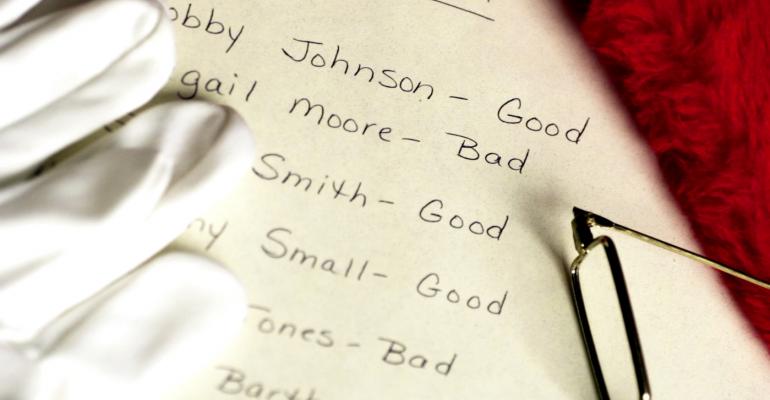

We’ve all seen enough comedies to know what not to do at the office holiday party. Drinking a few too many glasses of wine is a bad idea. Proclaiming unrequited love to a coworker likely will lead to awkward office encounters and maybe even worse (think Bridget Jones’s karaoke love song to her boss). But what most wealth management professionals don’t realize is that even a seemingly minor social media faux pas could cost them a client – or if it’s a major disaster, a career. However, that doesn’t mean that avoiding social media is the right route either, as sites such as LinkedIn, Twitter, Facebook and Instagram can be powerful business-generating tools for reaching out to new and existing clients alike, especially as using email blasts to send holiday greetings is a dinosaur method today. Navigating the wild sleigh ride that is social media can be a challenge, but you don’t have to do it unguided, as handy elves have put together the following list of holiday social media do’s and don’ts.

DO create and post digital holiday greetings. Programs such as Paint and Photoshop have made it easy to create your own custom digital images that you can post to sites such as Facebook, LinkedIn and Instagram. For example, you can take a Clip Art image of a menorah, Christmas tree, or Kwanzaa candles, and write, “Happy Chanukah from [your firm],” “Merry Christmas [from your firm],” or “Happy Kwanzaa [from your firm].” You also could go for a generic winter image, such as a fireplace, and write, “Happy Holidays [from your firm].” Then, throughout the holiday season, post these photos to your professional social media pages so that they appear in your followers’ newsfeeds. Seeing a fun or warm holiday image bearing your brand can go a long way in reminding existing clients of your services and attracting potential new clients.

DON’T flood your followers’ feeds with these digital holiday greetings. Post them once every few days and post other content such as helpful financial advice (see below) in the interim.

DO post holiday-themed financial advice regularly on all of your professional social media accounts. Between holiday gift giving and the approaching New Year, money is on many (if not all) of your followers’ minds during the season and unfortunately even may be a source of anxiety for them. To remind them of your expertise, post advice on topics such as how much money to donate to charities by year-end, how to save money even around the holidays, and how to set reasonable financially minded New Year’s resolutions. With these short tidbits of advice, you can include links to related blogs or whitepapers you have written. This doesn’t mean that you have to craft new content for all of your social media pages; instead, repurpose by posting the same content to Facebook, Twitter, LinkedIn, and so on, but with slightly different wording, in case you have clients that follow you through multiple social media sites.

Brand Awareness

DON’T "overshare” through your professional social media accounts. Maybe one of your New Year’s resolutions is to get a new job or even switch careers entirely. That’s great, but don’t post it on social media. Colleagues or clients may see it, alerting them to your intent to move and possibly burning bridges with them before you have a new job secured.

DO use social media to help create your brand image to clients. The holidays are a great time to foster personal connections. You want your clients to view you as a human being, not as a robot that just gives financial advice. It’s up to you and your family how much you want to share, but posting a fun holiday picture of your pet or your family can help clients see a different side of you and makes them aware that you know what it’s like to have responsibilities and worry about things such as saving money and succession planning. Relating to you on this level may make them more likely to take your financial advice on these topics in the future.

DON’T use social media to unintentionally damage your brand image. That picture you love of yourself guzzling eggnog or wearing reindeer antlers and a Rudolph nose is great to have for yourself. But don’t post it through your professional social media pages or even use it as a profile picture or cover photo for your personal accounts, as these latter two images are visible to the public. Do you really want clients picturing you with a big red Rudolph nose the next time you’re having a serious discussion about their investments?

No one likes to wind up on the naughty list, especially if the consequences are a lost client or, even worse, a damaged career. Use social media to connect with clients and colleagues during the holidays but use it wisely. Think of every social media post you make as a newspaper headline that’s visible to all of your clients and colleagues. If it’s a headline that you wouldn’t want them to see, act on the safe side and don’t post it. Otherwise, you might be getting a lot worse than coal for your year-end bonus.

April J. Rudin, Founder and President of The Rudin Group, is a financial services marketing strategist.