The adage to “invest when there’s blood in the streets” could easily apply to aggregators of registered investment advisors in the period after the 2008 crash. For firms with national aspirations and hunger for scale, the fields were rich with prospects. Wirehouse brokers sick of defending their employers to unhappy clients were starting to look at other options. Aggregators could offer compelling arguments like the opportunity to start fresh at a firm with a fiduciary-focused business model and one that boasted an ability to provide the same support as the national brokerages. In 2011, for example, the hybrid RIA HighTower recruited eight major teams with $5 billion in AUM. A sense of stampede was in the air.

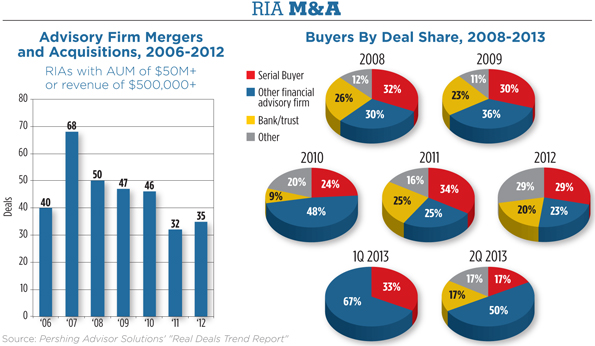

No longer. Two years later, merger and acquisition activity in the RIA space is off and some aggregators are feeling the slowdown. Pershing Advisor Solutions reported “sluggish” deal activity across all RIA channels in the first half of 2013: just 12 M&A deals, down from 22 in the second half of 2012, and 16 year over year. (Pershing tracks sales of retail-focused RIAs that manage $50 million or more in assets, or earn annual revenues of at least $500,000.) Serial acquirers made up just a quarter of the deals in the first half of this year, Pershing says, down from 32 percent in the second half of 2012.

Schwab Advisor Services, which also tracks RIA merger activity among both advisors who custody with  them and those who don’t, reported 18 deals in the first half of this year, the lowest since the first half of 2008. Strategic acquiring firms made up 39 percent of this year’s deals, Schwab said, down from more than half a year earlier. Even recruiting at the once high-flying HighTower has slowed precipitously—from nine new teams with $7.7 billion in assets last year (plus a tuck-in with $200 million AUM) to just two new teams so far this year with $950 million AUM, and two more tuck-ins totaling $390 million.

them and those who don’t, reported 18 deals in the first half of this year, the lowest since the first half of 2008. Strategic acquiring firms made up 39 percent of this year’s deals, Schwab said, down from more than half a year earlier. Even recruiting at the once high-flying HighTower has slowed precipitously—from nine new teams with $7.7 billion in assets last year (plus a tuck-in with $200 million AUM) to just two new teams so far this year with $950 million AUM, and two more tuck-ins totaling $390 million.

Are the days of gangbuster acquisitions over for aggregators? Tom Valverde, managing director at Pershing Advisor Solutions, thinks so. For starters, teams that are leaving wirehouses now are much larger than they were two or three years ago, which means they’re more capable of operating as fully independent practices and have less need for the services that consolidating RIAs can offer. “They really can be doing this on their own, and will be,” he says.

Also, expectations for M&A in the RIA channel “maybe have been a little bit high,” says Bing Waldert, a director at Cerulli Associates, the financial services research firm in Boston. Advisor movement happens when times are bad, not when they’re good, he says. Right now consumer confidence is starting to return, markets are up, and asset values are rising—all conditions that lower both investor apprehension and the pressure they put on their advisors for change.

In the meantime, the wirehouses have used their financial might to both keep advisors and recruit others from the competition. Signing bonuses of 300 percent trailing 12-month production are still being offered for top advisors, says Alois Pirker, research director at Aite Group, the Boston-based research and advisory firm. UBS Wealth Management Americas reports spending nearly 10 percent of its operating income in the second quarter on compensation commitments and advances for recruited financial advisors. Pirker notes that Wells Fargo Advisors recruited a $1 billion team from Morgan Stanley this fall. “So that obviously works against the aggregators,” he says. “That billion dollar shop that has gone to Wells Fargo Advisors could very well be going to a Focus (Financial Partners) or a HighTower, otherwise.”

The slowdown in aggregator deals doesn’t surprise Pirker. Firms that do many acquisitions have committed much of their staff and resources to the undertaking, which can divert those resources from operational functions. There can be consequences. This year, Pirker observes, the growth-minded national broker/dealer LPL Financial conceded lapses in oversight on its e-mail systems, resulting in a $9 million fine from FINRA.

“At a certain point, you have to take a breather and address those topics,” he says. “For the RIA aggregator, it’s not much different.”

Ruediger Adolf, founder and chief executive at Focus Financial in New York City, one of the largest aggregators in the business, disagrees.

“Digesting really means either you didn’t do very good deals so you need to clean up those you have done, or you didn’t properly resource the business to absorb the capacity,” he says. “Transactions don’t just come out of the blue and suddenly you’re surprised you closed a transaction. They have long lead times and a well-managed business of course is prepared for that.”

Adolf agrees that aggregator M&A is down, but he excludes Focus from that trend. With 27 partner firms and more than $65 billion in client assets, Adolf estimates the firm has added $5.5 billion in assets so far this year, including $2.2 billion in a deal to acquire Telemus Capital Partners in Michigan.

In a trend that’s popping up elsewhere in the aggregator world, Focus’ partners themselves are doing their own deals. In October its Colony Group in Boston announced it had recruited Prosper Advisors in Armonk, N.Y., with assets of more than $300 million.

“The lines are blurring from three to five years ago where you had the home office or corporate office facilitating the transactions,” says Jon Beatty, senior vice president of sales and relationship management at Schwab Advisor Services. “Now you’re starting to see the affiliates roll up firms in the local marketplace.”

Private investors are taking notice. In July, Centerbridge Capital Partners II announced it would invest $216 million in Focus Financial, money the aggregator used to allow shareholders to cash out a portion of their stakes. If mergers have slowed elsewhere in the industry, Adolf says, it isn’t due to a lack of financing. “There’s a lot of capital if you have the right business model and you’re very profitable,” he says. “Equity markets have done very well. At least at this point, there’s not huge volatility.”

The lack of volatility, coupled with good earnings in the RIA industry, means advisors aren’t hand-holding clients and instead can use their time to plan strategically, Adolf says. Focus periodically plays matchmaker and schedules meetings between its partners and outside advisors to see if any sparks fly. One such get-together was scheduled for October. “We will have more prospects in the room than ever in our history,” Adolf says with evident satisfaction. “The willingness to engage is very good…There’s absolutely no reason there should be a slowdown from an M&A perspective.”

Michael LaMena, president and chief operating officer at HighTower, agrees that talks with prospects remain strong; many are coming to the table with a more informed sense of their options for independence than he had seen among breakaway candidates a few years ago. “There clearly was a slowdown this year, but that’s temporary,” says LaMena, who expects a stronger fourth-quarter performance at HighTower that will provide momentum into 2014. “Inertia’s always a challenge in strong markets.”

For some aggregators, the official numbers on M&A for registered investment advisors fall short of capturing the true picture of the market. “There’s just a lot more transactions happening than are what’s being reported,” says Matt Brinker, senior vice president of partner development and acquisitions at United Capital Financial Advisers in Newport Beach, Calif. Internal transactions between junior and senior partners, for example, fall through the cracks, he says.

United Capital, with $9 billion in AUM at the end of September, reported three transactions last year with just under $1.6 billion in assets and three so far this year with $715 million in assets. “We could double the volume of deals we did if we were just a deal machine. And I’m sure other firms could double their amount of deals that they did,” Brinker says. “But we all have different sets of standards and qualifications for good acquisition partners. The seller obviously has to have a catalyst, but it typically isn’t market related. It’s going to be broader internal things that are happening in their organization like, how do I grow? How do I scale?”

Despite the current slowdown, the party isn’t over for aggregators, Cerulli’s Waldert says. There are more than 14,000 RIA firms, and not every one will be a merger candidate. “And that’s all right. Aggregators can continue to grow in spite of this,” he says. “There’s still going to be a need for what they can do. But I don’t necessarily see this, long term, as an explosive growth market. … Those that are doing it well are thinking very carefully about the firms that they do and don’t acquire.”