Proponents of ETFs often argue that traditional mutual funds are obsolete—black-and-white TVs in an age of streaming video. But the advantages of the ETF structure are limited, and they are eroded by the costs of trading. For many investors, mutual funds can be as cheap to use as comparable ETFs.

Of course, the average expense ratio of ETFs is lower than that of mutual funds. But the main reason for the cost advantage is that most ETFs are index funds, and most mutual funds are actively managed. Whether they are packaged as ETFs or mutual funds, index funds have low expenses because they don’t spend much on research. In addition, index funds tend to do little trading, which keeps a lid on trading costs and taxable capital gains. In comparison, actively managed mutual funds trade more and generate more costs.

Instead, ETFs should be compared to index mutual funds. “When you compare apples to apples, you see that ETFs are not necessarily lower cost,” says Joel Dickson, a senior investment strategist for Vanguard Group.

To make his case, Dickson calculated asset-weighted expense ratios of index mutual funds and passive ETFs. With this approach, index mutual funds have an expense ratio of 0.15 percent, compared to 0.3 percent for passive ETFs. In the asset-weighted method, big funds carry more weight than small ones. Dickson says that the asset-weighted measure provides a truer picture of what typical investors actually experience.

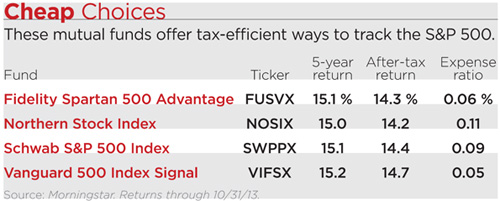

As Dickson observes, there are some expensive ETFs and cheap index mutual funds. Among ETFs that charge expense ratios of more than 0.8 percent are EGShares Brazil Infrastructure (BRXX) and Teucrium Natural Gas (NAGS). Index mutual funds that charge 0.08 percent or less include Fidelity Spartan Mid Cap Index (FSTPX) and TIAA-CREF Equity Index (TIEIX). Dickson says that in 2011 and 2012, 8 percent of ETFs raised their expense ratios. Many of the costly ETFs follow complicated strategies. Popular approaches emphasize factors such as high dividends or low volatility. Though the funds may be considered passive, their approaches require more trading and expenses.

Besides talking about expense ratios, ETF promoters often assert that mutual funds generate big tax bills because of the way they handle redemptions. When a shareholder makes a withdrawal, the mutual fund manager has to sell securities in order to raise the cash that is necessary to cover the payout. If the sale results in a capital gain, then all shareholders in the fund could face bills at tax time. In contrast, most ETFs need not sell securities to handle redemptions. Instead, ETFs make in-kind distributions, handing over stocks or bonds to cover withdrawals.

While the in-kind distributions can provide an advantage, most of the time the edge is small, says Michael Iachini, managing director of ETF research for Charles Schwab Investment Advisory. “It is true that ETFs have a little bit of built-in advantage, but most of the tax efficiency can be chalked up to the fact that ETFs are index funds that do little trading.”

Even if an ETF is tax efficient and has a low expense ratio, the advantages can be offset by higher trading costs. While no-load mutual funds can be traded for free, clients must pay a fee to trade most ETFs. If an investor pays a $9 commission and buys $100,000 worth of shares, the charge may be insignificant. But the same commission on a $10,000 trade would represent 9 basis points. If the client trades once a quarter, then the commission could wipe out any advantage that a low expense ratio offers.

ETF traders must also contend with bid-ask spreads. Most often big funds trade with little or no spreads. But spreads can present a special problem for small funds and portfolios that hold illiquid assets. Consider iShares India 50 (INDY), which has $453 million in assets. The shares recently traded with an ask—the price at which an investor can buy—of $22.35. The bid—the price at which you can sell—was $22.23. So someone who bought and sold could take a haircut of 0.54 percent. In contrast, mutual funds always sell for their net asset values—without any bid-ask spread.