In today’s troubled markets, investors face considerable challenges, as many of the tried and true formulae are coming up short. Equity investors are finding that continuing increases in share prices are no longer something they can count on. As a result, many investors are taking refuge in income-oriented investments, such as bonds, utilities, and dividend paying corporate stocks. And of course for those investors in or approaching retirement, investments providing income have always been in vogue.

An option that many investors overlook or turn away from is master limited partnerships, or MLPs. MLPs which pay quarterly cash distributions that often grow over time, represent an asset class that deserves attention. However, MLPs are often not well understood and can seem a little too exotic for the average investor. Taking the time to learn the basics about MLPs could well prove to be time well spent.

What is an MLP?

A more accurate name for an MLP is a publicly traded partnership, or PTP. It is, quite simply, a limited partnership (or sometimes an LLC choosing partnership taxation), that is traded on the public exchanges (i.e., NYSE, NASDAQ, Amex) just like corporate stock. A share in an MLP is called a “unit,” and its investors are “unitholders.”

A limited partnership consists of a general partner and the limited partners. The general partner manages the day-to-day operations and holds a small percentage ownership stake. The limited partners (or common unitholders) have no role in the partnership management but rather provide the capital and receive cash distributions (LLCs are slightly different; the owners are all members; some of them may manage the LLC, but there Master Limited Partnerships: An Investment You May Have Overlooked is no general partner).

The biggest difference between an MLP and a corporation is that as a partnership, the MLP does not pay corporate tax. This allows it to distribute more of its earnings to investors. A partnerships is not considered to be a separate taxable entity but is treated as a “passthrough” entity comprised of all its partners. The partnership’s income is allocated for tax purposes among all the partners, who pay tax on their share.

Not every business that chooses to can operate as a publicly traded partnership. The tax code strictly limits the right of partnerships to be publicly traded without paying corporate tax. In order to qualify for partnership tax treatment, a PTP must receive 90 percent of its income from specific sources such as natural resources activities, interest and dividends, real estate rents and income and gain from commodities.

As a consequence most of the approximately 97 PTPs trading today on the major exchanges—about 80 percent-- are engaged in natural resource based businesses. There are also some PTPs in real estate, investment, and other businesses, as well as commodities, but it is the natural resources group that most people think of when they say “MLP.”

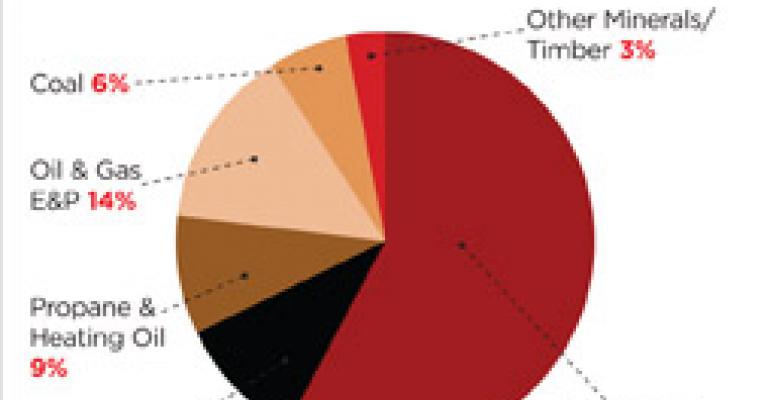

The MLPs in this group are engaged in a variety of activities. The majority of MLPs fall into the oil and gas midstream sector; i.e., gathering, processing, refining, compression, transportation in pipelines, and storage in terminals. Other MLPs are in engaged in exploration and production of oil, gas, and minerals; propane and heating oil marketing and distribution; transportation of petroleum products on tankers and barges; and coal leasing and production, as shown in Figure 1 below.

Why should I consider MLPs as an Investment?

There are several reasons to consider MLPs as an investment, most of them having to do with their partnership tax treatment.

• For most investors, the biggest advantage of investing in MLPs is the quarterly cash distribution, which provides high current and tax-deferred income. MLP investors typically enjoy a yield that is hard to find in corporate stocks: the median yield for energy MLPs as of September 30, 2008 was 9.5%. In addition, many MLPs make it a policy to increase distributions as often as possible. From 2003 through 2007, the energy MLPs increased distributions have increased at a median five-year compound annual growth rate of 8.6%, with a one-year distribution growth in 2007 of 11.5%.

• MLPs are a tax-advantaged investment. While investors are responsible for paying tax on their share of the partnership’s income, their taxable income is considerably lowered by their share of the partnership’s deductions (such as depreciation) and losses. Moreover, the distributions are not taxed as current income but are considered a return of capital and are not taxed until the partnership units are sold. Typically, taxable income will equal 10%-20% of the distribution.

• As with other securities, PTP units may be left to the owners’ heirs, whose basis in the units will be stepped up to market value at the testator’s death. Thus, if unitholders retain their units until death, neither they nor their heirs will pay the deferred tax on the pre-death cash distributions.

• MLPs provide diversification. While they are concentrated within the energy sector, they cover a wide range of businesses within that sector. Moreover, with the exception of this year’s market crisis, which no asset class escaped, the movements in MLP prices have tended not been highly correlated with changes in the broader stock market, interest rates, and commodity prices.

• The natural resource MLPs are in industries that are the backbone of America. They help produce, gather, process, and transport the oil, gas, and coal products that America relies on for energy independence. Those in the midstream sector earn their revenue through contracts for processing and transporting oil and gas that are not affected by fluctuations in energy prices.

• MLPs are also poised to be part of the future of alternative energy sources. Legislation was recently enacted that expands current law to allow mlps to transport and store alternative fuels such as ethanol and biodiesel. Pipelines to transport these fuels will be vitally needed and do not yet exist. It will be MLPs that build them.

What's the Downside?

There's no getting around it--MLPs are more complex than other investments. As with their benefits, many of their complexities derive from their tax status:

• Ownership of MLP units creates a more complex tax situation for the investor. Instead of a 1099, investors recieve a K-1 form detailing the various types and amounts of income, deductions, gains, losses, and credits that the MLP is passing through to them, and have to enter the amounts in the appropriate places on their own tax returns. Moreover, the investors' basis in its units fluctuates, adjusted upwards for the net taxable income and downwards for cas distributions. For sophisticated investors who already use accounting services to prepare their returns, this may be a less daunting prospect than for some others.

• Investors may be subject to tax in more than one state. Because of the passthrough nature of an MLP, investors are subject to state tax wherever an MLP earns income. By the time MLP income is divided up among all states and all investors, the resulting amount for one investor in one state will usually be too small for any tax to be owed. However, investors, especially those with large holdings, will need to be aware of the potential obligation.

• For the most part, MLPs are not an appropriate investment for retirement funds and tax-exempt institutions. This is because when a tax-exempt entity is a limited partner, its share of MLP income is considered unrelated business income, as if the entity had earned it directly, and subjects the entity to unrelated business income tax (UBIT) on amounts over $1,000. A few MLPs earn income that falls into one of the types exempted from UBIT, such as royalties.

One way of avoiding these issues while still enjoying many of the benefits of MLPs is to invest through a closed-end fund. There are several such funds which invest mostly or exclusively in MLPs and deal with the complexities of being a limited partner, allowing their investors to receive the familiar 1099 and to avoid UBIT and state tax hassles.

Where can i find out more about MLPs?

Visit the website of their trade association, the National Association of Publicly Traded Partnerships (NAPTP) . There you will find information including a list of currently trading MLPs, investor relations contacts, and answers to additional questions.