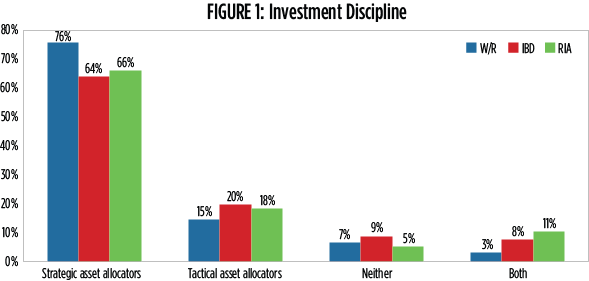

Responses to the question about investment discipline this year again reflects a preference for strategic allocation over tactical. This finding was true across every channel we surveyed, with W/R advisors, at 76% of respondents, showing the greatest preference for strategic allocation. After the macro effects of large economic swings during the last five years, and markets that have generally been characterized by greater than normal correlations, asset managers understandably continue to take a high-level view of their clients’ portfolios. Accordingly, the percentage of advisors across the three channels that employ only tactical allocation encompassed a relatively narrow range of 15% to 20%. A small percentage of advisors, in the mid–to-high single digits, report using neither of these broad approaches. Interestingly, RIAs and IBDs, at 11% and 8% respectively, are more likely than W/Rs to use a combination of the two approaches, with only 3% of the latter indicating that they do so. It remains to be seen whether the focus on strategic allocation is a secular trend or if tactical allocation will make a comeback once intra-market correlations fall to more normal levels and security-specific risk and return profiles once again become important components to disciplined investment strategies.

Next Part 2 of 4: Asset Allocation Change for Typical 45-Year-Old Client Targeting Moderate Appreciation