There has been a lot of buzz about managed futures over the past year. As you may have heard, it was one of the few asset classes that performed well in 2008. Ok, very well: The average managed-futures program, as measured by the Barclay CTA Index, was up 14 percent last year while the S&P 500 sustained a shocking 36 percent drop for the year. In fact, a 5 to 10 percent allocation to managed futures last year would have served as a very nice buffer for most portfolios, considering almost every other asset class collapsed. But media coverage of managed futures has been mostly negative in 2009, as the sector has underperformed over the past eight months.

The good news is that managed futures' strong showing last year wasn't just a one-year event. The Barclay CTA Index has gained an annual average of 12.2 percent since 1980. Not bad, right? Of course, before you run out and allocate a chunk of your clients' portfolios to managed futures, you'll want to take a look under the hood and check out managers carefully. You'll also want to make sure you know what kinds of managed futures funds are best for which kinds of clients.

First, it's important to understand that “managed futures” is not really a strategy. The media, as well as many financial professionals, refer to the industry as though it were a collective group of managers with homogeneous return profiles. Managed future funds, which manage an estimated $200 billion in assets, are run by professional commodity traders (CTAs), who buy and sell futures contracts in everything from beef and wheat to foreign currencies and stock indexes using technical trading systems. But, just like with hedge funds, the variety of trading strategies CTAs use is all over the map: fundamental, global macro, discretionary, equity-index oriented, mean reversion, counter trend, arbitrage, option strategies, etc., each of which exhibit unrelated return profiles. Some managers employ these strategies on a very short-term basis (days to weeks), while others stretch them out over much longer periods (months to years).

The most prevalent, well known, scalable, and profitable strategy over the long term is referred to as trend following. It is trend following, and subsets of trend following, that dominate the CTA indices — nearly 60 percent of CTAs use systematic trend following according to a recent Barclay's report. When CTA indices are up or down, it is largely trend following that is up or down. In 2009, for example, the media have been negative on the space as a whole, yet it is largely the trend-based managers who have been weak; many strategies have done well this year. Conversely, in 2008, the industry in general was praised for its outperformance, yet it was primarily the trend based managers who were responsible for the performance; some strategies within the managed futures space, like short option and long-commodity bias strategies, actually performed poorly.

Now that you've got that straight, you will need to think about what your client's risk profile looks like. For the client with high risk tolerance, you can use managed futures to diversify a portfolio, stabilize returns and protect against big downturns in the market. The best way to do this is with a pure trend follower. For clients with low risk tolerance, who don't have a high pain threshold for volatility, you should set aside a smaller portion of the portfolio to be evaluated on a standalone basis, and allocate that to a multi-system trend follower, which will be less vulnerable to big swings.

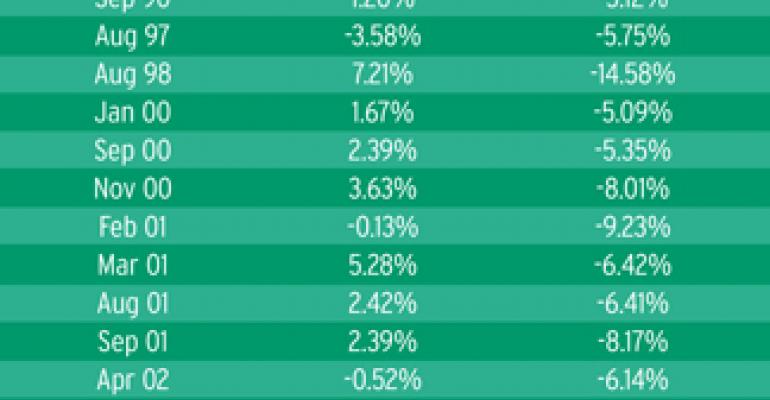

Let me explain. Pure trend followers typically perform best during periods of market stress. It is trend following that contributes most to the returns indicated in Table 1, which are highly uncorrelated to the S&P 500. But pure trend following can also be inefficient and underperform during non-trending markets. (A trending market is any sustained period where the market in the particular commodity being followed moves up or down. A non-trending market is any sustained period where the market is stuck within a trading range.) Any program needs some trend to make money, but for the most part trend strategies are based on moving averages or breaks from a trading range.

High Risk Tolerance

As a result, to invest in pure trend followers, your client must be willing to accept volatility. But as long as your allocation is no more than 5 to 10 percent of your portfolio, volatility is a good thing. In fact it is a great thing. You want volatility, because so often managed futures have a negative correlation with other asset classes, especially when those asset classes are weak. When the other 90 percent of your portfolio is down, you want that managed futures allocation to make up for the losses and then some, if possible.

Your client must also be willing to invest for a minimum of 3 to 5 years. Just as in 1999, 2003, 2004, and thus far in 2009, any trend-based manager will have periods where they underperform. You — and your client — must be willing to sit through these underperforming periods as well as the occasional down year. Keep in mind, though, that these periods of underperformance usually occur during periods of low volatility in which the larger components of your portfolio (stocks, real estate, private equity, etc.) will tend to perform well.

Again pure trend followers are your best bet here, as opposed to, say, a managed futures index fund. Rydex and the Royal Bank of Scotland all have investable low-cost managed futures index funds, based on the S&P diversified trend index, which aims to replicate the trend following used by many CTAs. While these products are very easily accessible by any individual investor, the returns have underperformed most of the top trend following mangers, as well as the broader CTA indices. And while volatility for these products has been lower, on a risk adjusted basis their performance does not compare favorably. (See Table 2.) In 2008, for example, a year that was off the charts for most trend-based CTA's, these index products yielded bond-like returns.

To illustrate this point, I took a well diversified portfolio (see Table 3) and added in a 10 percent allocation to 12 of the largest and best known trend-based CTAs (See Tables 4 and 5) and then took that same portfolio and added a 10 percent allocation to the S&P Diversified Trend Indicator and compared the two. While volatility is lower for the S&P DTI managed futures index fund (again, the index's mechanism is the basis for all the current managed futures funds on the market) compared with each of the CTA mangers, returns are also significantly smaller. More importantly, the effects of the managed futures index returns on the greater portfolio were negligible, only very marginally benefiting its risk adjusted returns. Conversely, every one of the 12 CTAs measurably helped the portfolio's risk adjusted returns.

If your client has low risk tolerance, you would be best off investing with a multisystem trend follower, preferably one that has been able to keep drawdowns to an acceptable level. Some pure trend followers look for longer term moves, 3 to 5 years, that when they hit, generate very high returns. But investors also must accept the longer down periods between these hugely profitable trades for which there might be just 1 or 2 per year. Conversely, multisystem trend followers add in short term and medium term trend strategies as well as, in some cases, non-correlated strategies such as mean reversion. As a result, they tend to have more consistency and exhibit less volatility. Go with these multisystem trend followers for impatient clients who tend to quickly want to move out of underperforming investments.

Low Risk Tolerance

For these kinds of clients, advisors should also look to create a portfolio of managers, using other (convergent) managed futures strategies to provide returns when markets are trend-less. Finding managers who complement other managers can be a difficult task. In fact I spend a good portion of each day studying managers and strategies and how they fit together. The relatively low barriers to entry means that there are many inferior managers saturating the CTA databases. It becomes critical that you separate those simply on a winning streak, from those who are superior CTA's. Barclays Trading Group, Stark Research, Altegris Investments and Institutional Advisory Services Group all have databases of CTA managers, some of which can be sorted by minimum account size, funds under management, as well as performance.

Finding complementary managers to pair with trend followers can, if done properly, allow you to satisfy client's demands for more consistency, while still providing some of the down-side portfolio protection often found with trend based strategies.

Ryan Davies is managing principal of Alternative Investment Consultants (AIC). Futures and Options trading involves significant risk of loss. Past performance is not necessarily indicative of future results.