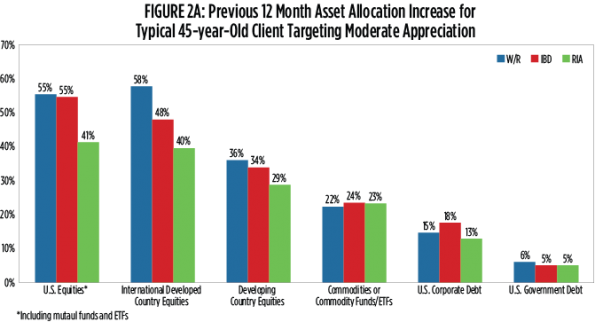

We also asked “for a typical 45-year-old client who is targeting asset appreciation, but not aggressive appreciation, how has their asset allocation changed during the last year?” As we saw in the RIA channel report, the responses largely reflect comfort with U.S. and international developed country equities. With the percentage of respondents ranging from 40% to 58%, these two asset classes showed the highest average increase in allocation across all three channels. The favorable change in allocation towards U.S. and International equities comes largely at the expense of positions in U.S. credit, both corporate and government. Across all three channels, only 5-6% of advisors recommended an increase in allocation toward U.S. government debt and the percentages advising an increase to U.S. corporate debt ranged only slightly higher, from 13% to 18%. With respect to international developing-country equities, advisors across all three channels are relatively bullish, with approximately one-third favoring an increase in allocation.

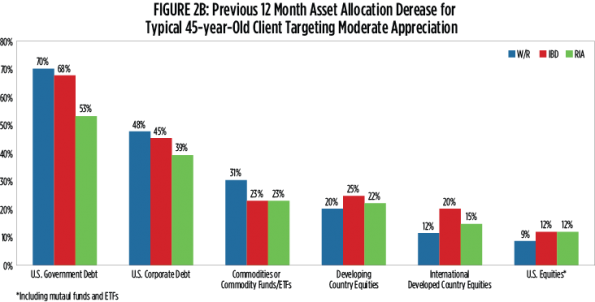

When we sort the responses to focus on the asset classes for which advisors recommend decreased allocation, we note that both the W/R and IBD channels are more aggressive in calling for less exposure to U.S. credit. Interestingly, apart from high yield, U.S. credit markets have performed very well this year, and the survey results are consistent other findings that show a majority of investors were too bearish on government and corporate fixed income in 2014. The allocation toward commodities reflected very evenly split responses, with only the W/R channel responses demonstrating a slightly cautious view: 31% recommending a decrease vs. 22% recommending an increase. Finally, with respect to international equities, IBD advisors were slightly more aggressive in recommending decreased allocations within client portfolios.

Next Part 3 of 4: Advisors' Product Usage