It must be exhausting to be an Edward Jones advisor. Jones reps express an ardor for their firm that is so strong that it puts off non-Jones FAs (just visit our advisor forum on RegisteredRep.com to see the sometimes acrimonious back-and-forth). Indeed, Edwards Jones reps spend a lot of time having to explain why it's so great to be them. (In a way, they're a lot like residents of New Jersey; you have to live there to understand the beauty of the place.) This year it's more of the same: For the 17th consecutive year, reps awarded the firm the highest overall approval rating (9.4) on our annual Broker Report Cards survey.

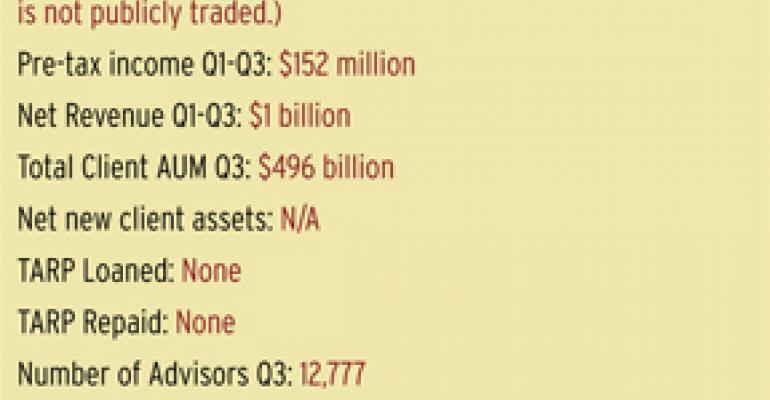

Still, Edward Jones was not spared the pitfalls confronted by the rest of the brokerage industry. James Weddle, managing partner, says the firm went through a “significant cost reduction process.” While there haven't been any layoffs, the firm froze the salaries of home office associates and branch staff. “Everything you can reduce or eliminate, we did, but the bottom line is we're still growing and profitable. That is what we hoped to accomplish,” says Weddle.

Jones has almost exclusively grown its army of 12,777 reps by recruiting professionals who are new to the financial services industry, training them in-house. However, this year, Weddle says the firm hired 100 producers with an average of 14 years of experience, compared to the 35 or so veterans they hired last year. While Jones has never offered up-front money, without disclosing amounts, Weddle says the firm has provided “financial support” for those producers.

Jones reps aren't known to be aggressive, but sticking to an investment philosophy of “buy quality, diversify and be patient,” didn't serve all reps well. In fact, Jones received its lowest score (7.4), in products and services, namely limited access to anything but mutual funds and ETFs. As one Jones rep puts it, “Their product offerings, specifically fee-based advisory programs, are simply inferior to other firms. There is not enough flexibility to manage assets the way we choose. Their ‘buy-and-hold-through-anything’ philosophy did not bode well for clients last year.”

That hasn't stopped the flow of assets into fee-based advisory accounts (called Advisor Solutions Accounts), which attracted $22 billion since the program was launched last May. In addition, the firm continues to improve its technology offerings, a long-time thorn in the foot of Jones advisors. In all, Jones stuck to its knitting, which has its advisors pretty much drooling. Says one advisor: “We didn't have a lot of business model drift that got us into trouble the last couple of years.“