppauge, N.Y., it has about 300 employees, and its revenues and profits now account for over half of NorthStar, says Andrew Rogers, president of Gemini Fund Services. It’s a significant player in the liquid alternatives space, helping hedge fund managers put their strategies into mutual fund wrappers. It services over 300 liquid alternative funds across multiple strategies.

Miola says he never felt like an outsider for not being a member of the Clarke clan, especially since he had to fund NorthStar at the beginning.

“The first thing I had to do was finance the company, because the Orbitex people stripped the cash out; there was nothing,” he says. “There wouldn’t have been a NorthStar if it wasn’t for me, and everybody knew it and everybody respected that. So the fact that my last name wasn’t Clarke didn’t mean a thing.”

Blu Giant

Blu Giant, launched in January 2012, is the youngest NorthStar business, run by the youngest Clarke brother, Brett.

Because of the age difference, Brett grew up in a very different home than his older brothers, one where his father had fewer responsibilities at work and could spend more time with his son.

“My father and I actually had a friendship,” Brett says. “Because he was kind of in that stage in his life where it’s like, ‘Hey, I want to play and have fun,’ and I was in the stage of my life where, ‘Hey, I want to play and have fun.’ We just knitted together.

“My number-one goal was to not work (at NorthStar),” Brett says. “Sometimes you’re too close to the trees to see the forest, so I didn’t realize what it was. I just saw all the bad of it and that it was hard work and that it was boring.”

But after studying construction management in undergrad at Utah Valley University, Brett moved back to Omaha to be the project manager on the construction of NorthStar’s current building. When the building was finished, the firm’s IT department needed help, so Brett pitched in.

“It’s a family business,” Eric says. “You don’t get to choose what you want to do. You fill in and you do the role that you need to do to support the family business.”

During his initial days at NorthStar, Brett was introduced to Christopher Norton, the firm’s creative director at the time. The two had the idea to launch a new division that would build websites for advisors, giving them the ability to make their own videos and to better digitally market their firms. They built a video studio in the basement of the NorthStar building, with a green screen and a control room. They even bought a drone for getting high shots.

A Family Tragedy

Months after the final Clarke brother entered the family business, tragedy struck.

Patrick and his second-oldest son, Scott, a medical doctor who lived with his wife and four kids in Springfield, Mo., were returning from a trip to California where they spent the weekend driving at a racetrack. Being the only Clarke son not in the family business, Patrick and he would deliberately schedule trips together—just the two of them—once a year.

Scott, a pilot, was flying his twin engine Cessna when something went wrong. The plane crashed near Fresno, killing both father and son.

Miola flew out to Omaha to be with the family. While the emotional toll was severe, there was little interruption to the business. The elder Clarke didn’t have an office in the new building, though he would visit occasionally. “Pat and I set the company up to where Eric, Todd and Andrew were completely in charge of the day-to-day,” Miola says.

The Acquisition

Two years after the accident, Miola and Lana Clarke, Patrick’s wife, decided to cash out of the business and retire.

The board considered several options, including purchasing the shares themselves, going public, and taking on strategic partners. Eric and Todd could have cashed out themselves, hung up their cleats and moved to some tropical location.

In the end, they sold to private equity firm TA Associates in May.

“They were not the high bidder, but they were the bidder that would allow us to continue to grow and do great things with our business as we move forward,” Eric says.

In the short term, that likely means acquiring another asset management company and bringing the resources of Orion and Gemini to bear, and perhaps buying an offshore fund administration company to offer U.S. investment managers access to foreign investors.

NorthStar has also moved into the online advice space.

In February, they joined with Riskalyze to launch an automated asset management platform called AutoPilot. The tool lets an advisor’s online clients or prospects access Riskalyze to gauge their risk tolerance, link to their outside assets and open a new account, and e-sign everything. Once a client account is opened, CLS acts as the asset manager.

Orion also teamed up with Jemstep in April. Jemstep will give Orion advisors an interactive user portal for prospects and clients, including paperless sign-ups, portfolio analytics, communications, and an account aggregator to locate “held-away” assets like 401(k)s.

Advisors can white label the portal and tie it to Orion’s portfolio accounting systems, mobile apps and reporting, effectively digitizing the entire experience for the client.

“We’ve been growing year over year 20-plus percent. We’d like to see that now at 30-plus percent,” says Brian Nielsen, general counsel to NorthStar. “Endgame—I would see it as an eventual public offering in some format.”