You have to wonder why anyone would want to launch a domestic long/short equity fund these days. The S&P 500 Index has climbed 15 percent in the last 12 months. Buying a low-cost index tracker like the SPDR S&P 500 ETF (NYSE Arca: SPY) or the iShares Core S&P 500 ETF (NYSE Arca: IVV) seems like a no-brainer.

Despite this, alternative asset managers persist. First Trust Advisors recently debuted the First Trust Long/Short Equity ETF (NYSE Arca: FTLS), an actively managed exchange traded portfolio that exploits forensic accounting to find its investment targets. What’s that, you say?

Well, as First Trust’s Ryan Issakainen puts it, the fund’s managers use a proprietary methodology that measures the aggressiveness of a publicly traded company’s accounting practices. Firms with low-quality earnings (read: “aggressive accountancy”) tend to be associated with lower future stock returns compared to more conservative companies. Higher-quality earnings, in this model, portend better returns. FTLS buys high-quality stocks while shorting the low-quality ones.

Over FTLS’ brief life, there seems to be something to the quality notion. The fund was launched on Sept. 9 and, through Nov. 20, has outdone the S&P 500 by nearly 60 basis points (0.57 percent, to be exact) with significantly less volatility.

The question is, of course, can this last?

History seems to favor long/short strategies. Just take a look at the 20-year track record of long/short hedge funds. Cumulatively, long/short plays have bettered the S&P benchmark by 62 percent with a third less volatility. (See Chart 1.)

Equity Only

A caveat here. Hedge funds labeled as “long/short” could be trading in myriad investments, including equities, bonds, currencies or options. We need to take a closer look at equity-only portfolios. And we should concern ourselves with publicly traded products.

Searching for long/short equity portfolios in the mutual fund or ETF realms requires some discernment. There’s a lot of dirt in the long/short category. Some funds labeled “long/short” are, in fact, market-neutral portfolios—meaning they target a zero beta. Not so with true long/short products: Beta, while potentially mitigated by short sales, isn’t eliminated entirely.

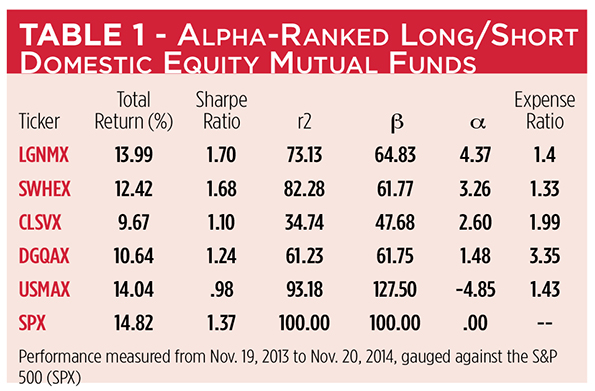

Among long/short domestic equity mutual funds ranked by Morningstar, this year’s top five include:

Logan Capital Long/Short Fund (OTC: LGNMX) — Buying targets include large-cap stocks with potential for rising earnings growth along with those delivering high dividends. Short sale targets include companies with deteriorating financial positions across all capitalization tiers.

Schwab Hedged Equity Fund (OTC: SWHEX) — Invests by taking long and short positions in stocks based on a proprietary rating system that evaluates fundamentals, valuation and momentum. Highly-rated stocks are bought; low-ranked issues are sold short.

CBRE Clarion Long/Short Fund (OTC: CLSVX) — Concentrating in the real estate sector, CLSVX managers rank companies using proprietary criteria, then finance long exposures in excess of the fund’s net asset value with short sales of low-ranked stocks.

AmericaFirst Defensive Growth Fund (OTC: DGQAX) — Another concentration product, this fund focuses its buying interest on defensive, non-cyclical equities, namely consumer staples and healthcare. Short sale candidates are drawn from any industry.

Natixis Tactical U.S. Market (OTC: USMAX) — Fund managers use a risk model to throttle this fund’s exposure to the domestic market. A positive risk-return tradeoff warrants overexposure through derivatives, while a negative signal triggers a beta-reduction strategy.

Blame Beta

Clearly, there was a price paid by mutual fund shareholders for long/short equity exposure over the last 12 months. None of the top five funds outdid the S&P 500’s total return, even though most cranked out positive alpha. The reason for the seeming disparity? Beta. Alpha measures a fund’s return against the beta-adjusted benchmark. Four of the five funds were less volatile than the S&P index.

Then there’s the annual expense. Long/short plays aren’t cheap. On a market-weighted basis, investors in these five funds forked over 1.9 percent to the portfolio managers.

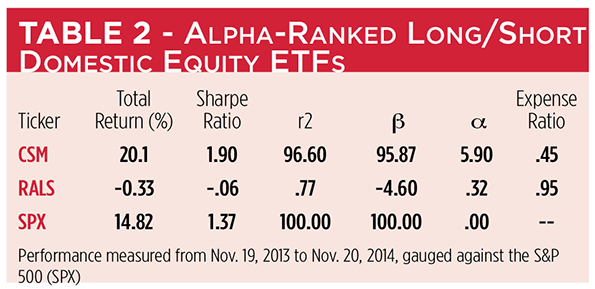

Exchange traded funds boast lower holding expenses, but pickings in the domestic long/short equity sector are pretty sparse. There’s a suite of four thematic QuantShares ETFs that are lumped into the long/short category, but they’re really market-neutral portfolios. Among more than 1,600 extant exchange traded products, there are only two—with the exception of the new FTLS portfolio—that can be properly tagged as domestic long/short equity ETFs:

ProShares RAFI Long/Short ETF (NYSE Arca: RALS) — An index tracker based on the Research Affiliates Fundamental Index (RAFI). Long positions are undertaken in companies with better fundamental metrics—i.e., RAFI weights—relative to their market cap weights, while stocks with smaller RAFI weights are shorted.

ProShares Large Cap Core Plus (NYSE Arca: CSM) — CSM aims to outperform the S&P 500 while maintaining a market-like beta. The fund tracks the Credit Suisse 130/30 Large Cap Index which overweights highly ranked stocks on the long side, financed by short sales of issues with low or negative expected alpha.

Long/short ETFs, as you can see in Table 2, are a mixed bag. The smallish RALS portfolio hasn’t benefitted from the past year’s beta bonanza, while CSM took advantage of it in spades. This shouldn’t be a surprise. RALS, most often thought of as an absolute value play, equally weights its long and short exposures. CSM, in contrast, skews to the long side: 130 percent of its net asset value is committed to long positions, 30 percent to shorts.

Metrics Look Promising

CSM’s asset base, at $487 million, is nearly eight times larger than that of RALS, tilting the long/short ETF category’s market-weighted expense to 51 basis points (0.51 percent), a quarter of the expense borne by investors in the five mutual funds featured in Table 1.

The First Trust FTLS fund comes to market with an expense ratio of 99 basis points, cheap by mutual fund standards but pricey when measured against ETFs. FTLS expects to be 80 to 100 percent invested in long positions, complemented by short positions ranging from zero to 50 percent.

“As of October 31,” says First Trust Portfolio Manager Mario Manfredi, “the fund had long positions equal to 99.6 percent of NAV and short positions equaling 20.1 percent, for a net market exposure of 79.5 percent.”

It’s early days for the fund, but the metrics look promising. FTLS exhibits an r-squared (r2) coefficient of 94 against the S&P 500, with a beta of 83. If the fund continues on its present trajectory for a full year, an alpha north of five could be expected. Not quite that of CSM, but certainly better than RALS.

Presently, FTLS goes tradeless about a third of the time. In 17 of the last 53 trading sessions, there’s been zero volume. That doesn’t worry Manfredi. “It’s not unusual for a newly launched ETF to have limited or no trading volume on many days,“ he says. “In our experience, as an ETF gradually builds a track record, interest grows and trading volume follows. We feel that alternatives as an asset class are here to stay, as demonstrated by the growth in assets and overall strategies over the last six years. We have a strong sales and marketing team who we are very confident will drive interest in the fund by working with advisors to help them fulfill their clients’ objectives.”