Chicago: “I’ve been trying to develop a relationship with this particular CPA for a while, but I wasn’t sure if I was getting anywhere,” explained Harold. Then, with a big smile, he added, “I remembered something you said about tax time, so I put together a ‘survival basket’ of all kinds of goodies and dropped it off at their office. The next day I got my first referral, a $1.5 million opportunity.”

Few topics in the financial services industry get as much attention, few topics create as much frustration, and few topics can bring about such marvelous results as developing healthy referral alliances. Beyond the affluent referral he was so pumped-up over, the message Harold was actually communicating was the long, arduous process of developing a personal relationship with a potential referral partner. Unfortunately, many advisors will miss this underlying message and start just delivering “survival baskets.”

Let there be no mistake about it: a healthy strategic referral alliance with a CPA, an attorney, or a handful of other professionals can be a gold mine. However, you must take the time and devote the energy to properly establish and then focus on managing each relationship. Although the concept appears simple, when it comes to arranging referral alliances with CPAs, attorneys and other professionals to utilize each other’s expertise, most advisors struggle.

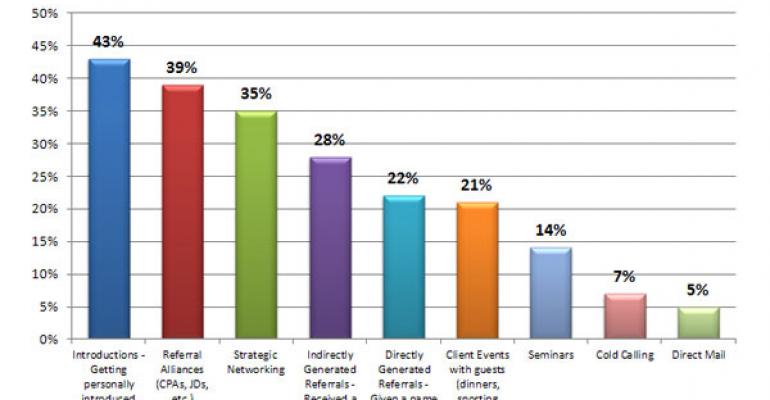

Here is the unfiltered truth about developing strategic referral alliances. When approached properly, they are relatively easy to establish, and yes, they are extremely powerful as the chart below illustrates.

One out of five affluent investors said a recommendation from another professional is what led them to their current advisor, which doesn’t account for those who used other professionals as a secondary source.

At the Oechsli Institute, we’ve spent years analyzing the approach of advisors who’ve had success in developing healthy referral alliances. We’ve discovered that they basically follow four simple steps, albeit with some variations.

Find Them. One of the biggest frustrations we hear from advisors is, “It’s a one-way street. I send referrals but never get any in return.” There are many reasons this might occur, but for our purposes I’m going to focus on the tactical side and suggest a handful of qualities to look for: someone who doesn’t compete with you, who appreciates your expertise, who is open to a referral alliance relationship, and is trustworthy.

Once you’ve created your profile, begin by asking your top clients and COIs what other professionals they use and if they recommend them to friends, colleagues, and family members. Your objective is to ask for an introduction.

This will always be a numbers game. Jack, one of our rainmakers, has five healthy CPA referral alliance relationships, but he had to meet with 40 before he was able to narrow it down to a small group he could be comfortable with.

Do Your Homework. Jack did his homework before meeting with each of the 40 CPAs. This involves gathering intelligence: how long they have been in practice, the type of accounting they perform, the type of clients, how long they’ve been with their current firm, what their hobbies are, what their family situation is, etc.

Then make the connection. This involves making contact and getting face-to-face with each potential referral alliance partner identified in step one. Whether it’s orchestrating an introduction through a mutual acquaintance, a client, or making the contact cold, these advisors get face-to-face.

Make Contact. Harold was introduced to the CPA he’d been romancing by an estate attorney. They were all members of the same Rotary Club. It was from this initial contact that Harold was able to work at developing a personal relationship. They had lunch a couple of times, went to a ball game, and went out to dinner with their spouses. But none of this relationship building would have occurred if Harold wasn’t able to make a good first impression.

Whenever possible, work to get introduced. An important credibility transference occurs, albeit on a subconscious level. You benefit from the credibility of your introducer. At this stage you want to develop rapport, avoid talking business, and orchestrate a second point of personal contact.

Manage Your Core. This is all about developing and managing each of these relationships. It is important that a potential referral alliance partner gets to know you on a personal level. This provides the platform upon which a prospective alliance partner determines that they like you, which leads to developing trust. It is within this framework where you will work to manage the relationship.

Not that you need any more convincing, but these four steps work. Their effectiveness has also been validated through our research on advisors. As you can see in the chart below, referral alliances are a close second to personal introductions in acquiring new $1 million+ clients.

Be on the lookout for a webinar that Stephen Boswell, our resident expert on this topic, will be conducting for Registered Rep. in the near future. If you would like a FREE copy of an excerpt of “5 First Meeting Fundamentals” from our Strategic Alliances Mini-Guide, please visit our download center by clicking here. Enjoy!

Also, if you haven’t already, join The Oechsli Institute’s Group on LinkedIn!

Once again, we want to thank all of you who have e-mailed comments and questions to us. We will continue to do our best to answer each one.

If you have any topic suggestions or special requests, please contact Rich Santos, publisher of Registered Rep. and Trusts & Estates magazines, at [email protected].