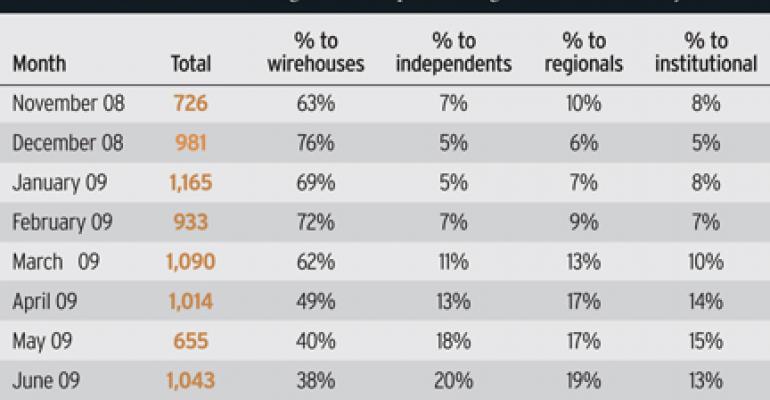

Wirehouse reps are increasingly looking beyond Wall Street firms these days. The proportion of wirehouse advisors switching to another has fallen steadily over the past year, while the number going to independent b/ds and RIAs, as well as to regionals and institutional firms, has risen, according to data from Discovery. (See table at right.) Indeed, wirehouses lost approximately $1.5 trillion worth of market share last year, data from Cerulli Associates shows. The four big Wall Street firms controlled 47.7 percent of advisor managed assets in 2008, down from 48.5 percent in 2007. Meanwhile, market share for independent firms grew to 32.8 percent in 2008 from 31.6 percent in 2007.

There are a number of reasons for this. For one thing, the markets have finally calmed down a bit, and the threat of financial Armageddon has receded, making the idea of a big move to independence more palatable for some advisors. Some clients have also begun encouraging their advisors to move, arguing that “independent” advice is better advice and voicing frustration about continuing negative headlines affecting Wall Street firms.

Take Sam, a southeast Merrill advisor who manages $165 million in assets and generates $1.3 million in revenue. Early this year, Sam was considering a move to Raymond James as he was worried about the Bank of America takeover of Merrill. But Sam was even more worried about the market conditions and feared his clients wouldn't follow him. More recently, however, his clients began asking him to move and in late July, he pulled the plug and joined Raymond James.

In the meantime, the upfront deals offered by the wirehouses have come down a bit and there are more strings attached. Through April of this year, most wirehouse firms were offering $1 millon producers transition bonuses that maxed out at 150 percent cash upfront with another 125 percent or more in deferred comp for some multimillion dollar first-quintile teams. Over the next three months, the deals offered by firms slipped back to 120 percent cash upfront, with up to 105 percent on the back end. These bounced back some in July to 130 and 140 percent cash up front, with totals of up to 250 percent. But firms say the higher bonuses are temporary, while reps are required to clear difficult growth hurdles in order to receive the full offers of cash and deferred comp. For example, at Merrill an advisor has to show 50 percent growth in assets by the end of a five year period in order to earn the maximum bonus.

There are also more options for going independent today than ever before. Advisors can join or create their own RIAs, join existing independent b/ds as registered reps, investment advisor reps, or hybrids, and in some cases, they can even get upfront money from RIA firms as well as equity. Plus, with all of the large teams that have already tried it, the move to independence is less of an unknown. There is a clear path to follow and the stigma has disappeared.

One UBS team from Long Island with $2 million in joint production recently moved from UBS to Wells Fargo Advisors' Financial Network, the bank's independent b/d platform. But the team joined another advisor who went independent three years ago and was looking to share office space. This made the transition a lot easier on them.

Writer's BIO:

Mindy Diamond

founded Chester, N.J.-based Diamond Consultants, which specializes in retail brokerage and banking recruiting. www.diamondrecruiter.com