We’re in a golden age of innovation, where many companies are growing up overnight, said Jud Bergman, chairman and CEO of Envestnet, speaking Wednesday to a group of over 800 advisors at the company’s annual advisor summit in Chicago.

The financial services and wealth management industries are at a tipping point; someone out there is trying to build a better mousetrap to get high-net-worth and high income clients. “Are you convinced of the superiority of a financial advisor-centric model?” Bergman asked.

Advisors need to be disruptive innovators to succeed and overcome the looming challenges the industry faces, he added. During his presentation, Bergman outlined the characteristics of companies that are innovators versus those who are disrupted by someone else with a better mousetrap.

Innovators invest in technology, build and protect their brand, perfect their marketing prowess, hire experienced managers and flex their distribution muscle. They believe in their own strength and flaunt their supremacy.

In addition, disruptive innovators have the courage to take risks and challenge the status quo. They’re always questioning—not just their customers—but also asking, ‘why aren’t they doing something another way?’ These individuals are also observing the smallest details and connecting disparate dots. They’re great networkers, connecting with different industries, departments, and thinkers, Bergman said. Their mantra is, ‘Test, develop, rework,’ meaning their always experimenting. And that doesn’t end when a product is launched. They also have what Bergman calls, “associative thinking,” where they’re intuitive in terms of connecting the dots.

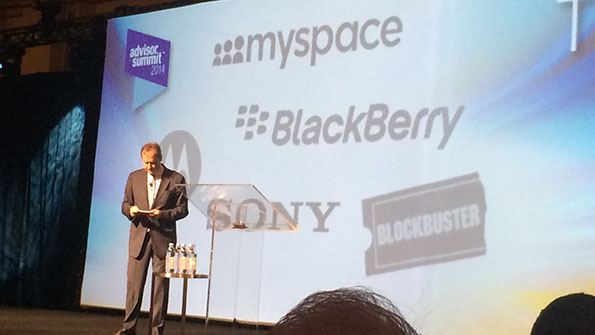

But these skills of great innovators often go out the window when a company becomes successful. The disrupted, however, forget or are blind to what’s happening in new markets and new areas of technology. They ignore startups, spin-offs and disruptive innovators. Bergman pointed to such companies as MySpace, BlackBerry, Blockbuster and Sony. These were companies that used to be innovative but are no longer considered to be.

The disrupted, however, forget or are blind to what’s happening in new markets and new areas of technology. They ignore startups, spin-offs and disruptive innovators. Bergman pointed to such companies as MySpace, BlackBerry, Blockbuster and Sony. These were companies that used to be innovative but are no longer considered to be.

Many say so called “robo-advisors” are disrupting the wealth management industry, Bergman said.

They’re doing good work on asset allocation, automation, and promoting their low-cost. But the one thing robos haven’t been able to replicate is having a deep understanding of a client’s needs, hopes and dreams. Bergman’s not so sure that these online advice platforms will be the next big idea in the industry.