Bears have become increasingly confident that the current equity market rally — 49 percent in the S&P 500 from the March trough — is due for a substantial correction. The latest indicator: The zeal with which company insiders are selling their shares. Insider buying and selling activity is a useful market indicator over the short term (weeks) to intermediate term (months), says Bob Bronson, principal of Bronson Capital Markets Research.

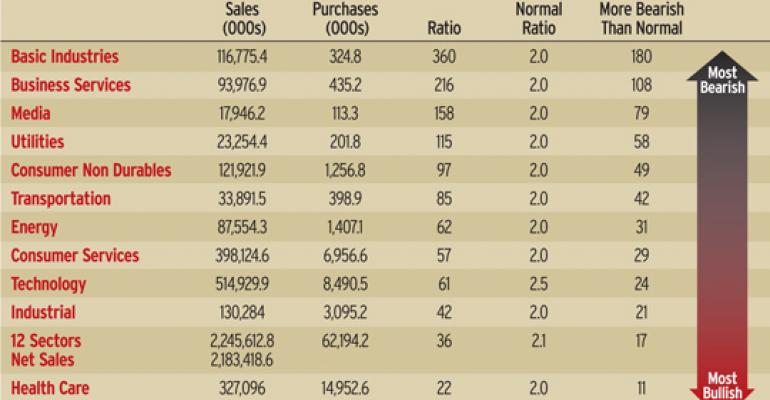

Historically, on average, the volume of insider selling is about twice the volume of insider buying, because insiders are often paid a large portion of their compensation in stock and prefer to cash out, says Bronson. During the five weeks ending August 12, insiders sold a huge $2.2 billion worth of stock and purchased only $62.2 million — for a sell-to-buy ratio of 36 to 1 — according to the WSJ Market Data Center. “Selling-to-buying in technology stocks was a huge 61:1, or 24 times normal,” writes Bronson in an August 19 note. “And remember, technology stocks lead the market, so the insider selling in that sector is an extraordinarily bearish indicator for the direction of the stock market.”