Most investors will tell you that they have a more intense emotional reaction to big losses in their portfolio than they do to big gains. Indeed, research in behavioral finance has demonstrated that, dollar for dollar, we humans hate losses at least twice as much as we appreciate gains. Thus, most of us are risk averse. A dollar lost is worth more to us than a dollar gained.

Sadly for investors, financial markets are prone to wild swings, both up and down, and tend to correct down more often, and more violently, than they race ahead. To make matters worse, the investment management industry has generally created products that do not protect against these big losses.

Over the last fifteen years, the market has experienced many gyrations, including a pair of strong bull markets followed closely by a pair of nasty bear markets that erased nearly all of the bull market gains. And now we are in the midst of yet another bull market, this one approaching its fifth birthday.

Some will argue that what investors have experienced since 2000 is the New Normal. Others say this was a once-in-a-lifetime bad patch never to be repeated. Neither side is quite right.

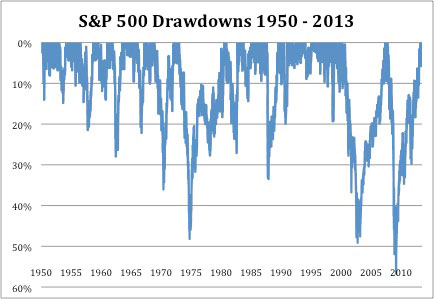

As exceptional as recent events may feel, the performance of the US equity market since 2000 has not been all that special. Indeed, over long periods, US equity markets have experienced severe corrections with disturbing frequency. There have been significant dawdowns in the market several times since 1950. Drawdowns are a measure of the negative market return from peak to trough.

While the memory of the market drawdown of 2007-09, which exceeded a 50% loss, is still fresh in our minds, it is worth remembering that there were many times in the last 60 years when the market declined 20%, 30% or even 40%. And these other drawdowns, while somewhat less historic than 2007-09, were felt quite harshly by investors at the time.

Observing that investors hate losses more than they love gains, and that significant equity market drawdowns are historically common, a person might think that the investment management industry would concentrate on creating products and strategies that mitigate downside exposure. Maybe the industry would work on, for example, products that emphasize reducing drawdowns while capturing some, or all, of the updrafts.

Instead, for as long as there has been an investment management industry, almost all its output has fit neatly into two categories: passive and active. Passive products seek to match, as closely as possible, the return of an index, that is, the market or some clearly defined subset of the market. Active managers attempt to outperform those same indexes, which means that their output is very similar to the index-following passive strategy. In practice, although investors always hope their chosen manager will beat the index, on average active managers do not.

Passive and active strategies do nothing to address the concerns of investors facing market drawdowns on a regular basis. Passive strategies, commonly marketed as “less risky,” carefully replicate the returns of the market, as if that was what the investor wanted most of all. Active strategies deviate from the market, but as traditionally designed and delivered, not by enough to make a meaningful impact on drawdowns.

What investors need are strategies that actively manage market exposure. They need strategies that participate in the market when it is rising but aggressively de-risk or go to cash when it is falling. These strategies may not yield market beating returns every year, and may trail the market during long bull markets. However, if implemented successfully, these “downside-protection, upside-participation” products will exceed the performance of industry-standard approaches over the full market cycle. More to the point, they will do so without the drawdowns that investors hate.

As the American population ages, as it becomes more affluent, as homeownership seems less and less a safe store of wealth, and as defined benefit pensions become ever rarer, providing savers and investors with financial products that address their needs has never been more important. To address those needs, the investment management industry must go beyond its standard paradigm of passive and active. Today’s investor needs, and deserves, more.

As exceptional as recent events may feel, the performance of the US equity market since 2000 has not been all that special. Indeed, over long periods, US equity markets have experienced severe corrections with disturbing frequency. The chart below illustrates this by showing the drawdowns in the S&P 500 since 1950. Drawdowns are a measure of the negative market return from peak to trough. Each data point in the graph is the drop from the previous all-time high to the then current market value.

Mr. Eigerman is a Senior Vice President at F-Squared Investments in Newton, Massachusetts, where he is a member of the Investment Committee leads their product development efforts.

Mr. Weed is a Managing Director of F-Squared Investments in Newton, Massachusetts, where he is a member of the Management Committee, co-chair of the Investment Committee, and co-head of Alternative Investments.