The migration to passive investing continues. And the story remains the same: While assets flowed into index funds, investors fled actively managed equity funds. Some of the outflows may be due to performance. Most active domestic equity funds have trailed the S&P 500 lately.

But outflows from active foreign funds may not be connected to actual results. During the first ten months of 2012, the average international stock fund returned 11.9 percent, according to Morningstar. That was a percentage point better than such index funds as Vanguard MSCI EAFE ETF (VEA) and nearly two points ahead of Vanguard MSCI Emerging Markets ETF (VWO).

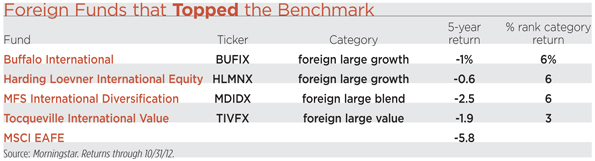

So why are investors dumping active international funds? Fear? The euro zone is enough to scare off any investor. And perhaps shareholders figure that the strong showing by foreign funds is a temporary phenomenon. Soon enough index funds will jump back into the lead. But history suggests that active international funds can continue their winning streak. During the past ten years, the average international stock fund returned 9.5 percent annually, almost two percentage points ahead of the MSCI EAFE benchmark.

Part of the reason that investors have embraced the passive international approach may be connected to the success of S&P 500 index funds. For decades, Vanguard S&P 500 (VFINX) has delivered consistent returns, finishing in the top half of the domestic equity category during most years. Influenced by those results, investors figure that foreign index funds will also be winners. But the MSCI EAFE has proven to be a much easier benchmark for active managers to beat. The EAFE index has 22 percent of its assets in sluggish Japan and almost none in the high-growth emerging markets. So active managers have topped the benchmark by underweighting Tokyo and picking the right emerging markets.

Make no mistake, Japan could rally this year, helping EAFE to beat active managers. But Japan remains burdened by enormous debts and the costs of supporting an aging population. So odds are good that active managers will top the benchmark.

Whether or not their winning streak continues, some active funds could prove to be valuable holdings because they are less volatile than the benchmarks. Such stable choices tend to outperform in downturns and provide shareholders with a smoother ride.

Managing Volatility

To improve your chances of success, consider a low-volatility fund with a record for beating the benchmark. Top choices include Tocqueville International Value (TIVFX), which returned 10.6 percent annually during the past ten years, outdoing 97 percent of peers in the foreign large value category. In the turmoil of 2008, the funded topped the EAFE benchmark by 8 percentage points. Portfolio manager James Hunt looks for unloved companies with solid balance sheets. The portfolio includes such rock-solid blue chips as Nestle and Swiss drug giant Novartis. “We avoid companies with significant problems,” says Hunt. “We try to find companies that may be misunderstood or have temporary problems that can be fixed.”

These days Hunt is keen on global businesses that are based in Europe. Although they have growing sales in emerging markets, the stocks have been punished because of their association with the Eurozone crisis. “We want companies that will have good cash flows, even if there is no strong recovery in Europe,” Hunt says.

For an all-weather fund, consider MFS International Diversification (MDIDX), which has topped EAFE by 3.6 percentage points annually during the past five years. The fund surpassed the benchmark during the downturn of 2008 and in the rally of 2009. To ensure that the portfolio can excel in a variety of market conditions, the portfolio managers put the assets into a broad collection of five MFS international funds. About 25 percent of assets go into MFS International Value and the same amount into MFS International Growth. MFS Emerging Markets and the small-cap International New Discovery each have 10 percent of assets. The allocation remains fairly static. “We did some backtesting to determine the optimal mix of assets,” says portfolio manager Thomas Melendez.

The approach only works if the individual funds succeed—and all five of the funds have outdone the EAFE benchmark during the past 10 years. Few fund companies can boost such as strong lineup of international funds. Notable performers include the international growth and value funds, which each outdid the benchmark by more than 2 percentage points.

Another low-risk choice is Harding Loevner International Equity (HLMNX). The portfolio managers shun companies that can only thrive in good economic times. Instead, the fund focuses on consumer staples and other businesses that can report growth year after year. Favorite holdings include software companies that enjoy repeat business from customers who must make purchases in order to stay competitive. “We are looking for companies that can show durable growth for the next three to five years,” says portfolio manager Alec Walsh.

A holding is SAP, the big German producer of business software. The company’s sales are reliable because it collects licensing fees from long-term customers. Besides supplying software, SAP also provides maintenance, a steady business.

Buffalo International (BUFIX) aims to find consistent growth stocks. The fund avoids cyclical commodities companies, focusing instead on reliable businesses in expanding sectors such as a health, technology, and consumer staples. The portfolio includes a mix of fast growers and companies that are growing at a slow and steady pace.

A reliable holding is Henkel, a German producer of haircare products. “This may never grow at a 20 percent rate, but it will show consistent topline growth and improving margins,” says portfolio manager Bill Kornitzer.

The ETF Route

Despite the strong showing of active funds, some conservative investors may prefer a low-volality ETF, such as iShares MSCI EAFE Minimum Volatility Index ETF (EFAV). Though it has lagged the EAFE benchmark in recent years, the ETF has excelled in difficult markets. In 2008, the ETF outperformed the EAFE by 16 percentage points. When the EAFE lost 11.7 percent in 2011, the ETF about broke even. That kind of downside performance can appeal to clients who remain wary of uncertain equity markets.