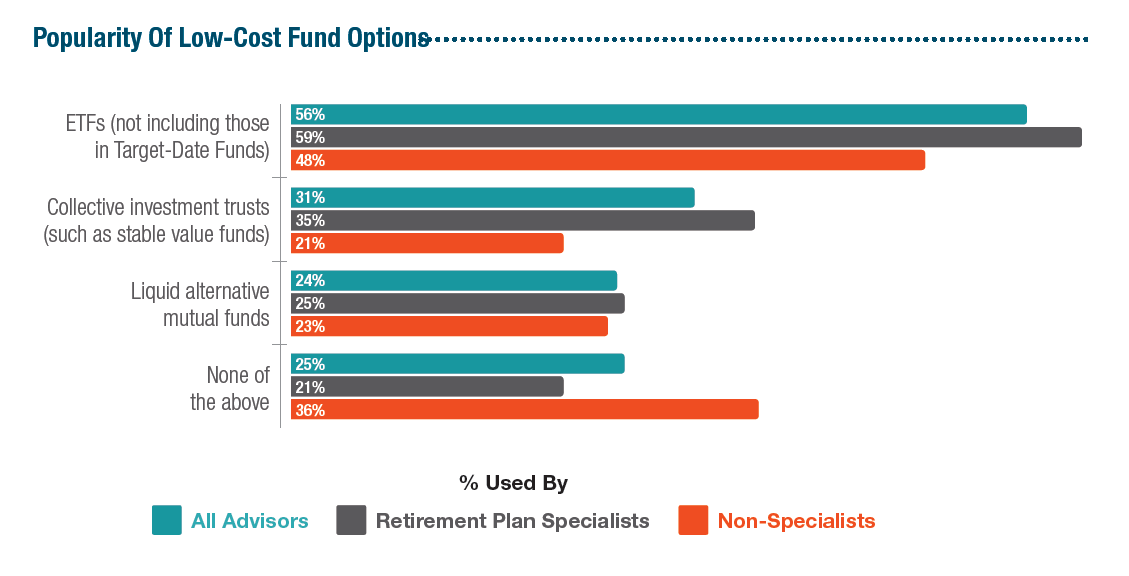

Retirement savings plans have a long time horizon, and small differences in fees can add up to big costs over several decades. This may be one reason why advisors are more likely to use lower-cost investment options such as ETFs (used by 56%) and collective investment trusts (used by 31%) than more-expensive liquid alternative mutual funds (used by 24%). The relative popularities of these options were consistent among retirement plan specialists, but for advisors who service more institutional plans (more than 25% of their total plans are institutional), collective investments trusts are far more popular. Half of that group of advisors use trusts in their retirement plans—more than twice the advisors who service fewer institutional plans.

Advisors averaged similar allocations to ETFs and liquid alternative funds, holding 20% of plan assets in ETFs and 18% in liquid alt funds. Interestingly enough, advisors who don’t service institutional retirement plans reported a far smaller average allocation (6%) to liquid alternative funds than advisors who service institutional plans (more than 20%). It’s possible that advisors without institutional plans have less leeway to pursue liquid alternative strategies.

Next Part 2 of 5: Fees Can Add Up Over Time

Click to Enlarge

Click to Enlarge